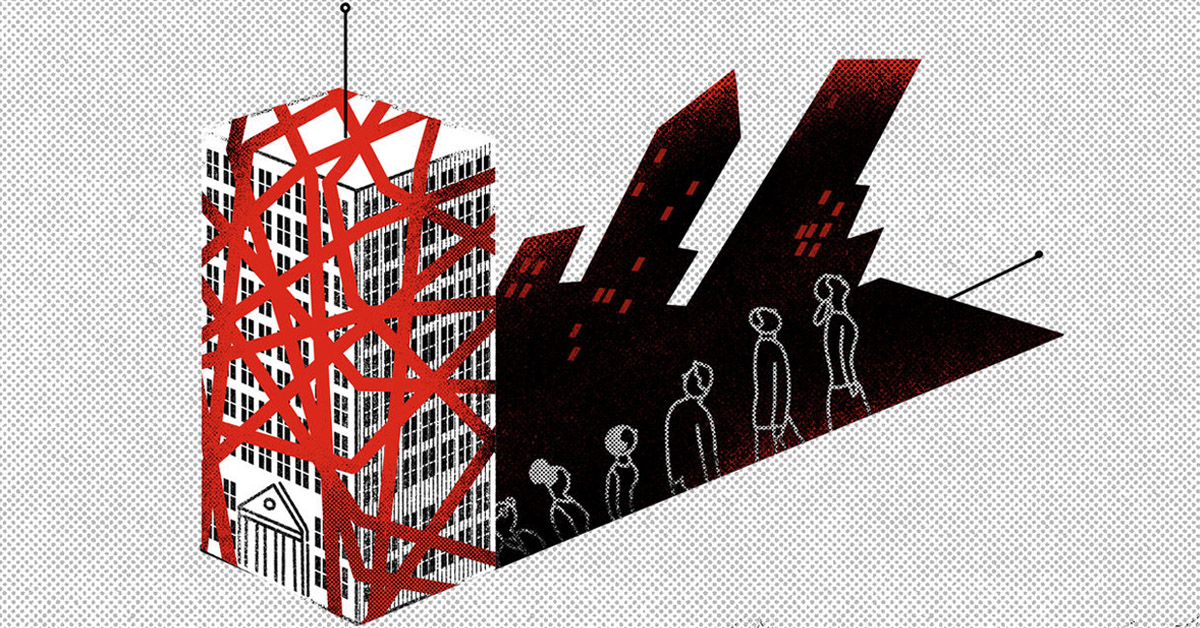

For the second consecutive year, third party violations of anti-bribery and corruption laws top the list of perceived risks for compliance professionals surveyed for the 8th annual Anti-Bribery and Corruption Benchmarking Report (“ABC Report”), a joint study conducted by Kroll and the Ethisphere Institute. The study further reveals how compliance teams are grappling with the convergence of regulatory mandates, critical reputational factors, and data security issues as they try to protect their organizations from substantial financial and reputational harm as well as regulatory and legal exposure.

Despite the increased focus and robust deployment of organizational resources supporting compliance efforts, a staggering 93 percent of the 448 respondents believe their ABC risks will remain the same or worsen in 2018. Those who expect a greater level of ABC risks attribute the rise to increased enforcement of existing regulations, followed closely by new regulations. Indeed, heightened regulatory activity is evidenced in China’s sweeping anti-corruption campaign over the past five years; the UK Criminal Finances Act and France’s Sapin II, both of which became effective in 2017; a host of new anti- bribery and corruption legislation introduced worldwide, including in Germany, Ireland, and Slovakia; and ongoing U.S. Department of Justice and Securities and Exchange Commission enforcement actions.

“The stakes are high and so is the risk level, which is likely to cause some sleepless nights for compliance professionals,” said Steven J. Bock, Global Head of Operations with Kroll’s Compliance practice. “In today’s hypersensitive business environment where a company’s hard-earned reputation can be easily lost through a lapse of judgment by a third party, the job of a conscientious compliance professional has never been tougher or more central to the success or failure of a business.”

China has surpassed Africa and becomes the market most cited by respondents (27 percent) that they had experiences in legal, ethical or compliance issues with a third party after initial due diligence had been conducted in the country in 2017.

“Beneficial ownership has become more of a concern across Asia in recent years from the continued impact of 1MDB (Malaysia’s state development fund) to Xi Jinping’s continued anti-corruption campaign,” said David Liu, Managing Director, Head of APAC Compliance at Kroll. “Changes made recently by the China Banking Regulatory Commission (CBRC) limiting any individual investor who owns more than 5 percent (considered a major shareholding) to no more than two commercial banks, or a controlling stake of no more than one lender as well as large Chinese conglomerates being under scrutiny, have made this issue more exposed, but it has always been a challenge. Ultimate beneficial ownership will continue to be a concern for all involved from governments, firms being considered for investments by foreign companies, as well as firms looking to invest in foreign companies.”

The study also shows that while reputational and integrity concerns remain the number-one reason why a third party fails to meet an organization’s standards, the corporate or ownership structure of a third party has emerged as a major concern for compliance teams. Notably, more than half of respondents reported that they were “concerned” or “very concerned” with beneficial ownership risks associated with their third parties, while less than 25 percent feel highly confident in their program’s ability to address these risks.

Ongoing monitoring that includes a regular refresh of the underlying third party data emerged among the ABC Report findings as a key strategy for maintaining the effectiveness of anti-bribery and corruption programs overall, and especially for keeping up with potential ownership changes.

The Kroll/Ethisphere report provides good news as well. For example, 36 percent of respondents indicated that their organization dedicated more resources to ABC issues in 2017 than in 2016. Executive leadership support also remains strong, as 92 percent of all survey respondents said that their leadership team is highly engaged or somewhat engaged in their ABC efforts.

“The 2018 Anti-Bribery and Corruption Benchmarking Report brightly illuminates the challenges facing today’s compliance experts, including the likelihood that third party risks will grow in relevance and impact,” said Erica Salmon Byrne, Executive Vice President, Executive Director, Business Ethics Leadership Alliance, Ethisphere. “We are encouraged, however, that partnerships across organizations continue to grow as company leaders assign greater priority to the adoption of best-in-class anti-bribery and corruption programs that protect not only individual organizations, but also the integrity of the global business ecosystem.”

Other findings in the ABC Report include:

- Regulatory focus on individual accountability heightens personal liability concern: 50 percent of respondents who reported post-onboarding issues with a third party indicated that the issues were discovered through ongoing monitoring.

- Perceived risk: 65 percent of respondents think that their risk will stay the same in 2018, and 28 percent think it will increase.

- ABC after onboarding and data: 75 percent of survey respondents monitor some or all of their third parties. Fifty-six percent of respondents whose organizations conduct monitoring opt to refresh third party data.

- Mergers and acquisitions: 62 percent of respondents indicated they engaged in M&A activity in 2017. Yet the data continues to show that respondents are not conducting appropriate levels of pre-acquisition due diligence.

- Enterprise risks converge: 76 percent of respondents said they are “concerned” about data security risks related to third parties, while only 56 percent feel prepared to address them. This 2018 ABC Report was officially released at Ethisphere’s 10th Annual Global Ethics Summit in New York City. The Global Ethics Summit is the premier annual event where CEOs, board members, chief legal officers/general counsels, chief ethics and compliance officers, and other business influencers with a diverse set of experiences gather to share best practices in building ethical businesses and continuously improving corporate behavior. Representatives from US companies as well as multinationals attend the summit to learn from an eclectic set of practitioners and to network with professionals who face challenges similar to their own.

Kroll

Kroll Tadashi Kageyama

Tadashi Kageyama