Published in Asian-mena Counsel: Projects & Energy Report 2020

Although Vietnam has long had favorable wind patterns and supporting geography, the serious development of wind power has only recently begun. The industry holds great promise. This article1 discusses Vietnam’s policy to develop commercial wind power. By Nguyen Huu Hoai — Partner, Russin & Vecchi.

Factors driving the development of wind power

Factors driving the development of wind power

Many factors are driving the development of wind power. First, Vietnam will face a severe shortage of energy in the near future — the accessible sources of fossil fuels (oil, gas and coal) are limited, and the exploitation of this traditional energy in Vietnam will continue to be more difficult and costly. Second, Vietnam mainly relies on coal-fired power plants that require a substantial amount of investment capital. Local banks are unable to finance large-scale coal fired projects and foreign banks appear to be less and less willing to finance coal-fired power plants due to environmental and other concerns. It is likely that large-scale coal power plants in particular will not be completed within the government’s approved schedule due to the shortage of finance. Third, climate change and human negligence in the construction and management of hydro power plants has begun to limit Vietnam’s traditional reliance on hydropower. Vietnam had paid much attention to disasters which have occurred in developed countries. They involve oil spills and nuclear power plants. Previously, it was largely unchallenged that nuclear power was clean, safe and efficient. In fact, the plan to develop a 4,000-MW nuclear power plant in Ninh Thuan was abolished soon after the Fukushima accident. Fourth, the development of renewable energy (including wind power) is beginning to thrive on the significant reduction of investment costs and the introduction of new technologies. Fifth, since Vietnam has insufficient means to store oil and gas, Vietnam will face an energy shortage if the global price of oil and gas rises. Finally, the retail price of electricity sold by Electricity Group of Vietnam (“EVN”) to end-users will gradually and continually increase. In the meantime, the price of renewable energy has become more competitive.

The long-term alternative solution is to find sources of energy that are cleaner, safer and more sustainable. Renewable energy (solar, wind, biogas and biodiesels) is now commercially viable. It explains why both domestic and foreign investors have a larger interest in development of wind power projects. There is now a clear opportunity for investors to explore in new “blue ocean” areas. A combination of wind power within an existing solar project is an option for solar power projects to generate additional income and to use land more efficiently. Offshore and floating wind farms open a new industry to develop Vietnam’s wind power offshore. These new markets may first be pursued by foreign investors that have advanced technologies, experience and large financial capabilities. Even so, there appears to be room for pioneers and serious players.

Vietnam’s conditions for wind power

Engineers and industry leaders have long concluded that Vietnam has particularly good conditions for wind power. Central and southern provinces are particularly well suited to the generation of wind power. A few wind farms are already operating in Binh Thuan, Quang Tri, and Bac Lieu provinces. Other projects in Ninh Thuan, Binh Thuan, Quang Tri, Baria-Vungtau, Ben Tre, Soc Trang, Binh Dinh, Tra Vinh, Thanh Hoa, Quang Ngai provinces, etc., are in various stages of implementation.

Vietnam’s policy

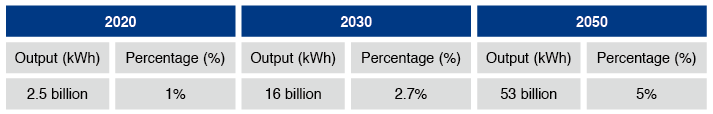

The policy on wind power is set out mainly in Decision 4282, Decision 373, Decision 20684, Circular 025 and Circular 966. According to premises set out in Decision 2068, the output of electricity generated by wind power will substantially increase, but will represent a small percentage of Vietnam’s projected total power. Below are wind power targets by years:

These targets are thought to be conservative in comparison with Vietnam’s potential, and it is quite possible that generating power from wind will exceed these low targets.

Licensing procedures

Wind power projects are especially encouraged projects. Even so, the licensing process for wind power projects is rather deliberate. In the first step, the investor must choose a suitable location. The proposed location may overlap or conflict with approved planning (eg, mining, resorts, etc). In such cases, the investor needs to work with the People’s Committee at the municipal level and with the local Department of Industry and Trade in order to be sure that the proposed location is suitable.

If the proposed project is not on the Government’s list of permitted projects, the investor must register it with local authorities and the Ministry of Industry and Trade (“MOIT”). There is a process to register a proposed project. The investor must present tests of wind capacity which cover at least 12 consecutive months at the proposed location. If the test results show significant promise, the investor is required to prepare a pre-feasibility study and submit it to the MOIT or to the Prime Minister for consideration. If the proposed project is approved, it will be added to the list of permitted projects.

The next step is to prepare a feasibility study and to submit it to the MOIT for evaluation. If approved, the local licensing authorities will issue an investment certificate. After that, the investor will sign a power purchase agreement and a grid connection agreement with EVN. The Investor must also obtain a construction permit and the other licenses necessary to construct, complete and operate the project. The process to find a suitable location and to obtain all necessary licenses will take more or less 24 months.

Technical requirements

Generally, turbines used in wind farms must be new and they must meet Vietnamese, IEC7 or equivalent standards. Their date of manufacture, up to the date of installation, must not exceed five years. Use of second-hand turbines must be approved by the MOIT. Old equipment and outdated technology may be rejected. These requirements will affect the initial capital expenditure and production costs.

