I. Tied Product Tied Product should be entirely different, distinguishable and available individually from Tying Product. In Tetra Pak case, SAIC held the opinion that the aseptic carton filling machines, technical services and packaging materials are independent commodities from each other from the aspects of the functions and substitutions of commodities, demands and transaction management, etc, and therefore, it determined that Tetra Pak conducts tying when Tetra Pak requires its customers to purchase Tetra Pak packaging materials or the packaging materials “recognized by Tetra Pak” or “with same quality” within certain period as set forth by Tetra Pak when selling and leasing the aseptic carton filling machines and providing technical services. II. How to determine the justifiable reasons in tying From the investigation and analysis of SAIC on the tying of Tetra Pak, we may catch a clearer standard to determine the justifiable reasons:

The basis for SAIC to make the above determination is the same as that for determining the justifiable reasons of tying which excludes or restrains competition stipulated in the Provisions on Prohibiting the Abuse of Intellectual Property Rights to Exclude and Restrain Competition, which says that (1) Compulsorily tying or combining different products for sale against transaction practices, consumption habits, etc. or regardless of the functions of the products involved; and (2) Tying sales enable the business operator to extend its dominant position on the market of the tying product to the market of the tied product, thus excluding or restraining the competition from other business operators on the market of the tying product or the tied product. Other specific factors considered by SAIC in Tetra Pak case are also reflected in the section of analyzing the effects or potential effects of tying on the competition on relevant market of the Guidelines for Anti-Monopoly Law Enforcement against the Abuse of Intellectual Property Rights (7th Draft of SAIC). The aforesaid two rules of SAIC only apply to the intellectual property related anti-monopoly cases; however, SAIC followed the approximately same determination standards when determining the justifiable reasons for tying in Tetra Pak case. In any future similar cases, it is very likely that SAIC will continue following the above standards which deserves our continued attention. 从利乐案看搭售行为正当理由的认定 一、被搭售商品 二、如何判断搭售有无”正当理由” 纵观国家工商总局对利乐案中利乐公司搭售行为的调查和分析,我们可以看出判断搭售有无”正当理由”的更为清晰的标准:

国家工商总局做出上述认定的出发点与《关於禁止滥用知识产权排除、限制竞争行为的规定》中认定滥用知识产权排除、限制竞争的搭售行为是否具有”正当理由”的出发点如出一辙,即(1)违背交易惯例、消费习惯等或者无视商品的功能,将不同商品强制捆绑销售或者组合销售;和(2)实施搭售行为使该经营者将其在主要商品市场上的支配地位延伸到被搭售商品市场,排除、限制了其他经营者在被搭售商品或者主要商品市场上的竞争。国家工商总局在利乐案中所考虑的其它具体因素在《关於滥用知识产权的反垄断执法指南(国家工商总局第七稿)》中”分析搭售对相关市场的竞争产生或者可能产生的影响”章节亦有所体现。上述两份国家工商总局的规章文件仅适用於涉及知识产权的反垄断案件,但是,国家工商总局在利乐案中认定搭售行为是否具有”正当理由”时遵循了几近相同的认定标准。在未来类似的案件中,国家工商总局认定搭售行为是否具有”正当理由”时将极有可能继续延续上述标准,值得我们持续关注。 –––––––––––––– |

China (PRC)

Latest Updates

Related Articles

Related Articles by Jurisdiction

Guidelines Promulgated to Facilitate Implementation of the Foreign NGO Law in China

The Ministry of Public Security issued guidelines for the registration of representative office of foreign NGOs.

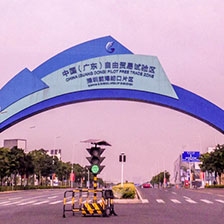

China to trial ad hoc arbitration in FTZs

China is experimenting with ad hoc arbitration in its free-trade zones, with the goal of creating a dispute resolution regime that is faster, cheaper and more flexible.

Latest Articles