How Global Banks Extend the Reach of U.S. Extraterritorial Jurisdiction, Directly and Indirectly Impacting the Global Expansion of Chinese Companies

November 16, 2020

This is first in a series.

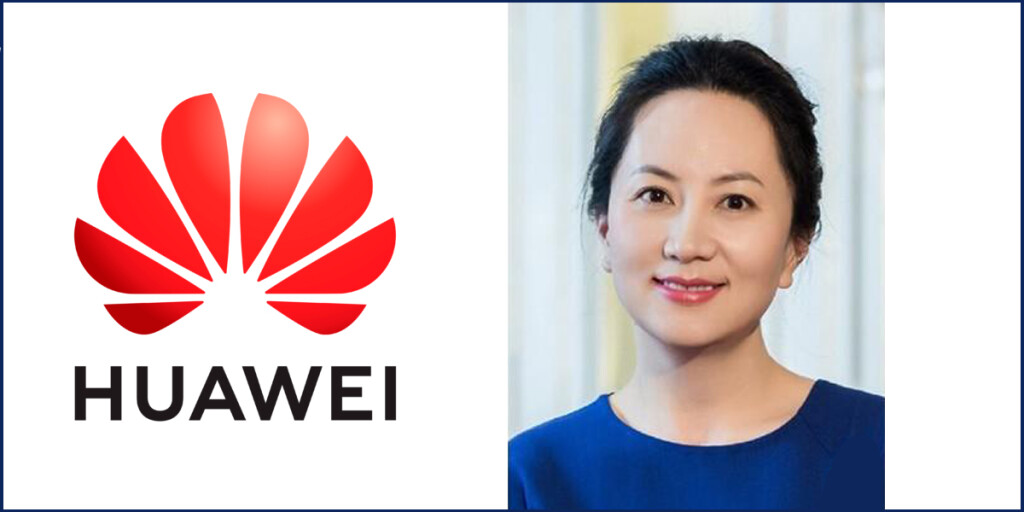

On December 1, 2018, U.S. President Donald Trump was heading to a private dinner with Chinese President Xi Jinping at the G20 summit in Buenos Aires. At the same moment, Canadian officials, acting at the request of the U.S. Justice Department, arrested Meng Wanzhou, CFO of Chinese telecommunications giant Huawei Technologies Co. Ltd., at the Vancouver International Airport. Ms. Meng, who is also the daughter of Huawei founder Ren Zhengfei, had arrived on a flight from Hong Kong and was taken into custody as she waited for her connecting flight to Mexico.

Ms. Meng’s arrest was made pursuant to an indictment which charged Huawei, Huawei’s U.S. subsidiary, Skycom Tech. Co. Ltd. and Ms. Meng with various counts of bank fraud, wire fraud, violation of U.S. sanctions against Iran, related conspiracy charges as well as obstruction of justice. The charges against Ms. Meng included allegations that in a meeting with representatives of HSBC in Hong Kong in August 2013 she made false statements regarding the relationship between Huawei and Iran-based Skycom in an alleged effort to cover up prohibited transactions with Iran entities. Such false statements were alleged to constitute bank fraud. The U.S. Department of Justice (DOJ) described the actions of the defendants as a “dual threat to both [the] economic and national security” of the U.S. According to U.S. prosecutors, Ms. Meng was charged “based on her own personal conduct and not because of actions or misconduct by other Huawei employees.”

Beijing has vigorously denounced the arrest of Ms. Meng, who is considered by many to be “corporate royalty” in China. Even President Trump reportedly referred to her as the “Ivanka Trump of China.” Chinese officials have repeatedly claimed that her arrest was part of a political conspiracy to block the growth of Huawei and other Chinese tech giants abroad. Ms. Meng’s arrest cast a pall over the U.S.-China trade talks and the relationship generally. The relations between Canada and China also were severely strained as a result of her arrest. Tensions between the two countries worsened further when, only nine days after Ms. Meng’s arrest, two Canadian nationals, Michael Kovrig, a former diplomat, and Michael Spavor, a business man, were detained in China and later charged with “spying on national secrets” and providing intelligence for “outside entities.” Canadian officials described their arrests as “arbitrary,” but China denied that the arrests of the two Canadians were in retaliation for or otherwise connected to Ms. Meng’s detention in Canada.

