Fasken Martineau DuMoulin’s Huy Do and Jack Yu1 write that acquisitions of, or investments in, Canadian businesses can give rise to merger control and foreign investment reviews. The following provides a general overview of the merger control regime under the Competition Act (Canada) (CA) and the foreign investment review regime under the Investment Canada Act (ICA).

A. Merger control – Competition Act

Substantive merger provisions

The CA sets out a regime for the civil review of “mergers” (broadly defined) which the Commissioner of Competition (Commissioner) considers are likely to prevent or lessen competition substantially. All mergers may be subject to review under the CA, regardless of whether they are subject to mandatory pre-merger notification, and can be challenged pre or post-closing.

Pre-merger notification

Under the CA, parties to certain types of transactions must notify the Commissioner and provide specified information to permit the review of such mergers. Mergers that are subject to mandatory pre-merger notification may not be completed before the expiry of certain time periods.

Subject to specific exceptions, pre-merger notification in respect of certain types of transactions (e.g. acquisition of voting shares, assets or interests in combinations, as well as amalgamations and combinations) is required where the merger involves, directly or indirectly, an operating business in Canada and, where applicable, size-of-parties and size-of-transaction thresholds are exceeded.

(i) Size-of-parties threshold

There is no requirement to provide pre-merger notification in respect of a proposed transaction unless the parties to the transaction, including their affiliates, have:

(A) assets in Canada that exceed C$400 million in aggregate book value; or

(B) annual gross revenues from sales in, from or into Canada that exceed C$400 million in aggregate value.

In the case of an acquisition of voting shares, the parties to the transaction are the acquiror and the corporation, the shares of which are being acquired, i.e. target corporation.

(ii) Size-of-transaction threshold

The size-of-transaction threshold is specific to the type of transaction being undertaken. The CA contains thresholds that are specific for: (a) acquisitions of shares; (b) acquisitions of assets; (c) amalgamations; (d) combinations; and (e) acquisitions of interests in combinations.

(a) Acquisition of shares

In respect of an acquisition of voting shares, pre-merger notification is required where the target corporation and any corporations controlled by that corporation have aggregate assets in Canada, or annual gross revenues from sales in or from Canada generated from such assets, exceeding C$86 million2, and where:

- in the case of a publicly-traded target corporation, the acquiror, including its affiliates, would own, post-transaction, more than 20 percent of the voting shares (or more than 50 percent of the voting shares, if the acquiror already owned more than 20 percent prior to the acquisition); and

- in the case of a private target corporation, the acquiror, including its affiliates, would own, post-transaction, more than 35 percent of the voting shares (or more than 50 percent of the voting shares, if the acquiror already owned more than 35 percent prior to the acquisition.

(b) Acquisition of assets

Pre-merger notification is required in respect of a proposed acquisition of assets of an operating business where the aggregate value of those assets in Canada, or the annual gross revenues from sales in or from Canada generated from such assets, exceeds C$86 million.

(c) Amalgamations

Pre-merger notification is required in respect of a proposed amalgamation of two or more corporations where one or more of those corporations carries on (either directly or indirectly) an operating business where the aggregate value of the assets in Canada that would be owned by the continuing corporation that would result from the amalgamation or the annual gross revenues from sales in or from Canada generated from such assets, exceeds C$86 million, and each of at least two of the amalgamating corporations, together with its affiliates, has assets in Canada or gross revenues from sales in, from or into Canada, that exceed C$86 million.

(d) Combinations

Pre-merger notification is required in respect of a proposed combination of two or more persons to carry on business otherwise than through a corporation (e.g. partnerships) where one or more of those persons proposes to contribute to the combination assets that form all or part of an operating business carried on by those persons and where the aggregate value of the assets in Canada that are the subject matter of the combination, or the annual gross revenues from sales in or from Canada generated from such assets, exceeds C$86 million.

