Asian-mena Counsel is delighted to partner with Taylor Root once again for their 12th annual report for the in-house legal and compliance sector. The aim of the report is to assist C-suite executives, General Counsel, HR and lawyers to benchmark their and their team’s compensation levels with market rates. If you require more specific information or would like benchmarking data for you or your team, please contact any of the Taylor Root representatives herein.

Jump to: The General Counsel Market l Banking and Financial Services l Corporate l Compliance

The General Counsel Market

General Counsels continue to strive to become more well-rounded business advisors, with increasing responsibilities and influence outside the traditional legal space. This is in keeping with pressure for legal departments to encompass a more business focused role. General counsel must now balance the need to manage risk and maintain independence with the need to be actively vested in the strategy and vision of the organisation. Across Asia this has led to General Counsel achieving more exposure to senior management within their organisations, and is witnessed through more formal reporting line to a local C-suite executive rather than an International General Counsel.

Globally this has led to the rise of the Chief Legal Officer (CLO). The CLO is a counsellor and advisor and can no longer be solely a technician. Being on the C-Suite (or at least close to it) is key to fully performing the CLO role. The CLO should be a strategic business partner to the senior executive team.

Unfortunately, due to the pyramid nature of in-house legal team’s, movement within the Asia General Counsel market is limited. Where possible companies also prefer to promote internally as internal knowledge of a company’s or an industry’s corporate governance, and risk management strategies often outweigh technical legal skills. Presently, CLO roles tend to be based in the US or UK/Europe and the market in Asia is small.

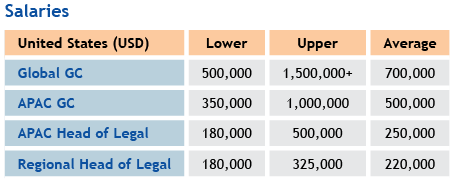

Salaries in Asia within the General Counsel market differ greatly depending on the role and responsibilities of each General Counsel. Here is a summary of the responsibilities at each level:

Global GC: Global coverage, C-suite executive, provides expertise and advice on legal, risk exposure, liability, compliance, corporate governance, reputation and integrity.

APAC GC: Multi-jurisdictional coverage, strategic adviser to Board, member of leadership group, matrix reporting line to Global GC and direct reporting to Asia management, provides expertise and advice on legal, risk exposure, liability, compliance, corporate governance, manages a complex legal and compliance department.

APAC Head of Legal: Multi-jurisdictional coverage, strategic adviser to key stakeholders in Asia, reports to Global GC and matrix reporting line to local leadership group, provides expertise and advice on legal and risk exposure, works closely with Head of Compliance, manages a sizable legal department.

Regional Head of Legal: Regional coverage, reports to APAC GC or International GC, manages a small legal department or sole counsel for North Asia, Greater China or Hong Kong region.