The origins of the charges against Ms. Meng merit close analysis as they illustrate the global reach of U.S. criminal laws and the risks that senior managers in Chinese and other non-U.S. corporations face in dealing with global banks even outside of the U.S. In order to assess these risks, in this first article in this series we will look at HSBC and their role in triggering the investigation of Huawei and Ms. Meng. In the second and third articles in the series, we will examine the charges against Ms. Meng as well as the defenses raised by her counsel in the pending extradition proceedings in Canada. This factual background, drawn from voluminous public records and published reports, will then provide a framework for an assessment of the related legal and practical implications for Chinese and other non-U.S. companies as they expand globally, which we will address in the fourth and final installment in the series.

The HSBC Deferred Prosecution Agreement

This particular saga actually starts not with Huawei but with HSBC. On December 11, 2012, HSBC entered into a Deferred Prosecution Agreement (DPA) with the U.S. Justice Department. The underlying conduct to which HSBC admitted as part of the DPA represented an egregious breakdown in HSBC’s internal compliance management controls over an extended period of time. In the DOJ press release announcing the DPA, the DOJ characterized HSBC’s criminal misconduct in the following stark terms:

“HSBC is being held accountable for stunning failures of oversight – and worse – that led the bank to permit narcotics traffickers and others to launder hundreds of millions of dollars through HSBC subsidiaries, and to facilitate hundreds of millions more in transactions with sanctioned countries,” said Assistant Attorney General Breuer. “The record of dysfunction that prevailed at HSBC for many years was astonishing.”

The aspect of the criminal misconduct on the part of HSBC that is pertinent to this case study included HSBC’s allowing approximately US$660 million in transactions prohibited by the Office of Foreign Assets Control (OFAC) to be processed through U.S. financial institutions, including HSBC’s U.S. subsidiary. OFAC is a department of the U.S. Treasury Department that administers and enforces U.S. economic and trade sanctions. All banks which access the U.S. financial system to process U.S. dollar transactions are required to screen and report prohibited transactions involving sanctioned entities to U.S. government authorities. In this case, over an approximately ten-year period, HSBC failed to screen and report OFAC-prohibited transactions from Iran, Cuba, Sudan, Libya and Burma, and HSBC employees even went so far as to strip the identifying information from related payment messages so as to avoid detection. Senior compliance officers in HSBC’s global headquarters raised red flags about these practices, but their warnings were ignored.

After investigation, U.S. authorities prepared indictments and then ultimately negotiated and signed the DPA with HSBC. A DPA is a form of pre-trial settlement or diversion agreement, which requires the company to admit to the facts constituting the crime as charged and to agree to the imposition of a severe criminal penalty, but one which will not cause the corporate defendant to go out of business (as was the case with Arthur Andersen in connection with the Enron scandal in the early 2000s). Other conditions, such as enhanced compliance management undertakings, the appointment of an independent outside monitor, etc., are also commonly included. DPAs thus are a means by which the U.S. government can force corporate defendants to agree to substantial penalties and other onerous settlement terms without having to go to trial. For corporate defendants, by signing a DPA they save the costs of going to trial (although negotiation and remediation costs and penalties should not be underestimated) but also achieve additional certainty as to the result and avoid the risk of being subject to the corporate “death penalty.” However, DPAs also limit the ability of corporate defendants to raise defenses to the government’s theory of the case and interpretation and application of the law, which can result in the DOJ adopting more aggressive positions than they otherwise may in a contested trial setting.

In this case, the terms and penalties under the HSBC DPA were appropriately severe given the serious nature of the criminal conduct. Under the DPA, HSBC forfeited US$1.256 billion and also agreed to pay an additional US$665 million in civil penalties. HSBC also was required to undertake enhanced compliance management measures, and Michael Cherkasky, who previously served as a senior New York City prosecutor and thereafter had been the CEO of Kroll Inc., was appointed as the independent monitor to oversee the promised improvements in HSBC’s compliance systems. HSBC also was required to replace almost all of its senior management and to “claw back” or defer senior management bonus payments.

In addition, during the five-year term of the DPA, HSBC was to apply the OFAC sanctions list to U.S. dollar transactions as well as to the acceptance of customers, and even more to the point for purposes of this case study, HSBC was (with certain exceptions) prohibited from knowingly undertaking any cross-border electronic payments in U.S. dollars in respect of any person or entity resident or operating in Iran, North Korea, Sudan, Syria or Cuba.

If HSBC breached the DPA, then it would be subject to criminal prosecution for all of the charged acts to which HSBC had already stipulated. On the other hand, if HSBC fully complied with the terms of the DPA, all related charges would be dropped at the end of the term.

