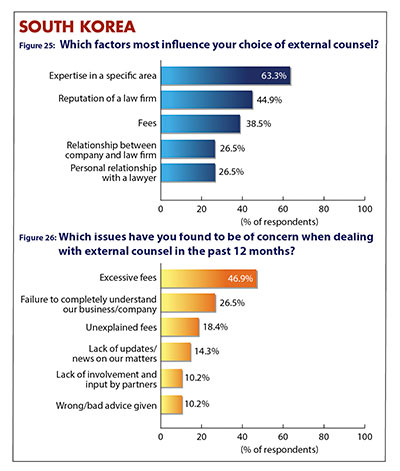

This year, counsel employed in Manufacturing and Financial Services were the most responsive amongst South Korea’s In-House Community, each with 20.4 percent representation. Technology, Media and Telecommunications came third at 14.3 percent and the fourth most common industry for participants to work in was Energy/Natural Resources (12.2 percent). Team size Over the coming year, most surveyed in-house counsel expected their teams to remain the same size. Other than the 61.3 percent that said this, 36.7 percent anticipated growth in team size and just two percent said their teams would shrink. The few that said their teams would shrink noted a changing business model, at times due to cost and an upcoming increased reliance on external counsel, while those remarking that their teams would grow mentioned an increasing workload due to company expansion. Workload (remaining constant) and cost were also reasons for in-house counsel expecting their teams to remain the same size. KEY ISSUES AND CONCERNS A less than vibrant economic situation in the country is also taking its toll. According to one community member there “Overall, continued soft orders make competition hotter than ever, leading to the business [being] more focussed on sales, survival and cost saving rather than on risk management”, with another reflecting the comments of his Seoul peers: “The uncertainties in the Korean economy in general will have spillover effects on [those of us in] the in-house community”. From a regulatory perspective, compliance with the Personal Information Protection Act (PIPA), as with its equivalent legislation in other Asian jurisdictions, is a concern for many in Korea. Working with external counsel Increasingly complex and diverse work was why most of those that thought their use of external counsel would increase did so, as well as an incrementing workload. Some who said their use of external help would remain the same remarked that law firms are only factored in when the company faces an unexpected litigation. Others expected a steady amount of legal work, so saw no reason to adjust the amount handled outside the company. Some who said they intend to use external counsel less said that, rather than concerns such as cost or lack of understanding, it was due to expecting less work in the coming year, though one participant stated that when workload diminished, the preference was to outsource less rather than shrink the in-house team. The three issues above were concerns had by many within South Korea over the past year, with excessive fees being noticed by 46.9 percent and a failure to understand the business causing problems for 26.5 percent. Other issues that were of high concern include unexplained fees (18.4 percent), a lack of updates (14.3 percent) and wrong or bad advice being given (10.2 percent). (Figure 26) As it was last year, expertise in a specific area is the forefront reason for some external counsel standing out from others, with 63.3 percent making decisions based on this. Second was reputation of a law firm (44.9 percent), fees came third and both personal relationship with a lawyer and relationship between company and law firm are regarded fourth-highest at 26.5 percent. Reputation of an individual lawyer and responsiveness were the only other aspects thought to be of high importance by over a fifth of participants, each with 20.4 percent of the votes. (Figure 25) |

| Jump to FIRM OF THE YEAR result |

Back to survey home page |

Recent examples of consent decrees in Korea and their implications