Hayden Gordine

Partner | Hong Kong

T: +852 2973 6333

E: haydengordine@taylorroot.com

Banking and Financial Services

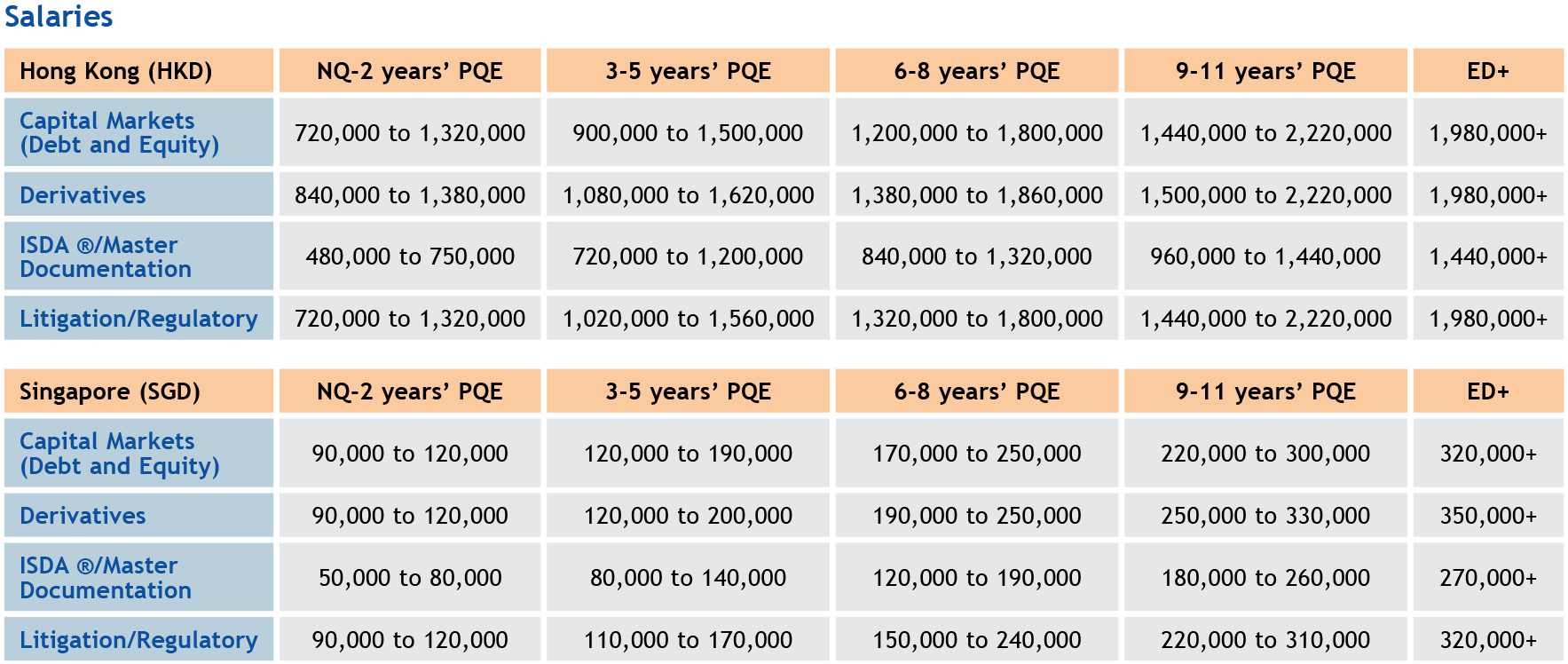

Hiring activity within the investment banking sector remains subdued, reflecting the challenging conditions within the sector globally. Notwithstanding the lower levels of activity within the investment banking sector generally, there has been increased hiring activity within financial markets, with derivatives and structured products lawyers particularly in demand. Chinese financial institutions are also aggressively building or expanding their global markets desks, hiring experienced individuals from international law firms and global banks.

Demand has been driven by a combination of increased trading activity within these markets, together with ongoing regulatory reform projects as global banks implement the requirements of Dodd-Frank, MiFID II/MiFIR and EMIR reforms, and move to more efficient centrally cleared trading platforms. An interesting trend has been the move towards compliance roles by regulatory lawyers which require them to be involved in developing policies and strategies for the bank.

ISDA negotiation teams remain busy with high volume margin rules workflow. They predominantly expand at the junior to mid-level or with seasoned contractors. Derivatives regulatory work has generally required qualified lawyers which has increased the salaries especially for contractors in this area.

