By Peter Ch’ng, Partner, Conyers

Earlier this month I hosted a webinar in Hong Kong entitled “Offshore Separate Portfolio Company: Flexible Ring-Fencing in the World of Insurance, Funds and Family Office”. Having spent 17 years in Conyers’ Bermuda office before joining Hong Kong, separate portfolio companies (SPCs) or segregated accounts companies (SACs) were a big part of my practice. I saw increasing adoption of these structures amongst my US and European clients, but was surprised to see a low level of use or even familiarity in the Asian markets. In a totally non-scientific poll conducted live during the session, only 20% of the audience had worked with or encountered such entities.

So what are SPCs and SACs?

SPCs and SACs are offshore limited liability companies with an added twist. By virtue of local legislation, they may create and operate multiple separate portfolios of assets within a single company, each of which is legally isolated from each other and from the general non-portfolio assets of the company. Each portfolio or account is created for the exclusive benefit of a group of persons.

Each portfolio or account is responsible for its own business mandate, assets and liabilities and the creditors of one portfolio cannot have legal recourse or make legal claims against the assets of another portfolio or of the company itself by statutory law. This applies even if there are insufficient funds in the portfolio to pay off the debts and claims of its creditor or if the SPC/SAC itself is liquidated or wound-up. General creditors of the SAC/SPC unrelated to the portfolio cannot have legal recourse to the assets of the portfolio even in liquidation and any liquidator appointed must respect the order and priority of payments set out and agreed between the stakeholders with respect to that portfolio. Accordingly one portfolio has no correlation to another portfolio because each portfolio is individually segregated or “ring-fenced”; the success or failure of one portfolio will have no impact on the success or failure of another portfolio.

SACs and SPCs are prevalent in the reinsurance and investment fund industry to ring-fence different asset pools.

What would the Private Client world do with such an entity?

Plenty. Two words say it all: “Asset Protection”.

Often a Family Office is just an administrative body at its core and usually does not hold a family’s assets or operate its businesses directly. But for those Family Offices or foundations that do hold significant assets in their own name or through offshore subsidiaries/affiliates with exposures to liabilities, there may be a benefit to segregating assets and investment portfolios along diverse investment types, strategies, or beneficiaries (for different family branches or different generations).There’s no reason why it could not be registered as a Bermuda SAC or a BVI company as a BVI SPC for the added ring-fencing protection.

Statutory ring-fencing brings strong asset protection for multiple family portfolios because they contain a form of offshore “firewall” protection to resist any foreign law and foreign court interferences with respect to the ring-fencing. Offshore jurisdictions like Bermuda, Cayman and BVI have “firewall” legislation for their trusts which inhibits the use of foreign laws to attack or vary an offshore trust except in accordance with Bermuda, Cayman or BVI law, particularly in cases where the trustee has not submitted to the jurisdiction of the foreign onshore courts. Provisions in the SAC/SPC legislation requiring that constitutive instruments or contracts be governed by the local SAC/SPC ring-fencing legislation binding on the creditors and the liquidator, operate as a form of offshore “firewall” protection.

Under general principles of private international law, a foreign court should recognize the law governing the organization of the company or where parties have adopted it by contract. Any move to get an offshore court to recognise a foreign court order that is contrary to the local SAC/SPC legislation would likely be contrary to local public policy and not be successful.

Could a SPC/SAC ever take the place of a trust?

That is not as unlikely as it may seem, given a general trend forwards adopting a more “corporatized” structure as a trust alternative. Instead of a trustee, a board of directors is appointed to manage the corporate entity, comprising a select combination of key family members and professionally qualified specialists (e.g. trust specialists, bankers and other experts). We are already seeing the use of Bermuda and Cayman foundation companies as trust alternatives and perhaps it won’t be long before they are also registered as SACs/SPCs to earmark and ring-fence different assets.

The Segregated Investment Fund

Notably, in Hong Kong we have seen the convergence between Family Office and the Private Funds world where Family Offices are increasingly self-managing their own wealth fund (often focused on real estate) and relying less on traditional institutional support.

