On September 14, 2022, the Parliament approved the draft of the Act Amending the Thai Civil and Commercial Code (the “Amendment Act”) covering Title XXII on Partnerships and Limited Companies. Under this Amendment Act, a new M&A scheme and amended corporate governance requirements have been introduced for limited companies. The draft was initiated by the Department of Business Development (“DBD”) with the goal of facilitating business operations by revising outdated requirements, removing excessive corporate compliance obligations, and promoting the business consolidation scheme under the Thai Civil and Commercial Code (the “TCCC”). The Amendment Act was recently submitted to the Cabinet for His Majesty the King’s signature on September 19, 2022, and will take effect 90 days following its announcement in the Government Gazette.

This article highlights key elements of the Amendment Act, as well as comparisons with the existing provisions under the TCCC and the implications for business operators.

Key Elements of the Amendment Act

The groundbreaking changes proposed under the Amendment Act can be divided into three major aspects as set out in the following table.

| Topic | Details |

| 1. Company Establishment | (i) Minimum Number of Promotors

Section 1097 of the TCCC requires a limited company to have at least three individuals as promotors upon its incorporation. The Amendment Act reduces the minimum number of promotors required to just two individuals. |

| (ii) The Memorandum of Association

While Section 1099 of the TCCC does not provide any deadline for the registration of a limited company’s Memorandum of Association, the Amendment Act requires that the company shall be incorporated within three months from the registration date of its Memorandum of Association with the DBD. In the event of a failure to meet such a deadline, the registered Memorandum of Association will be invalid. |

|

| (iii) Minimum Number of Shareholders

The change of minimum number of promotors required affects the requirements for maintaining the minimum number of shareholders, which shall be not less than two persons at all times, whether they are individuals or juristic persons. Accordingly, the following legislation has been amended to comply with such minimum requirements. – The grounds for company dissolution under Section 1237 (4) have been amended to now state that the company must be dissolved when the number of shareholders falls to one. The requirement for the transformation from a partnership into a limited company under Section 1246/1 of the TCCC has been revised by removing the requirement of there being a minimum of three partners prior to the transformation. |

|

| (iv) Share Certificate

The Amendment Act has revised Section 1128 of the TCCC by imposing the additional requirement of the affixing of the company seal (if any) for greater clarity. |

|

| 2. Meeting Arrangements | (i) Arrangement of the Board of Directors’ Meeting

The TCCC will now legitimize board of directors’ meetings held electronically (the “BOD e-Meeting”) through Section 1162/1, as annexed to this Amendment Act. Unless otherwise prohibited by their company’s Articles of Association. According to the Amendment Act, any directors attending the BOD e-Meeting shall be counted as part of the quorum and have the right to vote in the meeting. Despite being introduced explicitly as part of the TCCC, the BOD e-Meeting arrangements must still comply with the Emergency Decree on Electronic Meetings B.E. 2563 (2020), which includes compliance with minimum security standards and data recording requirements. |

| (ii) Delivery of the Notice of Shareholders’ General Meeting Currently, Section 1175 of the TCCC requires that shareholders’ general meetings to be summoned through; (i) publication of a notice thereof in the local newspaper; and (ii) submission of a notice to the shareholders by post with acknowledgement of receipt. The Amendment Act reduces the level of corporate compliance by amending such provision to require only submission of notice by post with acknowledgement receipt to shareholders holding share certificates under their own names. The requirement for the publication of the meeting notice in a local newspaper at least once or through electronic media in accordance with procedures outlined in subordinate laws will be enforced only if the company has shareholders who hold bearer shares. |

|

| (iii) Quorum of Shareholders’ General Meeting The Amendment Act has added the requirement relating to the quorum for a shareholders’ general meeting that it must consist of at least two shareholders or proxies who hold an accumulated total of a minimum of 25 percent shares of the company’s capital. The amendment of this provision is in line with a precedent set by the Supreme Court requiring at least two shareholders to attend the meeting to fulfill the general traits of a shareholders’ meeting (Supreme Court Decision No. 6713/2561). |

