July 6, 2021

In March, Vietnam’s Ministry of Industry and Trade (MOIT) submitted its draft Power Development Plan VIII for 2021-2030 to the Prime Minister for consideration and approval. According to the document, the mix of natural gas in power generation sources is expected to rise from 14.9% in 2020 to 26% in 2045 and will significantly replace coal. An estimated US$180 billion will be needed over the next decade to meet the expansion targets for gas and renewables generation facilities, along with LNG gas terminals. As with many developing countries, the likely desirable investment model for LNG-to-power projects in Vietnam is a public-private partnership (PPP). Among the available PPP models in Vietnam, build-operate-transfer (BOT) is probably the most realistic considering the availability of an established legal framework for off-taking and state-sponsored contracts and precedent BOT projects. Sponsors would want the power project to be owned by the BOT company under a BOT contract with the relevant state authority and the LNG infrastructure to be owned by a separate joint venture company, with the cost of LNG infrastructure to be passed through to the electricity tariff. Under current legislation, non-BOT power projects (except solar or wind) are generally ineligible for off-taking arrangements, and are instead required to sell on the “competitive electricity market,” which may raise an important bankability issue. Against this background, Vietnam recently passed a PPP Law and an Investment Law, while issuing a new decree to implement the new PPP Law called Decree 35/2021/ND-CP (together, the “New Laws”). These took effect in early 2021. The changes are not fundamental but do include some features which may be material to... June 24, 2021

Over the past five years, solar electricity developers (developers) have busily installed photovoltaic (PV) panels on the rooftops all over Thailand. For commercial and industrial (C&I) businesses, the panels were an easy sell. For instance, PV installations are often financed by the developers, rooftop solar reduces overall electricity costs and the glare caused by the sun shimmering off PV panels can display the occupant’s green credentials. Developers are seeking premier projects such as new factories or stores with creditworthy occupants as they expand their portfolios in Thailand. The initial exuberance remains, but some developers are hesitant to enter Thailand perceiving that many of the best opportunities have already been seized. However, Thailand’s rooftop solar sector can still expand so interested developers must be aware of relevant regulations so they can take advantage of these opportunities. This article will look at how the market might consolidate if developers sell some of their existing assets, which may also create refinancing and bankability concerns. The potential impact of carbon trading markets will also be discussed. Market Consolidation – Regulatory Issues For Buyers And Sellers There are a significant number of developers active in Thailand’s rooftop solar sector and much of their financing is sourced from shareholder equity contributions or corporate lending. This has resulted in projects tying-up developers’ capital and delaying expansion plans. To free up some of this cash, developers may look to sell off existing projects which would consolidate the market and result in merger control issues. Merger Control In 2009, Thailand’s Energy Regulatory Commission (ERC) enacted the Regulation on the Establishment of Criteria to Prevent Mergers, Competition Lessening or... June 23, 2021

A brief discussion on how should MNCs respond to OECD’s new measures relating to Automatic Exchange of Information and Transfer Pricing issues. AEOI And CRS – Enhanced Tax Controls On Tax Evasion We are living in a globalized world, and cross-border activities have become the norm in the last few decades. In the past, multinational corporations (“MNCs”) often adopt aggressive tax strategies by booking most profits in tax heavens where information sharing with foreign tax authorities is often minimal. The result is that tax authorities across the world often face difficulties in gathering sufficient offshore asset and transactional information of the tax payers to conduct tax assessment in their home jurisdiction. To unplug loopholes, the OECD has led the international effort in the implementation of Automatic Exchange of Information (“AEOI”) and adoption of the Common Reporting Standard (“CRS”). In order for participating countries to enjoy the mutual benefits of information exchange, financial institutions (“FIs”) of a participating country are required to report financial information regularly to local tax authorities which is then transmitted to their overseas counterparts in exchange of similar information from other participating jurisdictions. It is noteworthy that more than 100 jurisdictions are already committed to AEOI implementation as at June 2020. Why Relevant To Me? Let’s assume that you are a tax resident of your home Country A and have offshore assets or income in Country B. If both countries are committed to AEOI, Country B will become duty-bound to share your financial information automatically with tax authorities of Country A such that the latter may track your offshore investments beyond national borders, carry out tax avoidance... June 23, 2021