Subsidies and financial support

Although commercial wind power has been developed in several countries and although costs are falling, the production cost of wind power remains high. Subsidies are normal. The price of wind power may eventually become more competitive as the cost of electricity from traditional sources increases (due to the increase of the price of gas and coal) and the investment costs of wind power plants decrease (thanks to the development of technology). In the meantime, and to be competitive in the present, the young industry still needs government subsidies.

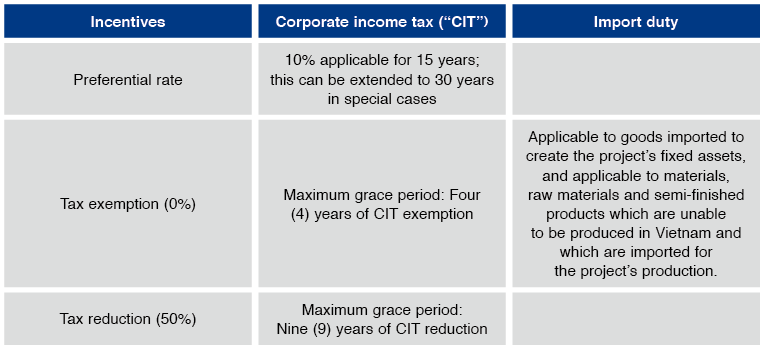

Wind power is unlimited, and it is well-known as zero-carbon energy. Wind projects are especially encouraged by the Government. They are entitled to exemption and reduction of land rental and land levies. They can also qualify for favorable state loans and tax incentives. Below are tax incentives applicable to wind power projects:

In addition to the above tax incentives, the Government assures that the entire output of wind power farms will be purchased at a price of US cents 8.5 per kWh (applicable to onshore wind farms) and US cents 9.8 per kWh (applicable to offshore wind farms) pursuant to a standard power purchase agreement between EVN and the wind farm. Of note, these prices will apply for 20 years, but they will apply only to wind power projects that are able to commence their commercial operation before November 1, 2021. Subject to conditions and circumstances as the deadline approaches (eg, development of technology, Vietnam’s energy demand, etc.), these prices may increase or decrease or remain the same after November 1, 2021. There is experience that the tariff for onshore and offshore wind farm were originally capped at US cents 7.8 per kWh. But the current prices were actually increased as of November 1, 20188.

Under Decision 37, the Government commits to provide financial support of US cent 1 per kWh to EVN through the National Environment Protection Fund. This means that, in fact, EVN needs to pay only US cents 7.5 per kWh and US cents 8.8 per kWh for energy generated by onshore wind farms and offshore wind farms, respectively. The price paid to subsidized wind power developers is higher than the average price that EVN currently pays for energy generated from traditional sources.

In addition to the Government’s subsidy, there is another form of support. Wind farm investors may also receive additional income from the Clean Development Mechanism (“CDM”) pursuant to the Kyoto Protocol of which Vietnam is a signatory. Of course, qualifying conditions must be met.

Government support to the industry

These tax incentives and the favorable tariff may or may not be sufficient for the young industry. Government support and sensible policies are crucial. Other countries provide government subsidies and financial support. Vietnam can continue to learn from them: production tax credits for each kWh generated by wind farms, a reasonable allocation of the premium of wind power’s price to monthly invoices billable to end-users (instead of using state budgets to subsidize), prolongation of grace periods to enjoy incentives, tax credits, etc.

The Government also needs to consider other forms of support: (i) creating favorable conditions and simplifying the licensing process for wind power projects; (ii) reserving sufficient land and sea areas for wind farms; (iii) perfecting comprehensive regulations on public-private partnerships in respect of infrastructure projects in general and wind power projects in particular; (iv) encouraging other ancillary production sectors, such as the production of turbines, towers and transformers; (v) granting tax incentives to individuals and contractors who work at wind power plants, (vi) VAT exemption or reductions for wind power; (vii) shaping sensible regulations on power purchase agreements between EVN and wind farms. Any of these measures are welcome by private investors and the public. In return, Vietnam will have security and diversification of energy and a source of energy friendly to the environment.

________________________________

Endnotes

- A version of this article was first published in 2013 on CorporateLiveWire and has been updated to reflect current policies on wind power.

- Decision 428/QD-TTg of the Prime Minister dated March 18, 2016 (“Decision 428”).

- Decision 37/QD-TTg of the Prime Minster dated June 29, 2011 (“Decision 37”) which was amended by Decision 39/TTg-QD of the Prime Minister dated September 10, 2018 (“Decision 39”).

- Decision 2068/TTg-QD of the Prime Minister dated November 25, 2015 (“Decision 2068”).

- Circular 02/2019/TT-BCT of the Ministry of Industry and Trade dated January 15, 2012 (“Circular 02”).

- Circular 96/2012/TT-BTC of the Ministry of Finance dated June 8, 2012 (“Circular 96”).

- International Electrotechnical Commission.

- The effective date of Decision 39

![]()

![]() Click Here to read the full issue of Asian-mena Counsel: Projects & Energy Report 2020.

Click Here to read the full issue of Asian-mena Counsel: Projects & Energy Report 2020.

Russin & Vecchi

Russin & Vecchi Nguyen Huu Minh Nhut

Nguyen Huu Minh Nhut Sesto E Vecchi

Sesto E Vecchi