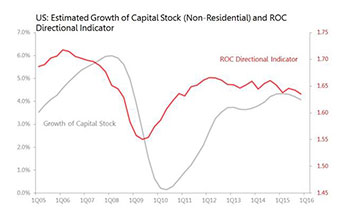

Is the US heading for a ‘profits recession’, or might it already be in one? And if a profits recession is a feature of the economic landscape, how long might it last, and what sort of corporate response to it can we expect?The profits recession is already upon us: that’s the message from two separate streams of US data last week. What’s more, it’s clear that even a recovery of nominal GDP growth to around four percent (double the annualised rate of 4Q) would at this stage only stabilise profits. But that much must be achieved before we can herald the start of the next profits cycle. Both the second estimate of 4Q GDP growth released last week provided useful evidence on the state of play, and prospects. It found 4Q GDP growth was 0.3pps higher than the advance estimate had suggested, at an annualised one percent. The upward revision was courtesy of a higher estimate of private inventory-building and a downward revision in imports. But these were partly offset by private consumption being revised down to two percent annualised (from 2.2 percent in the advance estimate), and government spending revised down to a fall of 0.1 percent annualised (vs +0.7 percent in the advance estimate). To determine what this means for profits, we need to look both at what’s happening to the return on capital, and also what’s happening to the growth of the stock of capital. In nominal terms, private fixed capital formation grew only at an annualised 0.9 percent in 4Q, with non-residential investment down 1.3 percent and residential investment up 9.7 percent. Depreciating non-residential investment spending over a 10-year period, I estimate growth rate of that capital stock slowed to 4.1 percent from 4.3 percent in 2014. Crucially, the two percent annualised growth rate of nominal GDP is lower than the growth rate of the capital stock producing that GDP. It therefore follows that the return on capital must be falling. In fact, capital stock has been growing marginally faster than nominal GDP growth since 2012, with the result that the ROC directional indicator has been gently tending to drift down since then. |

Still, whilst capital stock growth was still accelerating, overall corporate profits growth could be maintained even if the return on that capital stock was stagnating. But since the middle of 2015, capital stock growth has slowed at the same time as the ROC directional indicator has fallen. On this calculation, the US is already in a profits recession, and has been for some time.(I need to add this qualification: I have excluded the dynamics of the residential property sector, which have seen profits growth sufficient to mask the underlying deterioration in profits growth until mid-2015.) So what happens now? For profits growth to be stabilised, either nominal GDP growth must accelerate so it is growing faster than capital stock (which means significantly above four percent), or investment spending must be cut sharply in order to slow the growth of capital stock. But of course, there’s a tension between those two: for companies, the immediate response to falling disappointing sales, revenue growth and capacity utilisation is to slow capital spending. But when companies cut capital spending, a crucial driver of the macroeconomic business cycle goes missing, which in turn slows GDP growth. This is one of the crucial dynamics underlying almost all business cycles, and the cycle turns precisely when capital stock growth slows enough to allow return on capital to rise. Whilst it’s quite reasonable to expect a return to four percent+ nominal GDP growth this year, this will probably only moderate, or at best stabilise, profits growth this year. Only after that has been achieved can we look forward to the start of a new re-investment cycle – that means 2017 at the earliest. There is a second likely corporate response to these situations, which will probably be fetching up on your desks this year: companies buy, merge, or consolidate with their competitors. The rationale for mergers or takeovers in these circumstances is one of consolidation: one balance sheet can be trimmer than two; consolidating production facilities can boost capacity utilisation rates and so generate higher returns on capital. Moreover, consolidating now confers first-mover advantage when the new investment cycle starts in earnest. In short, a profits recession can be a profits opportunity for mergers and acquisitions lawyers! Michael Taylor runs Coldwater Economics, a consultancy serving institutional investors worldwide since 2009. Michael spent 15 years of his career in Asia, principally Hong Kong and Tokyo, as Asia economist for Morgan Stanley and chief economist for W I Carr. He offers a daily Shocks & Surprises services which tracks approximately 450 economic data releases each month, identifying and briefly explaining those which deviate significantly from consensus or trend. For more information: |