By Rosinah Mohd Salleh, AZMI & Associates

Back in 2015, Bursa Malaysia, the Malaysian stock exchange, reported that the Global Risks 2015 report by the World Economic Forum identified that 70 percent of the top 10 risks were sustainability-related, which in turn “raises new risks and opportunities for businesses to understand” and ultimately affects its value.

Against that backdrop, and recognising the “greater demand and expectation for non-financial information to be provided alongside the financial information” to a company’s stakeholders, Bursa Malaysia introduced a requirement under its Main Market Listing Requirement and ACE Market Listing Requirement (collectively referred to as “Listing Requirements”) for the issuance by listed companies (PLCs) of a Sustainability Statement in their annual reports.

This requirement was introduced to be in line with the Malaysian Capital Markets Services Act 2007 and replaced the existing statement on corporate social responsibility practices previously required to be disclosed by PLCs. In essence, a Sustainability Statement is a narrative statement of a PLC’s management of material economic, environmental and social (EES) risks, including how they are identified, why they are important and how they are managed (see Paragraph 6.2(c), Practice Note 9).

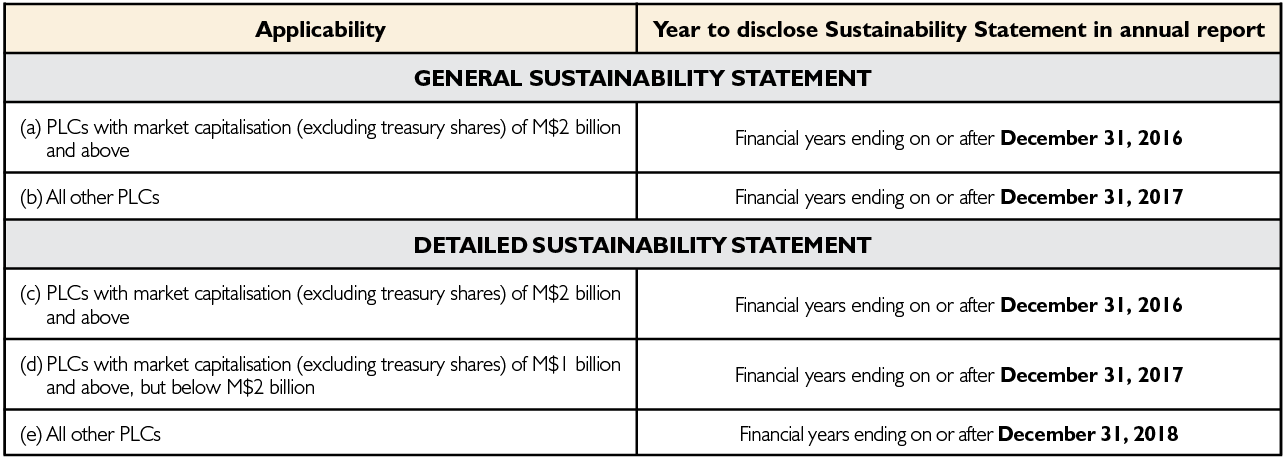

All PLCs should ensure that the information in the Sustainability Statement is balanced, similar and important by referring to the sustainability reporting guide (Guide) issued by Bursa Malaysia. The implementation of the Sustainability Statement requirement for PLCs is done in stages as follows:

Under the Ace Market Listing Requirement, Sustainability Statements must be included in the annual report for financial year end on or after December 31, 2018.

This sustainability framework, which was launched in October 2015, comprises the Guide and is complemented by the sustainability toolkits (Toolkit) containing guidance to PLCs on embedding sustainability in their organisations and reporting it. In identifying the material EES risks and opportunities, PLCs should take into account the themes set out in the Guide, which covers the business care for sustainability, providing case studies, and includes example disclosures while the Toolkit includes, among others, the method on how to collect and report sustainability data and information; the best practices in relation to sustainability data and disclosure; and examples of disclosures on themes and indicators.

The first round of Sustainability Statements has already been issued by some PLCs in its annual report for the financial year ending on or after December 31, 2016. The forms and depth of such first-time Sustainability Statements are understandably varied, as companies are still grappling over issues such as the “how to” and the “what”, as well as the diverse nature of material sustainability matters from company to company.

Although the initial reaction of PLCs on such requirement ranges from treating it as a mere compliance exercise or just another cost to incur, to scepticism as to its need or value, here and there we could already see some conscious efforts to address sustainability matters. One of the more recent efforts seen is assistance given to a company’s supply chain partners in flood prone areas.

In conclusion, although the reporting side is still in its infancy, efforts to address sustainability matters are gaining traction, and it could just be a matter of time before sustainability practice, as well as its reporting, becomes part of the DNA of a company, with Bursa Malaysia and the PLCs spearheading the agenda.

T: 603 2118 5000 Ext 5016

Azmi & Associates

Azmi & Associates Dato’ Azmi Mohd Ali

Dato’ Azmi Mohd Ali Norhisham Abd Bahrin

Norhisham Abd Bahrin Syed Zomael Hussain

Syed Zomael Hussain