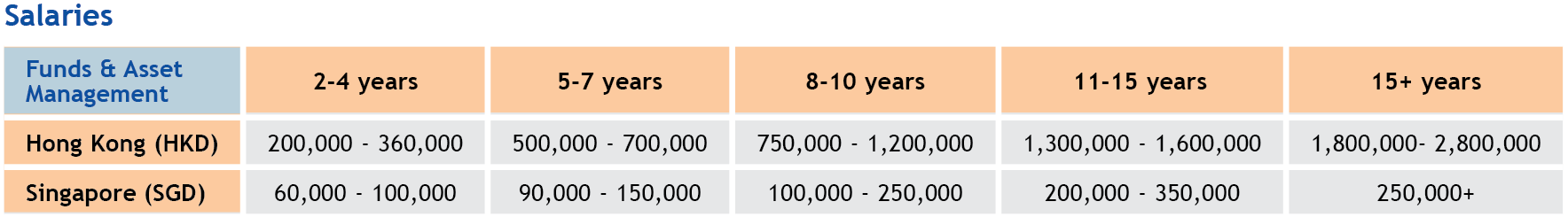

Asset Management

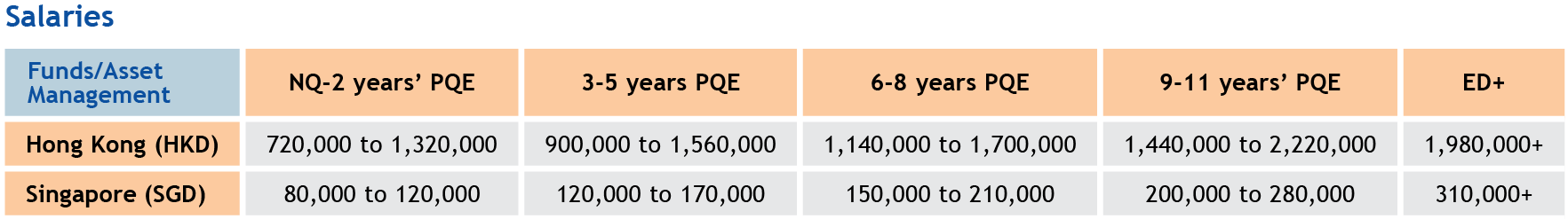

Maintaining the trend of recent years, funds and asset managers continue to be a growth sector for in-house legal roles. As more small and mid-cap fund managers increase their exposure, they are increasingly seeing value in adding in-house legal resources. Additionally, as their investments become more diverse and greater in value, these organizations are also under regulatory pressure to ensure that they have sufficient legal and compliance resources in place.

There is a keen interest to bring on junior to mid-level lawyers with broad experience, in view of their desire to maintain lean teams due to budget constraints. In the long run, this could play a pivotal role in contributing to a candidate-driven market within the financial services sector. Conversely, hires made at executive level remain focused on recruiting experienced counsels with a strong M&A background as the forecast for private equity firms is projected to be aggressive in the coming year.

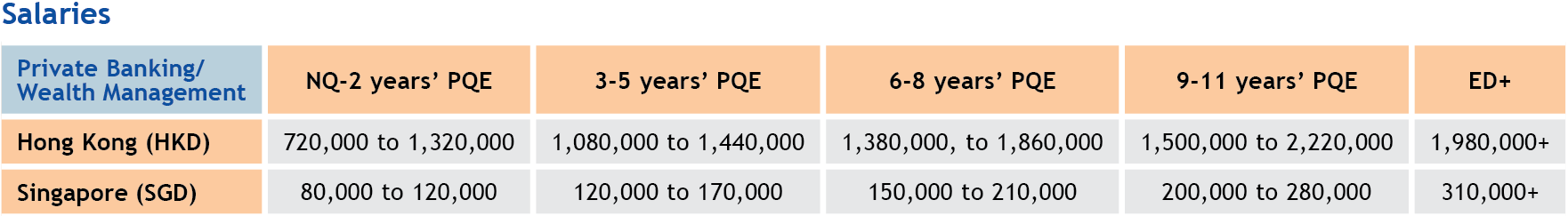

Private Wealth Management

Wealth management has been a key growth area within the in-house legal market, with a number of organizations including investment banks, PRC and Asia banks, private wealth management firms and brokerage houses competing to capture a share of the high-net worth market, both in Hong Kong, Singapore and across Asia.

As technology platforms have evolved, wealth management firms have been able to provide clients with access to a broader range of products, but have consequently been subjected to increased regulatory pressure, making it imperative for these firms to ensure their legal and compliance teams are adequately resourced. Given the small size of most teams within the wealth management sector, there are a small number of candidates in the market who have specific experience in wealth regulatory advice, client transaction structuring and general commercial advisory.

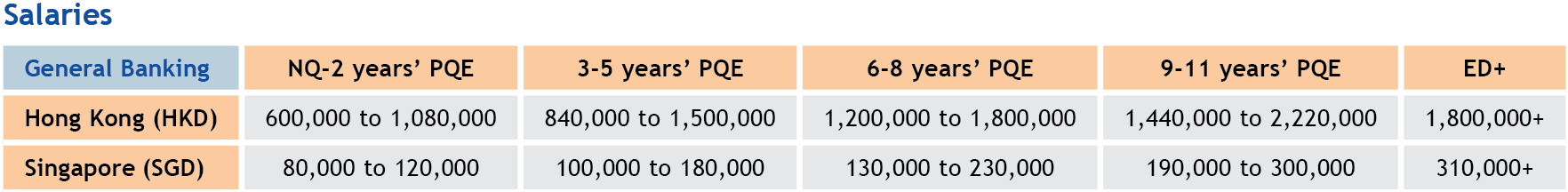

General Banking

The market for general banking lawyers’ remains subdued largely due to the stability of teams and the availability of law firm secondees. Transaction banking skill sets such as trade finance, securities services and cash management remain highly sought after. However, hiring has centred on mid-level rather than senior roles.