(e) Acquisitions of interests in combinations

Pre-merger notification is required in respect of a proposed acquisition of an interest in a combination that carries on an operating business other than through a corporation where: the aggregate value of the assets in Canada that are the subject matter of the combination, or the annual gross revenues from sales in or from Canada generated from such assets, exceeds C$86 million; and as a result of the proposed acquisition, the person(s) acquiring the interest, together with their affiliates, would hold an aggregate interest in the combination that entitles the person(s) to receive more than 35 percent of the profits of the combination or assets on dissolution (or more than 50 percent where the person(s) acquiring the interest are already to receive more than 35 percent of such profits or assets).

|

(3) Notification and review process

Where notification is required, the parties to the proposed transaction are required to wait for a 30-day period to elapse before completing their proposed transaction. During this 30-day period, if the Commissioner requires more information to evaluate the proposed transaction, he may, during the 30-day waiting period, issue a supplementary information request (SIR) and a second 30-day waiting period will commence once all of the information requested is received. Each party to a notifiable transaction must submit its own notification, which is commonly accompanied by a competitive impact submission.

Alternatively, where a proposed transaction does not raise significant substantive competition issues, the parties can apply for an advance ruling certificate (ARC). Where an ARC is issued prior to the expiration of the 30-day waiting period, it effectively terminates the 30-day waiting period and has the effect of preventing the Commissioner from challenging the proposed transaction to which it applies. If an ARC is not issued, the Commissioner may nonetheless issue a no-action letter (where he states that he does not plan to challenge the proposed transaction, but retains the right to do so within one year of closing) together with a waiver of the 30-day waiting period (if the waiting period has not yet expired).

The time required for the Competition Bureau (Bureau) to complete its assessment of the merger does not necessarily correspond with the 30-day statutory waiting periods. In its Fee and Service Standards Handbook, the Bureau identifies “service standard” periods, which are non‑binding maximum turnaround times within which the Bureau expects to complete its review. These service standard periods vary according to the “complexity” of the transaction under review. Following its receipt of a filing, the Bureau will typically classify the transaction as either “complex” or “non-complex”, in terms of the competition issues raised by the proposed transaction. The service standard for “complex” transactions is 45 calendar days, commencing the day on which a complete notification or ARC request is received by the Commissioner. For non-complex mergers, the service standard is 14 calendar days, commencing the day a complete notification or ARC request is received by the Commissioner.

Irrespective of whether an applicable waiting period or service standard period has elapsed, or if a no-action letter is issued, the Commissioner can bring an application before the tribunal for a remedy in respect of a merger within one year following the substantial completion of the merger, but not thereafter. However, this ability to challenge a merger one year after completion is not available where the Commissioner has issued an ARC in respect of that merger.

|

B) Foreign investment review – Investment Canada Act

All acquisitions of control of Canadian businesses by non-Canadians, whether direct or indirect, are subject to either notification or review under the ICA, subject to certain exceptions. Under the ICA, direct and indirect acquisitions of control by non-Canadians of Canadian businesses which exceed specified monetary thresholds, subject to certain specified exceptions, are reviewable (i.e. require the approval of the federal Minister of Industry and/or the federal Minister of Canadian Heritage (collectively, the Minister) based on a “net benefit to Canada” test). Any acquisition of control of a Canadian business by a non-Canadian which does not exceed the applicable review threshold is merely notifiable. A notification can be filed either prior to or within 30 days following implementation of the investment (e.g. closing).

In the case of corporations, an “acquisition of control” is considered to have occurred for purposes of the ICA when in excess of 50 percent of the voting shares of a corporation have been acquired by a person, or will be rebuttably presumed to have occurred when one third or more of the voting shares of a corporation have been acquired. (The presumption can be rebutted by establishing that, upon the acquisition, the corporation is not controlled in fact by the acquiror through the ownership of voting shares.) Please note, however, that notwithstanding the above acquisition of control rules the Minister has the discretion to determine that an acquisition of control in fact has occurred in relation to: an investment by a state-owned enterprise; an investment in the cultural sector by a non-Canadian; or an investment that is subject to the national security provisions of the ICA.

(1) Transactions for net benefit to Canada

In general, where the acquiror is a WTO investor, or where the target corporation is immediately prior to the transaction controlled by a WTO investor:

- direct acquisitions of a Canadian business require review and approval only if the enterprise value of the entity carrying on the Canadian business and all other entities in Canada control of which is being directly or indirectly acquired in the transaction is equal to or greater than C$600 million;3 and

- indirect acquisitions (e.g. acquisitions of a foreign corporation that controls4 a Canadian corporation carrying on the Canadian business) are not subject to review (unless the Canadian business involves a cultural business, in which case the thresholds discussed below apply).