The Hong Kong Meeting

The heightened scrutiny of HSBC’s compliance management systems pursuant to the DPA provides a critical backdrop to the series of events leading up to the fateful meeting between Ms. Meng and HSBC officials in Hong Kong in August 2013. It is also important to note that HSBC reportedly had been providing banking services to Huawei since the late 1990s, so this was not a new relationship. HSBC was already very familiar with Huawei’s global operations and its business and financial management policies and procedures.

The longstanding relationship between HSBC and Huawei was put in jeopardy when in December 2012 and January 2013 Reuters published two articles implicating Huawei in possible Iran sanctions violations. The first article was published on December 30, 2012, less than three weeks after HSBC signed the DPA, and indicated that Huawei had “close ties” to Skycom, which had offered to sell embargoed Hewlett Packard computer equipment to Mobile Telecommunications Co of Iran (MCI), Iran’s largest mobile phone operator, in late 2010 in violation of U.S. sanctions and in contravention of the export control restrictions in the HP distribution agreement entered into with Huawei. According to the article, the implication that there were “close ties” between Huawei and Skycom was based on reports that Skycom and Huawei shared the same headquarters in China and that Skycom employees in Tehran all wore Huawei badges. In addition, portions of the Skycom proposal to MCI were marked “Huawei confidential” and carried the Huawei logo. Huawei told Reuters that Skycom was one of its major local partners in Iran and further stated that Huawei conducted business in Iran in strict compliance with all applicable laws and required its partners to do the same.

In the second article, published one month later on January 31, 2013, Reuters reported that a review of publicly available corporate documents suggested that ties between Huawei and Skycom and Huawei were even closer than originally reported. Specifically, the article stated that Ms. Meng had served on Skycom’s board from February 2008 to April 2009, and that in 2007 she served as company secretary for a Huawei holding subsidiary that held 100% of the shares of Skycom. In response to questions, Huawei stated that the relationship between Huawei and Skycom was “a normal business partnership” and reiterated its commitment to strict compliance with applicable laws and its policy of requiring its business partners, specifically including Skycom, to adhere to the same high standards. The Reuters articles also confirmed that MCI in fact did not award the contract to Skycom, and as a result the embargoed HP equipment was not supplied by Skycom to MCI.

If accurate, these reports would cause serious concern on the part of HSBC given their OFAC reporting obligations generally as well as their enhanced undertakings pursuant to the DPA that had only recently been signed. Accordingly, HSBC asked Huawei for clarification. Huawei representatives allegedly initially provided blanket denials of the substance of the reported allegations. In order to clarify the situation and alleviate the bank’s concerns, Ms. Meng requested a meeting with HSBC senior executives. The meeting took place in a private room in the back of a Hong Kong restaurant on August 22, 2013. Ms. Meng had prepared a Chinese-language PowerPoint presentation which she shared with the HSBC representatives. An English version of the PowerPoint was supplied to the bank following the meeting.

The PowerPoint at the Heart of the Case

The statements and alleged omissions in the PowerPoint presented by Ms. Meng form a core factual basis for the DOJ’s case against her and Huawei for bank fraud. A copy of that PowerPoint is now part of the record in the extradition case in Canada, and casts light on what was and was not communicated in the August 2013 meeting. The PowerPoint presentation, entitled “Trust, Compliance & Cooperation,” is comprised of 16 slides, most of which outlined Huawei’s understanding of the applicable sanctions regimes together with a description of its compliance policies and practices generally and with respect to Iran specifically.

Given the centrality of the PowerPoint in the overall proceedings, pertinent portions of the presentation relating to the relationship with Skycom and Huawei’s business activities in Iran are set out below.

Slide 2 set out the following introductory statements:

Huawei operates in Iran in strict compliance with applicable laws, regulations and sanctions of UN, US and EU.

Huawei’s engagement with Skycom is normal business cooperation. Through its trade compliance organization and process, Huawei requires Skycom to make commitments on observing applicable laws, regulations and export control requirements.

A description of the busines cooperation relationship between Huawei and Skycom was provided on slide 6, which sets out the following bullet points:

- As a business partner of Huawei, Skycom works with Huawei in sales and services in Iran.

- Huawei conducts normal business activities in Iran and provides civilian telecommunications solutions in line with global standards (e.g. ITU/3GPP) and export control requirements of the US and the EU. Huawei works with local suppliers, distributors and carriers in strict compliance with its well-established business conduct guidelines.

The next slide (slide 7) set out a description of the shareholding relationship between Huawei and Skycom, listing the following bullet points:

- Huawei was once a shareholder of Skycom, and I [Ms. Meng] was once a member of Skycom’s Board of Directors. Holding shares and a BOD position was meant to better comply with relevant managerial requirements.