Key drivers for the consumer finance market are innovation and technology, as banks seek to gain a competitive advantage, win market share and create greater efficiencies of scale in a high volume, low margin market. This comes in addition to increasing pressure on major financial institutions from non-traditional service providers such as electronic payments services, remittance providers, second tier mutual banks/credit unions and mortgage providers.

Institutions have also been focused on the digital movement, in tandem with the increasingly busy FinTech sectors. In some cases, we have seen a demand for general corporate and commercial/IT lawyers within these FinTech companies, and as lawyers from such practice areas tend to be more mobile, there tends to be a higher incidence of cross industry transitions with good levels of success. Such roles tend to attract lawyers at the junior to mid-level, rather than at the senior level, as more senior lawyers tend to prefer the stability of being in more structured and established organizations.

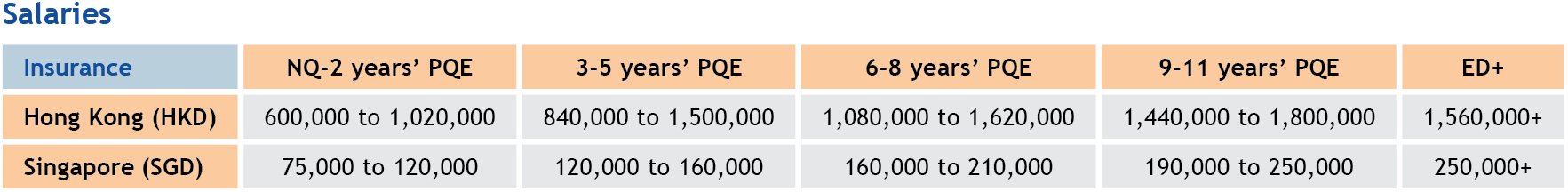

Insurance

Monitoring the progress of emerging regulations and assessing their impacts will be critical for insurers operating in the Asia-Pacific region in 2018-19. From rules on consumer protection and cybersecurity to new common reporting standards and capital requirements across multiple markets, the regulatory landscape for insurers in Asia-Pacific has never been more complex, and is a unique challenge for an industry that in the past has been slow to change. Headcount within legal is traditionally stable compared to other banking and financial services sector institutions, but establishing a fully trained compliance team with input into strategic business decisions will be essential for mapping out the right operational and strategic responses to the evolving regulatory landscape affecting the insurance industry.

Further to regulatory/ compliance pressures, the continued liberation of the insurance sector will ensure insurers draw on M&A to drive growth and build economies of scale. M&A will continue around the Asia-Pacific region, particularly in markets such as South Korea, Taiwan and Indonesia, where companies are getting out because of margin pressures or insolvency. Internationally, there is an ongoing appetite of Asia based firms to invest into the American and European markets. The vast majority of insurance brokers/ firms have specialist M&A lawyers and new headcount is likely to be at the junior level to cover commercial contracts, employment and litigations matter allowing the senior lawyers to focus on M&A and regulatory matters. Furthermore, as more insurance firms start to digitalise their business, there is also a demand for technology lawyers to focus solely on this aspect of the business.