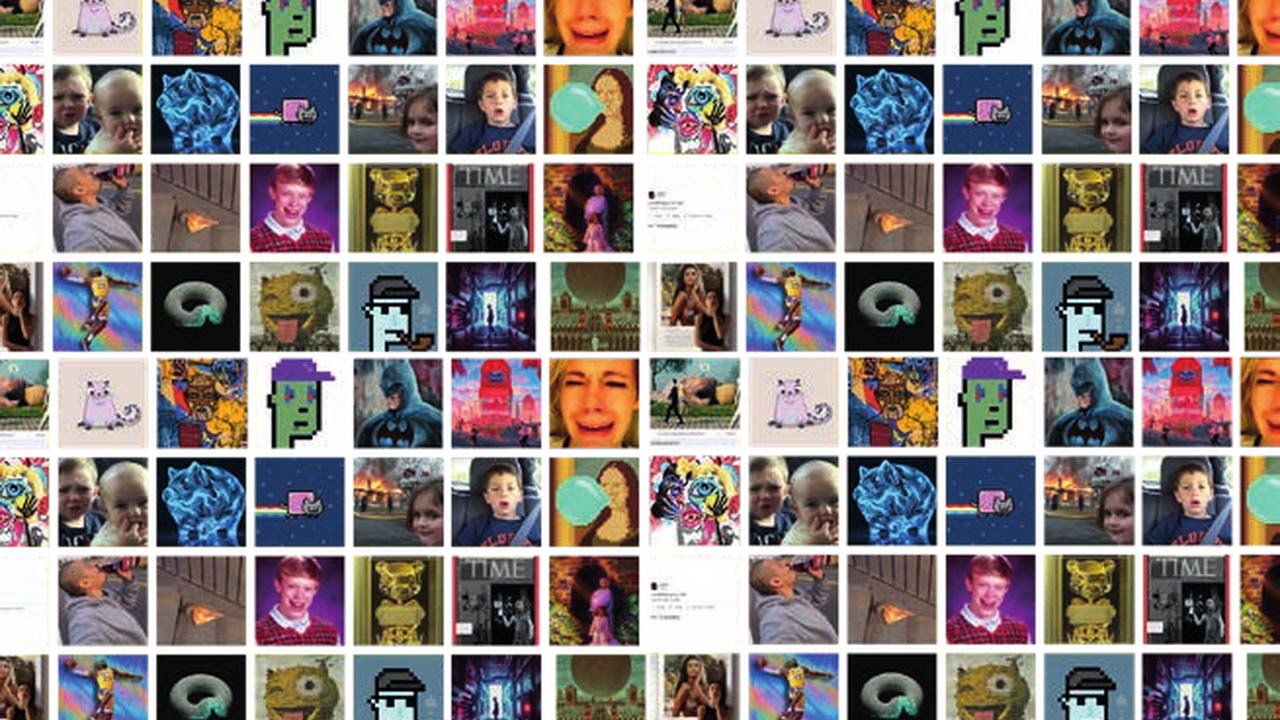

Although non-fungible tokens (NFTs) have been around for some time, they were recently in the headlines for the astronomical sums people have paid to own them. For example, a NFT issued by digital artist Beeple sold for US$69 million and the NFT of the tweet sold by Twitter co-founder Jack Dorsey for US$2.9m. What Is An NFT? An NFT is a unique cryptographic asset linked to an object, such as a piece of art or in-game item. In economics, a fungible asset is something with units that can be readily interchanged – like money. However, if something is non-fungible it means it has unique properties so it cannot be interchanged with something else. For instance, Bitcoin has an interchangeable supply. One Bitcoin is worth the same amount as any other Bitcoin, no matter which Bitcoin you’re holding. A one-of-a-kind trading card, however, is not interchangeable. If you traded it for a different card, you’d have something completely different. An NFT is a digital certificate of authenticity placed on the blockchain and when you buy an NFT, you (typically) hold the right to claim ownership of the NFT itself and the right to exclude others from claiming ownership of the NFT. However, ownership of an NFT will not entitle you to ownership of the digital asset, the underlying artwork, or any other object – unless the relevant contractual terms allow otherwise. By itself, an NFT is not an IP right. It is not a patent, for example. But even if an NFT itself does not easily fall into an existing category of IP, it does not mean there are no IP... May 6, 2021

Introduction https://www.inhousecommunity.com/wp-content/uploads/2021/05/In-House-Counsel-Pandemic-Insights.mp4 Now that we’re in Q2 of 2021, and 2020 is firmly in the past (but the hangover remains), it’s time to put the “Year of the Coronavirus” into perspective. Few companies emerged from last year unscathed. But as the old saying goes, no one becomes rich in the good times – wealth is generated in the bad times. Legal firms across the Asia Pacific and MENA weathered the Covid-19 storm and worked tirelessly to keep their clients satisfied. And judging by the scuttlebutt out there, nearly everyone in the profession was run off their feet in 2020 performing work ranging from M&A, Insolvency, Restructuring, and HR disputes to personnel rearrangements and advising on critical multi-million-dollar business deals. Some of the important legal work was done in the office, but most of it had to be done at home due to varying levels of lockdowns that forced people’s daily routines to adapt to a “New Normal.” On top of the wider business disruption, the constraints of working from home added plenty of extra pressure and learning curves. According to data from Citi Private Bank, demand for lawyer time fell only 1% in the first half of 2020, dropping by 4.2% in the second quarter – significantly lower than in 2019. But the lawyers who managed to stay busy had plenty of work to do. Jump straight to: Methodology Winner’s Updates Pandemic Insights from Results South Africa VILAF Raymond Goh – China Tourism Group China South Korea Khaitan & Co Carina Wessles – Alexander Forbes Hong Kong UAE Navrita Kaur – Omesti Group India Vietnam Stanley Lui – TI... May 6, 2021

On March 26, Philippines President Rodrigo Duterte signed into law the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Law, with several line-item vetoes of the version of the bill endorsed by the legislature. CREATE (Republic Act No. 11534) significantly amends further the provisions of the National Internal Revenue Code (Tax Code) after its overhaul by the Tax Reform for Acceleration and Inclusion Act (TRAIN) which took effect on January 1, 2018. CREATE also amends or repeals various laws granting tax incentives to investors, including incentives under the Omnibus Investments Code, the Special Economic Zone Act, and the charters of special economic zones. Except for the specific provisions in the law which provides its effectivity, CREATE is set to take effect 15 days after its publication in the Official Gazette or other media. Highlights of CREATE Amending Tax Code: Effective from July 1, 2020, the income tax rates of domestic corporations, in general, and resident foreign corporations are reduced from 30% to 25%. For domestic corporations with taxable income not exceeding ₱5 million and with total assets not exceeding ₱100 million, the income tax rate is reduced from 30% to 20%. Effective January 1, 2021, the income tax rate of nonresident foreign corporations is reduced from 30% to 25% of gross income. Additionally, regional operating headquarters (ROHQs), previously subject to the preferential income tax rate of 10% of taxable income, will be subject to the regular corporate income tax rate of 25% of taxable income; Capital gains on the sale of shares in a domestic corporation by foreign corporations are now taxed at 15% of net capital gains, on... Upcoming Events

Recent Past Events