For purposes of the ICA, the relevant “enterprise value” will be determined by:

- for a publicly-traded Canadian business, calculated as its market capitalisation, plus its total liabilities excluding its operating liabilities, minus its cash and cash equivalents. Market capitalisation will be determined at the point the investor makes an ICA filing.

- for a private Canadian business, calculated as its total acquisition value, plus its total liabilities excluding its operating liabilities, minus its cash and cash equivalents; and

- for a Canadian business acquired through an asset acquisition, calculated as its total acquisition value (i.e. total consideration payable for the acquisition), plus the liabilities that are assumed by the investor, minus the cash and cash equivalents that are transferred to the investor, all as determined in accordance with the transaction documents that are used to implement the investment.

-

However, the above C$600 million enterprise value threshold does not apply to acquisitions made by State-Owned-Enterprises (SOE’s), which will remain subject to the former threshold (C$369 million in “asset value”). In addition, if the Canadian business being acquired is engaged in a cultural business, or if the investor is not a WTO investor and the target is not controlled by a WTO investor, the review thresholds for direct and indirect acquisitions of Canadian businesses by non-Canadians are generally C$5 million for direct acquisitions and C$50 million for indirect acquisitions.

‘WTO investor’ is a defined term in the ICA. The rules as to whether a person is a WTO investor for purposes of the ICA are complex. Very generally, WTO investors are nationals, permanent residents and governments of WTO Members, and entities ultimately controlled by them. ‘WTO Members’ are the member countries of the World Trade Organization. Therefore, in direct WTO investments and instances where thresholds are not met, parties are only subject to notification and not review. Nonetheless, such transactions may still be reviewable under National Security grounds.

Where an investment is reviewable by the Minister, after receiving the application for review, the Minister has 45 days to review it and decide whether to approve the investment on the basis that it is likely to be of “net benefit to Canada”. If no notice is sent by the Minister to the applicant within the above 45-day period, the investment will be deemed to have been approved. The Minister may extend the 45-day review period by 30 days or such longer period as the applicant and the Minister may agree. If the applicant does not receive notice of the Minister’s decision within such further 30-day-or-longer period, the investment will be deemed to have been approved. If the Minister within such 45-day period, or such further period, informs the applicant that he will not allow the acquisition because it will not be of net benefit to Canada, the Minister must inform the applicant of its right to make further representations and to submit undertakings within a further 30-day period, or such longer period as the applicant and the Minister agree.

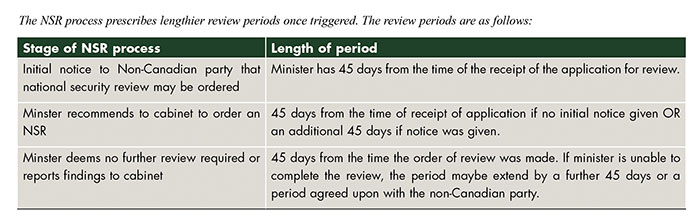

(2) National Security Review (NSR)

As a result of amendments to the ICA in 2009, the Governor in Council (i.e. federal cabinet) may review an investment by a non-Canadian in a business (including minority investments) where the Minister has reasonable grounds to believe that such an investment could be injurious to national security. The review of an investment on the grounds of national security may occur whether or not an investment is subject to review on the basis of net benefit to Canada or notification under the ICA.The ICA gives the cabinet the ability to take any measures necessary with respect of the investment to protect National Security. The cabinet is thus given a further 20 days to achieve this after recommendations are made by the minster at the last stage noted above.

_____

Endnote

- Huy Do is a partner and Co-Leader of the Antitrust/Competition & Marketing Law Group of Fasken Martineau DuMoulin LLP and Jack Yu is an associate within that group.

- The size-of-transaction threshold amounts are adjusted annually based on Canada’s annual Gross Domestic Product.

- This threshold will increase to C$800 million in 2017 then to C$1 billion in 2019.

- For this purpose, an entity controls a corporation either by owning a majority voting interests, or by control in fact (e.g. if one shareholder or a group of shareholders holds 10% or more of the voting interests, this may be control in fact). As well, the Minister may determine whether an entity engaged in a “cultural” business is or is not controlled in fact by another entity.

Email:

hdo@fasken.com

jyu@fasken.com

Website: www.fasken.com

FASKEN

FASKEN Mark Stinson

Mark Stinson Kathleen Butterfield

Kathleen Butterfield Edmond Luke

Edmond Luke