- As there was no process of organization at Skycom, Board supervision was the only way to ensure trade compliance. Holding shares or assigning Board member could help Huawei better understand Skycom’s financial results and business performance, and to strengthen and monitor Skycom’s compliance.

- Huawei will do business in Iran through its local subsidiary. Holding shares or sitting on the Board of Skycom is no longer necessary to ensure compliance.

- Considering this, Huawei has sold all its shares in Skycom, and I [Ms. Meng] also quit my position on the Skycom Board.

Slide 8 provided a description of the telecommunications equipment market in Iran, including a list of vendors (Ericsson, Nokia Seimens Networks, Huawei and ZTE) and customers (four domestic telecoms operators). The last bullet point stated that “In 2011, Huawei publicly announced restriction of its business in Iran.”

The concluding slide (slide 16) addressed future cooperation and communication between Huawei and HSBC. Pertinent bullet points are quoted below (emphasis in original):

- HSBC has been working with Huawei for a long time and has a deep understanding of Huawei’s history of growth around the world. We have been and will continue to be transparent in our financial operation and across the company. Open processes and voluntary disclosure of our annual reports are examples of transparency. The Huawei that you see and interact with is who we really are. Huawei’s engagement with Skycom is normal and controllable business cooperation, and this will not change in the future.

- HSBC has rich experience in trade compliance. We look forward to discussions on compliance and good experience from HSBC to help us further improve our compliance practices.

- Huawei subsidiaries in sensitive countries will not open accounts at HSBC, nor have business transactions with HSBC.

The HSBC Risk Committee Decision

In parallel with these discussions over the course of 2013, HSBC took two related but somewhat contradictory actions: first, in connection with the enquiries about Skycom, HSBC asked Huawei to close the Skycom account opened with HSBC, suggesting that HSBC considered Skycom to present potential risks, while at the same time recognizing Huawei’s control over the Skycom accounts; and second, in August 2013 HSBC coordinated a syndicated loan to Huawei in an amount equivalent to US$1.5 billion, and was one of the principal lenders in that transaction, indicating that HSBC intended for the banking relationship with Huawei to continue at least pending final resolution of the bank’s related internal enquiries.

The HSBC global risk committee met in London in late March of 2014 to discuss the “reputational and regulatory concerns” in respect of Huawei, and after full consideration of the related facts and circumstances as then known, the bank decided to maintain the banking relationship with Huawei. Shortly thereafter, HSBC issued a commitment letter to Huawei outlining the terms of a proposed US$900 million credit facility, and approximately one year later in 2015, HSBC participated in a US$1.5 billion syndicated loan facility extended to Huawei. However, once again, HSBC took another step in the opposite direction when in April 2015 the banks reputational risk committee decided not to do business with Huawei’s U.S. subsidiary. Ultimately, in 2017 HSBC would terminate the banking relationship with Huawei altogether.

But at this stage, in 2015 extending into 2016, even with the apparently inconsistent positions adopted by the bank in relation to Huawei, there was nothing to indicate that a meeting in a back room in a Hong Kong restaurant in August 2013 between representatives of Huawei, a Chinese company, and representatives of HSBC, a global bank registered in the U.K., to discuss business relationships and transactions in Iran, would result in criminal charges in the U.S. against Huawei as a corporate entity and Ms. Meng personally. But other forces were already at work, involving violations of U.S. sanctions laws by a Chinese competitor and potential new criminal charges against HSBC that would threaten to upend the 2012 DPA, together with broader geopolitical tensions, that would combine to change the overall trajectory of this case and land Ms. Meng in a Canadian court fighting extradition to the U.S.

Robert Lewis is a lawyer licensed in California. He has worked in leading U.S., U.K. and Chinese law firms in China for nearly 30 years. He is the author of the book, The Rules of the Game of Global M&A: Why So Many Chinese Outbound Deals Fail.

Robert Lewis is a lawyer licensed in California. He has worked in leading U.S., U.K. and Chinese law firms in China for nearly 30 years. He is the author of the book, The Rules of the Game of Global M&A: Why So Many Chinese Outbound Deals Fail.

Mr. Lewis is also co-founder and chief expert of docQbot, a legal tech company providing automated bilingual contracts for China-related inbound and outbound trade and investment transactions. He is fluent in spoken Mandarin and written Chinese.

The opinions expressed in this article are those of the author and do not reflect the opinions of InHouse Community Ltd, or it’s employees.