Lauren Pang

Financial Services | Hong Kong

T: +852 2973 6333

E: laurenpang@taylorroot.com

Carmen Mok

Financial Services | Hong Kong

T: +852 2973 6333

E: carmenmok@taylorroot.com

Celine Tay

Financial Services | Singapore

T: +65 6420 0500

E: celinetay@taylorroot.com

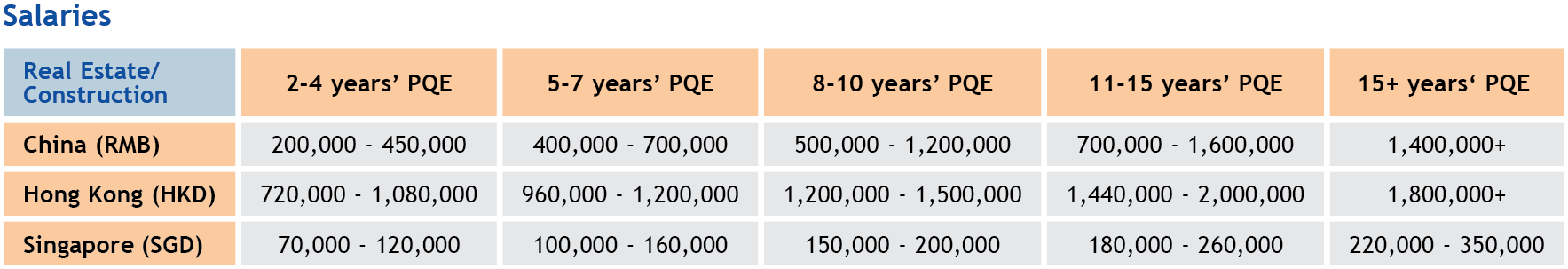

Corporate

Hiring in the Construction sector fluctuated over the past 6-12 months while the Manufacturing industry remained stable throughout, with a number of senior hires made in Asia. Within Construction, the skill set in demand has mainly focused on non-contentious construction whilst the Manufacturing sectors have looked at experienced, strategic hires with demonstrable corporate, commercial and cross-border experience. The majority of in-house teams acrosss Construction and Manufacturing tend to have between three to seven lawyers and most hires are driven by growth rather than replacement hires.

Real Estate

The Real Estate sector has been stable with the limited demand constrained within the larger Real Estate businesses. Headcount has not necessarily centered on property lawyers, but more broadly on the corporate/commercial side of experience. Within the Singapore market, the long-awaited upturn in the property market has boosted demand for in-house counsel with real estate and construction experience.

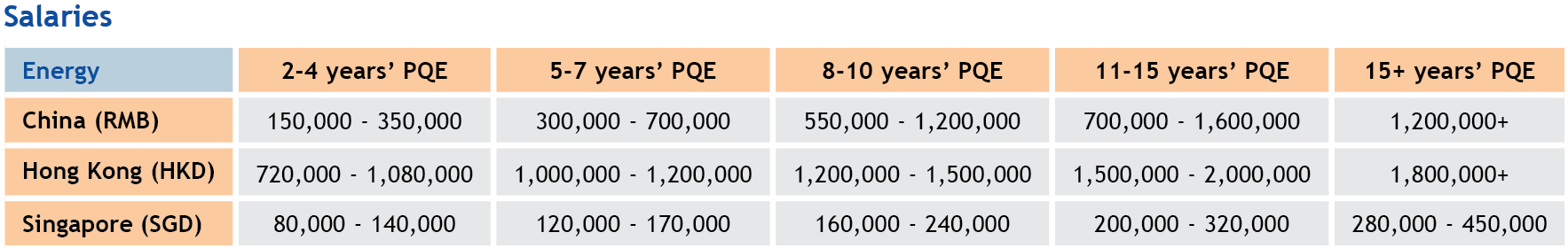

Energy/Utilities

Throughout the Asia region, a positive turn within the Energy, Commodities sectors has seen recruitment activity pick up. Whilst recruitment activity for these industries remained conservative through 2015 to 2017, we are seeing rekindled demand for in-house counsel as legal teams expand due to business growth.

Within the upstream oil & gas space, there remains a preference for lawyers with relevant industry and technical experience. Fluctuations in oil prices continue to drive demand for lawyers with commodities shipping and trading experience, albeit at a more conservative level. We have often seen lawyers with a broad corporate commercial background transition into downstream focused positions. Candidates often range from NQ to 8 years’ PQE, with an emphasis on candidates at the more junior levels.

