By Hong Bui,

By Hong Bui,

Business transfer as a structuring tool — when, how and what to note.

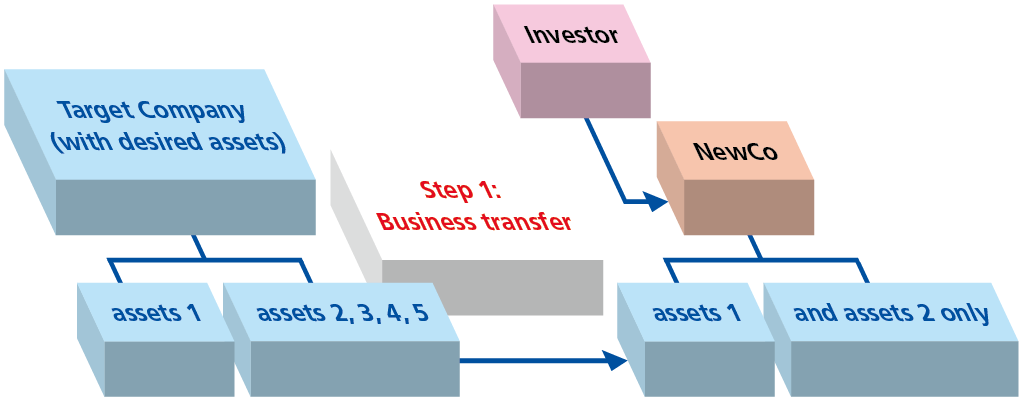

When investing in a business in Vietnam, an investor may prefer to cherry-pick a specific part of the business rather than buying the entire company. In such cases, an asset acquisition may be the best choice — however, in special situations where a share transaction is more appropriate, the transaction needs to be structured as a share acquisition and accordingly a “business transfer” needs to be used.

A business transfer usually covers the transfer of the targeted business to a newly incorporated company (NewCo), so that NewCo will be transferred to the buyer. The transfer generally includes assets, employees, licences and on-going contracts.

Typically, a business transfer can be conducted via two steps.

- Step 1: the seller establishes NewCo and transfers the targeted business to NewCo

- Step 2: the buyer acquires share capital to own Newco, thus owning the targeted business

Although there can be some variations, the whole transaction can generally be illustrated as seen in the chart.

Business transfer — an efficient tool for investment

Why and when should investors use business transfer for their investment? By purpose, business transfer helps the buyer to cherry-pick only the asset they wish to acquire. Meanwhile, by nature, business transfer is a means to conduct the contemplated transaction by way of a share acquisition. The hybrid nature of business transfer brings all the pros and cons of an asset deal and a share deal, which makes it a useful structuring tool when a deal needs to take advantage of both asset deal and share deal structures.

Usually, business transfer should be a preferred tool to structure a deal when one or more of the following come into play:

- the targeted business is only part of a larger business that the buyer wouldn’t want to acquire entirely;

- the company originally owning the targeted business may raise concerns for the buyer about accumulated liabilities that may remain hidden or unacceptable to the buyer;

- the licences for engaging in the targeted business are under the name of a company, and accordingly the acquisition transaction must be in the form of a share acquisition deal, not an asset deal; or

- it isn’t justifiable for the purchase price to structure the deal purely as an asset acquisition deal, meanwhile a share acquisition deal can help make the purchase price justifiable.

Generally, a transaction by way of business transfer is often more complicated than a purely asset deal or purely share deal. However, when the above listed items become relevant concerns, business transfer may be a preferred solution. Knowing how to use business transfer is therefore necessary.

Some key points to note when consider whether or not to use business transfer

The first point to consider is the transferability of each asset comprising the targeted business. Under Vietnamese law, the transferability of some assets can be conditional or subject to permission or consent by the government or by a third party. For example, land use rights may be restricted from transferring; some licences are granted to a legal entity on the ground of some conditions which may not be met by Newco; some contracts are transferable only upon consent by third party. Transferability, depending on the particular asset, could be decisive when considering whether to use business transfer.

The second point to consider is whether or not the operation of the business to be transferred can be maintained uninterrupted. Transferring an on-going business can be like trying to dismantle and re-assemble the parts of a running engine. In this regard, transfer of existing contracts should be handled carefully.

The third point to consider is the time to be spent for conducting a business transfer. Depending on the specific business component to be transferred, the business transfer process could take a long time to complete. Typically, business transfer of the targeted licences or the like can be very time-consuming and may mean that the business transfer structure is undesirable.

The fourth point to consider is the possibility and arrangements for the potential buyer to control the business being transferred, so that any liabilities newly incurred are monitored and subject to being approved or otherwise controlled by the potential buyer. This control is very important in many aspects, especially to ensure that the objects being transferred comprise only those that are targeted, and any liabilities incurred during the time when the business transfer is conducted are accepted by the potential buyer.

The fourth point to consider is the possibility and arrangements for the potential buyer to control the business being transferred, so that any liabilities newly incurred are monitored and subject to being approved or otherwise controlled by the potential buyer. This control is very important in many aspects, especially to ensure that the objects being transferred comprise only those that are targeted, and any liabilities incurred during the time when the business transfer is conducted are accepted by the potential buyer.

The last key point to consider is the tax perspective. For example, if the company with the targeted business is incurring substantial losses that could be deducted by the buyer, or it currently enjoys a special tax incentive that is no longer obtainable by a company newly incorporated like NewCo, it could become undesirable to use business transfer. Further, tax arising from the acquisition transaction could be a concern as well. That is, in case the company owned by the seller’s sole business is the one to be transferred; accordingly, after the business is transferred, the transferring company will be liquidated. In this case, the seller may be subject to both corporate gains tax (on the purchase price) and individual gains tax (to the shareholder, if the shareholder is an individual), and may find business transfer undesirable.

