Ho Chi Minh City Office – Unit 305, 3rd Floor, Centec Tower

72-74 Nguyen Thi Minh Khai, Ward 6, District 3, Ho Chi Minh City, Vietnam

Tel: (848) 3823 9640 / Fax: (848) 3823 9641 / Moblie: (84) 937 319 915

E: ngoc.luu@indochinecounsel.com

Hanoi Office – Unit 705, 7th Floor, CMC Tower, Duy Tan Street, Cau Giay District, Hanoi, Vietnam

Tel: (84) 4 3795 5261 / Fax: (84) 4 3795 5262

E: hanoi@indochinecounsel.com W: www.indochinecounsel.com

The State Bank of Vietnam (SBV) recently released regulations requiring banks and foreign bank branches in Vietnam to maintain a minimum capital adequacy ratio (CAR) of 8 percent from 2020.

The State Bank of Vietnam (SBV) recently released regulations requiring banks and foreign bank branches in Vietnam to maintain a minimum capital adequacy ratio (CAR) of 8 percent from 2020.

Circular No. 41/2016/TT-NHNN, dated December 30, 2016, is effective from January 1, 2020 and is oriented towards Basel II standards, including many changes compared to Circular No. 13/2010/TT-NHNN, dated May 20, 2010 on adequacy ratios of credit institutions. Under the Basel II standards, the minimum CAR of the banks is required at 8 percent, the same ratio required under Basel I. However, the CAR under Basel II is calculated under a new formula, which is also applied by Circular 41.

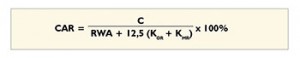

Presently, the minimum CAR required for banks in Vietnam is 9 percent (ie, higher than the CAR of 8 percent under Circular 41). According to banking analysts, the current CAR of some of the largest banks in Vietnam stands at about 9 percent and, therefore, their CAR will be reduced under Basel II standards. Under Circular 41, the minimum CAR of 8 percent required for banks in Vietnam is defined by the following formula:

Specifically:

C: the bank’s capital (equity)

RWA: Risk weighted assets

KOR: The capital requirements for operational risk

KMR: The capital requirements for market risk

Following Circular 41, CAR is calculated more rigidly to meet Basel II standards. Accordingly, 8 percent CAR under Basel II is an increase of the current application of 9 percent by Vietnamese banks.

The application of Circular 41 will help the banks to:

- plan their business operations and strategy more safely;

- operate with less risk because risk management is strengthened, while funds are managed more efficiently;

- attract more foreign investors because the banks operate in an environment of international standards.

However, Circular 41 also has negative impacts on the banking system, particularly when applying the Basel II standard, in which a higher rate of capital and control of liquidity will affect loan interest rates. This increases the capital costs and, as a result, the net profit of banks will decrease. At the same time, Vietnam’s banks would face such challenges as:

- a need to improve risk management;

- the requirement of reliable data systems of high precision;

- a demand to meet the huge deployment costs.

The Basel II application in Vietnam will be a challenge for local banks, but it is expected to make Vietnamese banks healthier.

Indochine Counsel

Indochine Counsel Dang The Duc

Dang The Duc To Xuan Tinh

To Xuan Tinh Le Nguyen Huy Thuy

Le Nguyen Huy Thuy