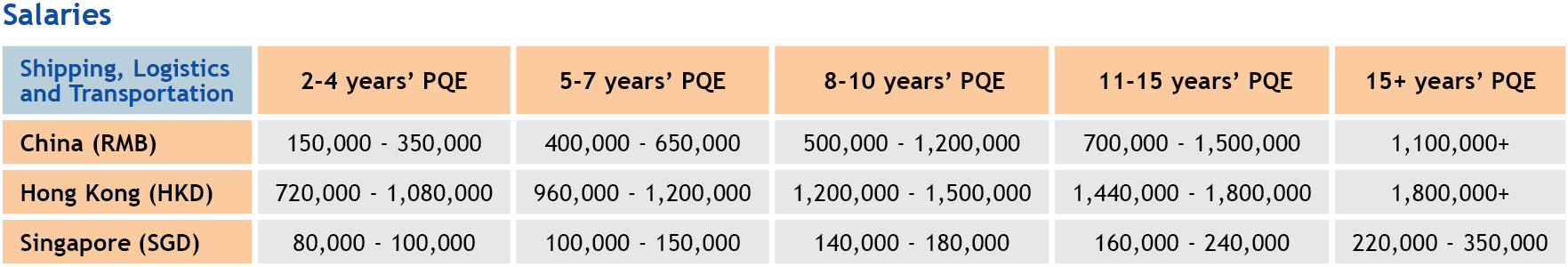

Shipping, Logistics and Transportation

Recruitment for the shipping, logistics and transportation industries has stayed flat since 2015. Positive economic sentiment and business growth has fuelled demand across a diverse range of industries, and we have seen things take a positive turn within these industries resulting in recruitment activity slowly picking up.

Besides growth in shipping activity, technology adoption and a recovery in oil prices is also driving the upturn. A decline in world trade volume growth may impact the industry’s recovery, but positive sentiment is likely to outweigh this. The logistics and transportation industries are experiencing a period of growth as well. Beside established players who continue to assert their presence, smaller entrants are making their presence felt in the market by way of technology disruption and nimble business expansion.

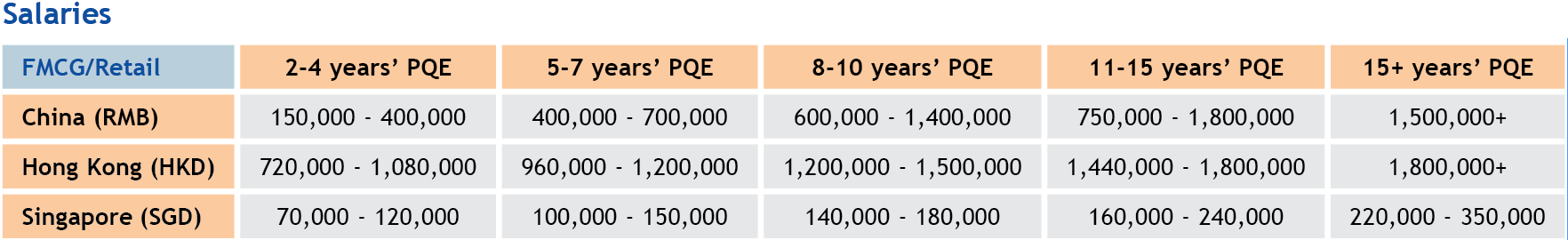

FMCG/Retail

Recruitment for the FMCG sector has remained steady over the past 12 months, with most legal recruitment activity being replacement hires as opposed to an increase in headcount. However, we understand companies are submitting business cases for additional hires in 2018 to deal with increased demand across the business, and to reduce reliance on external law firms. As with most in-house legal roles, most positions continue to be for mid-level (2 – 6 years’ PQE) lawyers with commercial and IP skill sets. We have also seen an increase in the demand for interim lawyers in this sector as companies attempt to get around headcount restrictions by taking an additional lawyer on an interim basis.

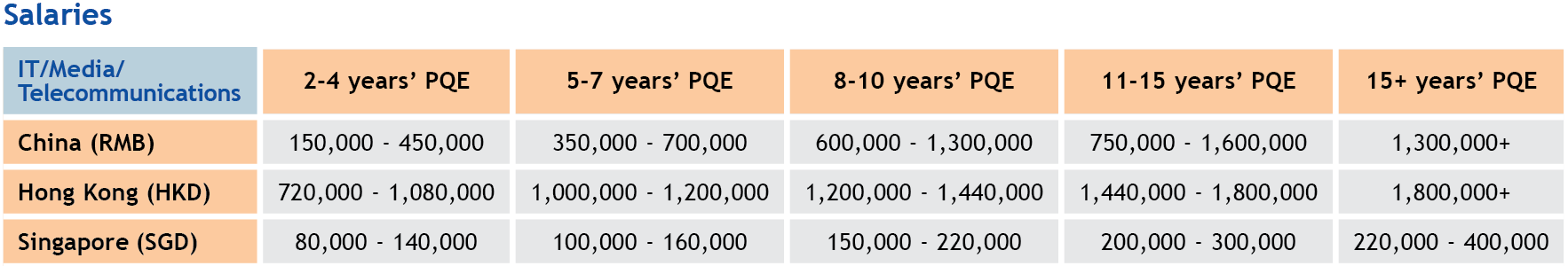

Technology/Telecommunications

The Technology sector has seen a significant increase in the number of new opportunities for lawyers since the beginning of 2017. We have seen a strong demand for specialised lawyers with technology, cloud contracts and data protection skills across all sectors and expect there will be continued interest in data protection expertise with the impending GDPR.