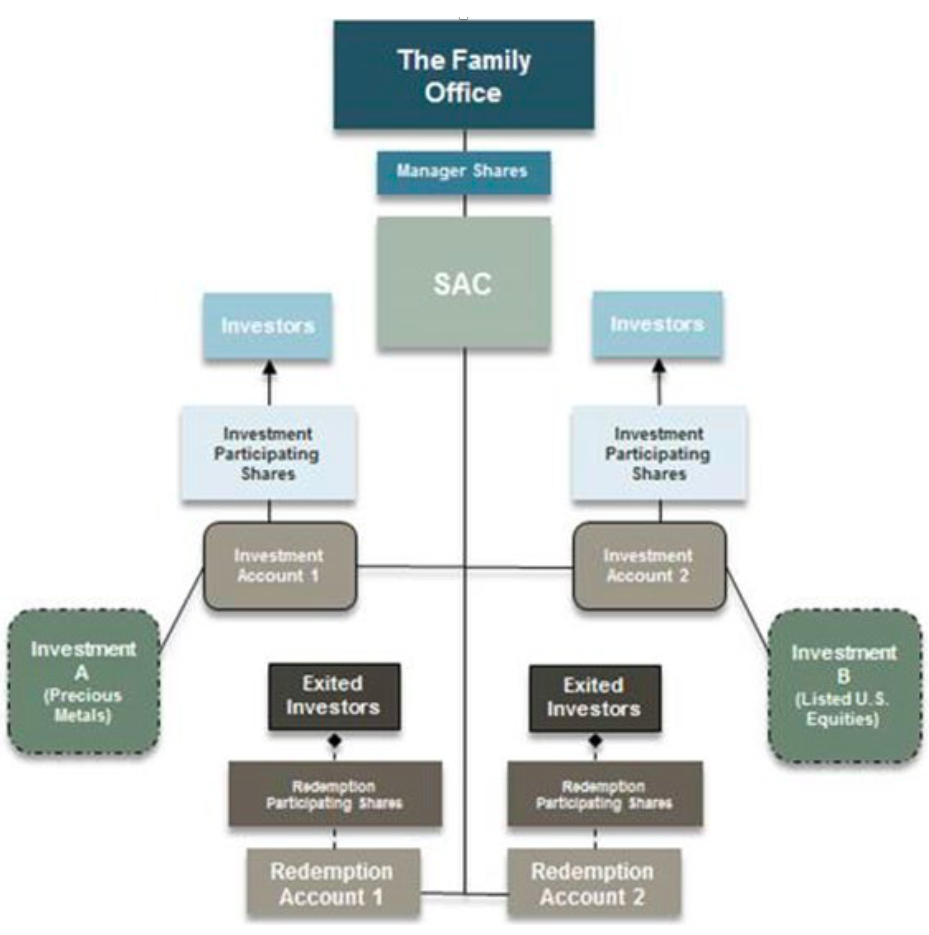

Some have set up a proprietary Family Office-owned private investment fund available for investment by members of the family only, with the Family Office as project coordinator and fund administrator pursuing diverse investment strategies. The fund could be registered as a SAC or SPC and its diverse underlying investments placed into separate portfolios with participating shares issued for each portfolio. The Family Office may pick and choose qualified experts to manage or advise on the specialized portfolios. By creating “accounts” with different investment mandates, this enables the family to mix and match investment decisions creating their own personalized portfolios by subscribing for shares in individualized “accounts”.

For example, a SAC may create an “Investment Account 1” to trade precious metals or other commodities, “Investment Account 2” to hold publicly traded securities to be managed by a licensed US broker-dealer and a more speculative “Investment Account 3” to invest in renewable energy resources in Japan. Each account is segregated and ring-fenced from the others in terms of liabilities and a particular investor may choose to invest in all three accounts or in any combination he desires. Further, the shares may be gifted, held for or bequeathed to the next generation or to charity by personal trusts or testaments.