|

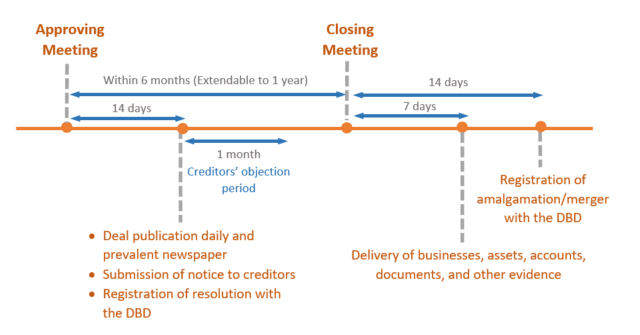

| 3. Merger Scheme | 1. Merger Scheme Regulatory compliance is another essential aspect to consider during deal structuring. Even so, the current legislation in the TCCC only recognizes the amalgamation scheme, where two entities combine to establish a new entity and dissolve themselves in the process. The Amendment Act proposes a revision of the entire chapter concerning amalgamation under the TCCC. It introduces the concept of business consolidation through a merger, in which one of the entities continues to exist after absorbing the dissolving one, which shall be prescribed under Section 1238 of the TCCC. Because a merger is not currently recognized by law, a company that would like to merge its business with another company and wishes to remain the surviving entity after completion must, under current law, carry out an entire business transfer (“EBT”) transaction, under which the other company will transfer its entire business to the acquiring company. The outcome of an EBT after completion will be similar to that of a merger. However, the EBT process can sometimes incur significant costs and expenses and also be time-consuming. Therefore, this new concept of mergers under the Amendment Act will become an alternative structure for M&A transactions in Thailand. The Amendment Act requires that an amalgamation or a merger of limited companies must be approved by a special meeting of shareholders (the “Approving Meeting”). If any shareholders vote against the transaction, the Amendment Act also proposes the addition of Section 1239/1, requiring the company to arrange the mandatory purchase of shares held by dissenting shareholders at the agreed price or the price assessed by the asset evaluator, who shall be appointed through procedures prescribed in subordinate laws. If the dissenting shareholders refuse to sell their shares within 14 days from the offer date, the company may proceed with the merger, and such dissenting shareholders shall become shareholders of the amalgamated/merged entity. The Amendment Act imposes a more precise compliance timeline by requiring the publication of a notice of such amalgamation/merger in a daily newspaper that is widely available and submission of a notice to the company’s creditors within 14 days from the date of the Approving Meeting through the revision of Section 1240 while reducing the creditor’s objection period from 60 days to 1 month from the date of receipt of notice under the same provision. |

Subsequent to the Approving Meeting and publication of the notice of amalgamation/merger, the Amendment Act requires a shareholders’ meeting to consider the corporate particulars (the “Closing Meeting”), such as the name, objectives, Articles of Association, and the number of shares of the amalgamated/merged entity. In this case, the Closing Meeting must be held within six months from the date of the Approving Meeting, extendable for up to one year with approval from the Closing Meeting pursuant to the addition of Section 1240/1.

Directors of the consolidating entities are required to deliver their respective company’s businesses, assets, accounts, documents, and other evidence to the board of the amalgamated/merged entity within seven days from the Closing Meeting date and register the completed deal with the DBD within 14 days as from the Closing Meeting date for post-merger integration according to Section 1241. The new company will acquire all the consolidating entities’ property, obligations, rights, and liabilities from such registration, and each consolidating entity shall cease to have the status of a juridical person.

Diagram: Timeline Conveying Compliance Procedures for Merger and Amalgamation Execution pursuant to the Amendment Act

Concluding Remarks

Despite the fact that the process appears to be getting easier for business operators, whether in terms of incorporation, operation, or consolidation, there still remain ambiguous elements pursuant to which operators who intend to follow these regulatory changes shall remain at risk.

- Absence of Official Interpretation

Section 1240 prescribed that the resolution for merger and amalgamation must be published in a ‘daily newspaper which is widely available’. The source of publication stated in such clause differs from Section 1175, which states that the notice of the general meeting must be published in a ‘local newspaper’. There is no specific definition for such two phrases that interprets the difference or the qualifications by which to ascertain brands or media companies as a sufficiently widely distributed newspaper. Therefore, it will depend on the official interpretation in this regard and may affect the legal compliance on publishing notices for merger and amalgamation.

- Absence of Enforcement of Other Authorities

Merger and acquisition transactions involve numerous aspects for consideration as well as dealing with different public authorities. Therefore, tax analysis is another essential step when conducting due diligence prior to deal closure. While there have been multiple rulings pertaining to tax liabilities in the course of share acquisition, asset acquisition, and amalgamation, which facilitates calculation to reduce tax exposure upon deal execution, the Thai Revenue Department is still silent upon the merger scheme under the Amendment Act.

- Limited Legal Recognition of Electronic Corporate Conduct

While the Amendment Act permits the holding of BOD e-Meetings, this legal recognition does not extend to permitting the same for shareholders’ meetings. This legal development is contradicted by the recent amendment to the Public Company Act, effective on 24 May 2022, which allows board meetings and shareholders’ meetings, including submission of related notices therefor, to be conducted electronically.

Ultimately, this Amendment Act is another significant step forward in developing Thailand’s corporate regulatory regime. We now must monitor this significant legal development, as well as the relevant subordinate laws and the establishment of corporate penalties in the event of non-compliance, which are expected to be enacted in subsequent amendments.

For more information, please get in touch with our corporate and M&A Team, or alternatively, please contact the authors.

Kudun and Partners Limited

Kudun and Partners Limited Kudun Sukhumananda

Kudun Sukhumananda Troy Schooneman

Troy Schooneman