There has been an increase in the number of sole counsel, first hire positions for newly emerging tech companies growing exponentially. Founders and senior management are realising sooner in a company’s lifecycle the value of in house counsel, particularly in ensuring legal risk is managed in line with their expansion and, often future sale ambitions. In tandem with recruitment for the regional headquarters (often Singapore or mainland China), we are seeing a healthy demand for in-country counsels for locations such as Indonesia, Malaysia, Philippines, Thailand and Vietnam as well.

The telecommunications industry has seen a continued reshaping with large acquisitions and mergers resulting in a slight decrease in recruitment overall. There have been a number of exciting developments within the industry and ever closer links to more traditional technology and media businesses. Businesses have continued to recruit commercial lawyers, particularly at a midlevel, for a wide range of skillsets including IT, IP and procurement.

Pharmaceuticals

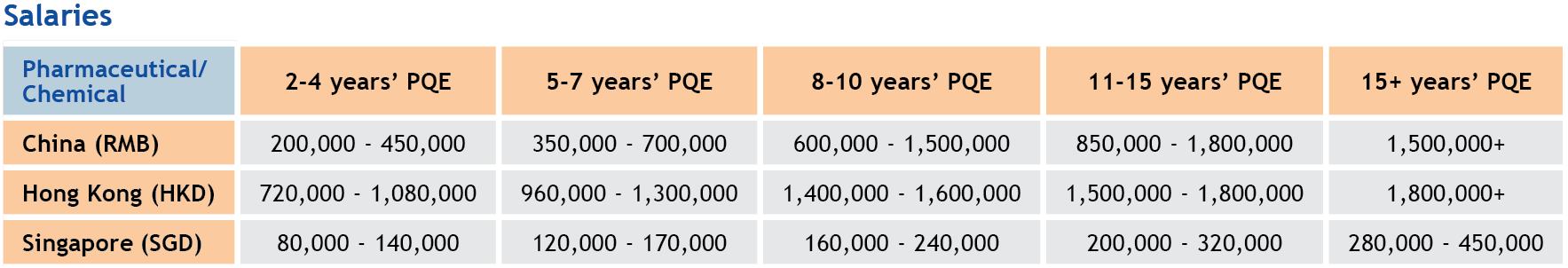

Pharmaceuticals

The Pharmaceuticals sector has continued to see consistent growth with new opportunities for industry specialist lawyers. With many multinational corporations, national and regional organisations looking to expand their Asia legal teams and the combination of the highly regulated nature of the industry, lawyers with at least five years’ experience in healthcare, life sciences, pharmaceuticals or medical technology are highly sought after.

Heidy Zhou

Corporate | China

T: +8621 5117 5879

E: heidyzhou@taylorroot.com

Charmaine Chan

Corporate | Hong Kong

T: +852 2973 6333

E: charmainechan@taylorroot.com

Theresa Pang

Corporate | Singapore

T: +65 6420 0500

E: theresapang@taylorroot.com

Selene Siregar

Corporate | Singapore and South East Asia

T: +65 6420 0500

E: selenesiregar@taylorroot.com

Compliance

The compliance market in Asia should remain buoyant throughout 2018 with hiring activity across all sectors. As demand continues to outstrip supply for compliance and risk professionals, employers will find it challenging to secure top talent. While there were obvious movements at the Executive Directors to Managing Director positions in 2017, financial institutions will focus efforts to expand and grow their teams with new head counts at AVP to VP in 2018. Compliance specialists will expect to receive a higher salary increase and employers will need to focus on the potential career progression when securing top talent, offering clear and realistic promotion outlines to potential employees.

Across top tier financial institutions with a large presence in Singapore, there is a focus on ensuring Monitoring, Controls & Testing teams are robust. Although plans to hire started in 2017, things are in full-swing this year with seemingly more commitment from hiring companies. The drive towards automation has led to the need to hire candidates with experience in coding, machine learning and system knowledge. Additional Asian languages such as Japanese, Mandarin and Bahasa have also been highly sought after. Still hiring managers have stressed on the importance of growing the team due to increasing pressure from regulators and management, but the challenge lies in attracting the right talent at the AVP and VP level (7-15 years). With most banks going through restructuring and job stability being a rarity, candidates move for other factors such as promotions or significant salary increments to mitigate their risk.