Increasingly, the role of the Family Office is seen not only as a means of coordinating wealth investments, but also to share the family blueprint with the next generation consistent with their family values and involving all in the management of their own wealth and business in a controlled fund structure. The family fund could also offer a way of supporting and educating the younger generation by getting the whole family involved in their ventures.

Let’s say an enterprising niece has a good business idea and needs seed capital support from the family. She could approach the Family Office and look to create a new account to own and run this incubator business or project, but still sharing back-office functions and costs with the core SAC until she is ready to take it to the next level whereupon the account can be spun-off into a separate company. It could also be easier for an account to raise external funds or take out a bank loan than a brand new start-up, given the backing and track record of the Family Office SAC. Other accounts can also provide financial support to the incubator account. Family members who are willing to support this incubator may subscribe for participating shares (with bespoke rights) in the account and if it should fail, it will only affect the particular sponsor and investors of that account and will not contaminate the other investments or family assets. By actively involving the whole family as sponsors or as investors, they learn to take responsibility for their own investment or entrepreneurial successes or failures.

A potential unique add-on feature is for each Investment Account to be accompanied by a dedicated and separate “Redemption Account”, the sole purpose of which is to receive the redemption proceeds following the redemption of shares of the Investment Account, without having to repatriate the proceeds back to the home jurisdiction, and thereby incurring a taxable event.

The investors could opt to exchange their participating shares in the Investment Account for equivalent shares in the Redemption Account, parking their proceeds in a ring-fenced account held by the same SAC. Proceeds in the Redemption Account may subsequently be deployed for reinvestment in another Investment Account or to other external investments as directed by the owner of the Redemption Account.

In some instances, there could be tax and other advantages in legitimately deferring income taxes on dividends or capital gains taxes from the realisation of overseas investment assets from the exchange of investment shares for redemption shares in different accounts of the same fund.

Firewall asset protection

It’s often said that where there is an onshore need, there is an offshore solution – with a menu of choices.

There are many separate portfolio or segregated accounts companies in the offshore world. Each product is slightly different and so the choice of jurisdiction could be important. Cayman and BVI SPC legislation are more geared towards investment funds, whereas Bermuda SACs are slightly more universal and prominent in the reinsurance sector. Bermuda has robust dedicated stand-alone SAC legislation and also ISAC1 legislation and the ability to do inter-cell transactions, but it may cost slightly more to incorporate and maintain. BVI SPCs need to seek permission from the BVI Financial Services Commission when creating new portfolios – Bermuda and Cayman companies generally do not. BVI and Cayman SPCs allow for terminated accounts to be reinstated – Bermuda is silent on this. BVI SPCs provide for the appointment of a portfolio liquidator by the BVI court to deal with insolvent accounts, whereas Bermuda and Cayman have fewer provisions dealing with account insolvencies. There are likely to be onshore factors specific to the Family Office and the family member-investors, so be sure to seek the counsel of an experienced Bermuda, Cayman Islands or BVI lawyer and take a comparative approach to see what platform works best for the particular group.

The “offshorization” of corporate assets for asset protection, minimizing the application of “unfriendly” onshore local law to asset title and ownership, is not a new idea or phenomenon – especially in uncertain times. Statutory ring-fencing coupled with offshore “firewall” legislation to compartmentalize and ring-fence different asset pools and business ventures makes the SAC/SPC a powerful tool across myriad industries. I am certain the Private Client world could teach the SAC/SPC world a few things about innovation.

Peter Ch’ng

E: peter.chng@conyers.com

T: +852 2842 9593

This article is not intended to be a substitute for legal advice or a legal opinion. It deals in broad terms only and is intended to merely provide a brief overview and give general information.

For further information please contact: media@conyers.com

Endnote:

1 An incorporated segregated account company under the Bermuda Incorporated Segregated Accounts Companies Act 2019, whereby each account has its own separate legal personality and separate board of directors, capable of suing and being sued in its own name.

Conyers

Conyers Christopher Bickley

Christopher Bickley