Some technicalities to help investors conduct a business transfer

Conducting due diligence (DD)

When it turns out that a business transfer is to be used, the DD should focus on only the targeted business, which is to be reflected in a checklist. Accordingly, the existing company’s liabilities which shall not be the subject of the business transferred can be excluded from the DD scope.

In conducting the DD, the transferability — legal and practical — of each item of the targeted business should be verified. When transferability of an item in the targeted business is conditional, eg subject to another party’s consent, obtainment of such consent should be raised for possible solution. When re-issuance of some licences for continuing the targeted business require NewCo to meet some conditions, it should be confirmed that NewCo can meet the respective conditions.

Conducting the business transfer

The parties need to agree on how to implement the business transfer. The buyer needs to have the business transfer conducted so that all the targeted business is transferred properly. In case any desired assets are not transferred, that has to be taken into account, eg for possible price adjustment. Any liabilities incurred to NewCo should be monitored and controlled by the buyer.

Preparing transactional documents

With the investigation results from the DD, transactional documents will be prepared. These may include memoranda of understanding (MOU), master agreement, shareholders’ agreements and other agreements to implement the business transfer and to realise the contemplated transaction.

In an acquisition transaction that involves the use of business transfer, a master agreement should be deployed. The master agreement sets out the terms to conduct the deal, and especially the business transfer — by using many affiliate agreements. Examples of these affiliate agreements include real estate transfer agreement, intellectual property transfer agreement, assignment agreements for each on-going commercial contract and employment contracts such as termination minutes, and new employment agreements.

Special transaction terms: In addition to the standard terms, a transaction involving the use of business transfer may require the transactional documents to take into account the following:

- The status and performance of the business to be acquired should be detailed. A list of assets, detailing tangible and intangible ones, commercial contracts, liabilities, employees, etc, with detailed status should be annexed to the purchase agreement.

- Agreement on how the business transfer should be conducted should be set out. As mentioned, a deal using business transfer involves establishment of NewCo, transferring the targeted business from the selling company to NewCo. Accordingly, the method of transfer, the transfer procedures, the record of acquired assets to the NewCo’s accounting system need to be anticipated and agreed beforehand by the parties.

- The buyer’s right to manage, monitor and check the status of business transfer should be set out. Frequently, the business keeps running during the transfer process and the acquisition. New inventories may be acquired, and new sale contracts and purchase contracts may be concluded. These events may affect receivables and payables of the targeted business. Transactional documents should provide appropriate mechanism to deal with those scenarios. The agreement may set certain rules applicable to the seller in operating NewCo, for example, (i) list of action requiring the buyer’s consent (eg change of NewCo’s charter capital, business lines, loan obtainment, change of management structure, etc); (ii) list of transactions to which NewCo being a contracting parties require the buyer’s consent (which can base on criteria of value or nature of transactions); (iii) agreement between the seller and the buyer so that persons appointed by the buyer will hold some managerial position in NewCo even before the closing.

- As to purchase price, the transactional document should include a mechanism to evaluate the targeted business at the closing, with the applicable accounting standard rules to apply.

- And, similar to any M&A deal, the transactional documents should record detailed arrangements on how the buyer can take over the business, including conducting necessary registration procedure, appointment of key managerial positions, decision-making rules, etc.

Some points to note in conducting the transfer of the targeted business

Some points to note in conducting the transfer of the targeted business

- Asset transfer: In Vietnam, some types of assets require ownership registration, such as real estate, ships, vehicles, etc. When dealing with transferring these types of assets, it should be clear who is responsible for the registration.

- Commercial contracts: Transfer of existing contracts to NewCo requires the consent of the contract counterparty. Negotiating a new agreement may result in the loss of attractive terms.

- For supply contracts and customer contracts: there can be two options, signing new ones or having contracts assigned. In any case, the parties should agree on which obligation to be transferred, how to deal with payables and receivables, and whether NewCo or the buyer shall absorb such rights and obligations.

- For lease agreement, deposit should be a concern. In practice, the lessor normally does not want to return the deposit. Therefore, the transferor and the transferee to the lease must agree on how to deal with such amount, eg whether this amount should be added to the purchase price.

- Employment transfer: Basically, for conducting employment transfer, the selling company shall reach agreement with the employees to terminate the employment relationship, and at the same time, NewCo shall enter into new employment contracts with the employees. A note from practice is the termination agreement should include all severance payment amounts payable to the employees. Also, the selling company should have a good filing system to keep all relevant documents recording the fulfilment of its relevant obligations, including confirmation of employees on receiving the payment, no claims declaration.

- Sublicences: Except for certain sublicences attached to assets and being confirmed transferable, NewCo/the seller needs to reobtain all required sublicences before starting running the business. In Vietnam practice, obtaining sublicences can be very time-consuming. This should be taken into account to avoid the situation where the company has to open without the required licences.

In summary, business transfer can help buyers to cherry-pick desirable assets, avoid liabilities and, when needed, make the purchase price justifiable. Offering all the advantages of both asset deal and share deal structures, a transaction by way of business transfer is often more complicated than a purely asset deal or purely share deal. When business transfer has to be deployed to get a deal through, nevertheless, the deal should be conducted with care, including utilisation of the dos and don’ts for a hybrid of share deal and asset deal, in an on-going business.

LNT & Partners

LNT & Partners Nguyen Anh Tuan

Nguyen Anh Tuan Bui Ngoc Hong

Bui Ngoc Hong Nguyen Ha Quyen Hoang

Nguyen Ha Quyen Hoang