Consumer, Investment & Private Banks

For the first quarter of 2018, monitoring and surveillance was top of the agenda for recruitment across the permanent market. Banks have been consistently under pressure in the past year to meet new demands from the regulator and improve controls. There was a notable trend towards hiring staff at the VP level focusing on candidate with expert knowledge of audit, assurance, monitoring, review and surveillance. Candidates with good knowledge of regulatory policies and procedures been in demand. Hiring managers are keen to meet with specialized talent as opposed to professionals with generalist background as specialist knowledge is increasingly required in areas such as Control Room, Monitoring & Testing and Surveillance.

Singapore has become known as the APAC hub for KYC/AML with very active hiring in this space. While Hong Kong traditionally houses the advisory functions, Singapore based candidates often take on the operations and execution responsibilities. However, as our local compliance market matures, and MAS regulations tighten, there is now a need for candidates to assume a business-facing role. This is particularly so for the tightly regulated sectors such as Private Banking and Investment Banking, where mid-level professionals are expected to take on decision making and advisory responsibilities.

Asset & Investment Management Firms

China is an important market and has become essential to most Asset Managers’ strategies for Asia. While obtaining the WFOE license will enable firms to establish an on-the-ground presence in mainland China, most firms will need to look for compliance professionals with knowledge and experience working with Chinese regulations i.e. CSRC. In addition, firms are looking to strengthen their existing communications and marketing compliance framework, so they are keen to speak to candidates with thorough understanding of marketing regulations in Asia.

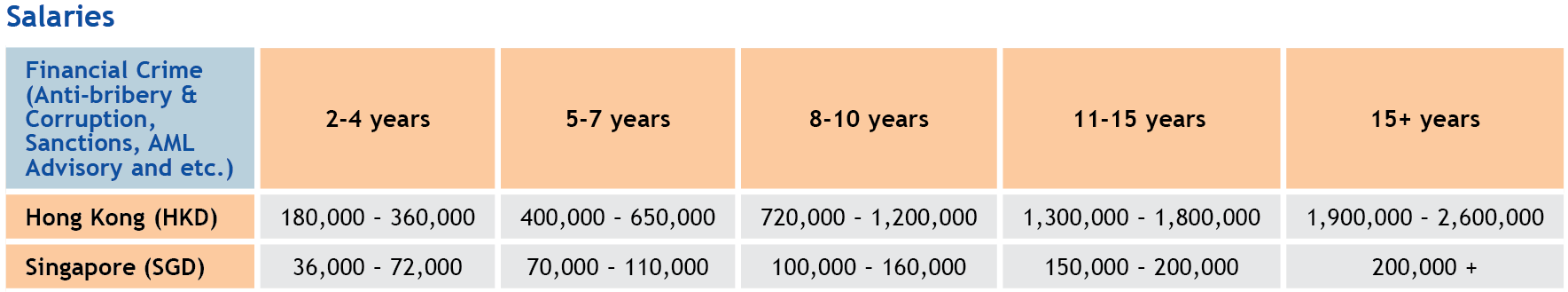

Financial Crime Compliance

Financial Crime Compliance

On a positive note, there is an increased awareness of financial crime threats along with a more collaborative approach to strengthening the integrity of the financial system. Tougher regulation ensures banks are better equipped to fight financial crime, but that comes with additional costs. Financial institutions are still keen to speak to candidates with solid fraud control, investigations and AML/CTF background. As payment processing becomes faster and more efficient, financial crime control processes need to keep up. Candidates with RegTech, IT background with exposure to compliance will be in very high demand. As a matter of fact, we have seen a few AML specialists moving from investment banks to Fintech payment companies in the recent 12 months.

David Richardson

Risk | Hong Kong

T: +852 2973 6333

E: davidrichardson@taylorroot.com

Michelle Yau

Compliance | Hong Kong

T: +852 2973 6333

E: michelleyau@taylorroot.com

Heem Hian Lim

Compliance | Singapore

T: +65 6420 0500

E: heemhianlim@taylorroot.com

http://www.taylorroot.com/asia/