China (PRC)

| In a groundbreaking transaction, Industrial and Commercial Bank of China, based in Beijing and the world’s largest bank by market capitalization and profitability (ICBC), entered into an agreement with The Bank of East Asia, a major Hong Kong bank (BEA), to purchase an 80 percent common equity stake in BEA’s subsidiary bank based in New York, The Bank of East Asia (USA) National Association (BEA-USA). The agreement positions ICBC to become the first mainland Chinese bank to acquire a controlling stake in a US bank, according to White & Case. The agreement, which was announced by the parties on 23 January 2011, evidences the global business reach of the large mainland Chinese banks, which have market capitalizations sufficient to make them major players in international mergers and acquisitions markets. If approved by US regulators, the deal would signal the opening of the US banking market to acquisitions and other equity investments by mainland Chinese banks, said White & Case in a recent client alert. Although mainland Chinese banks, including ICBC, and other foreign banks have established banking offices in the United States, to date no mainland Chinese bank has established or acquired a US bank subsidiary. Many foreign banks maintain both branch offices and FDIC–insured subsidiary banks in the United States. Foreign banks typically serve the wholesale financial markets through their US branches, and their US subsidiary banks tend to serve the middle market and small businesses and are able (unlike the uninsured US branches of the foreign bank parents) to take FDIC–insured consumer deposits. In order to close the deal, ICBC must apply for and receive the prior approval of the Board of Governors of the Federal Reserve System (Federal Reserve) under Section 3 of the Bank Holding Company Act of 1956, as amended (the BHC Act). In order to approve the transaction, the Federal Reserve is required under the BHC Act to make a number of determinations and findings, including that ICBC, as a foreign bank applicant, is subject to ”comprehensive supervision or regulation on a consolidated basis” by the bank supervisory authorities in its home country, the People’s Republic of China. The Federal Reserve considers this standard met if the home country supervisor receives sufficient information on the worldwide operations of the bank and any affiliate relationships to assess the bank’s overall financial condition and compliance with law and regulation. |

Latest Updates

Related Articles

Related Articles by Jurisdiction

Vertical agreement: illegal per se or the rule of reason? (Part II)

In the previous issue, we compared illegal per se and the rule of reason, and pointed out that cases where illegal per se applies turn out to be favourable to the enforcement agencies and the plaintiff in ...

Cross-Border M&A

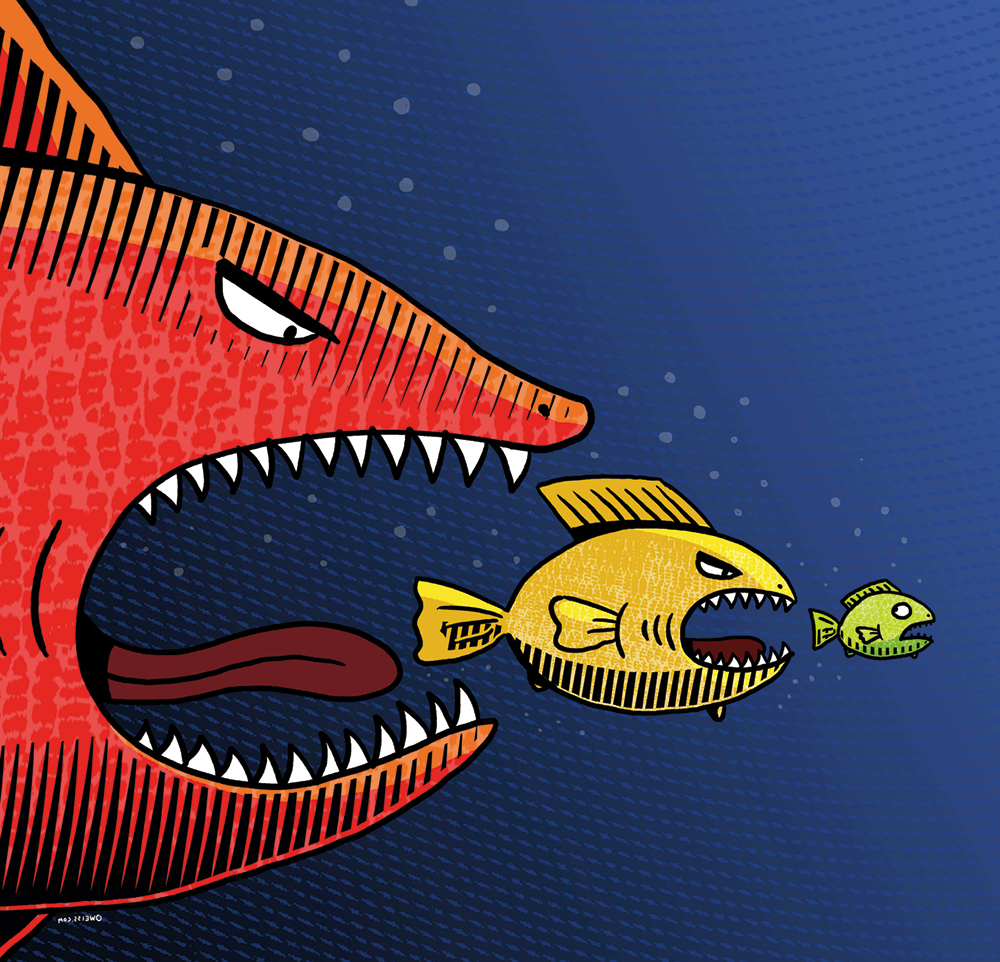

Last year’s strong M&A activity in Asia has continued in the first half of 2011. In our Special Report, senior lawyers practising in the field share their insights into the factors driving activity, from Asia’s thirst for ...

VPN compliance in China

China has strengthened its supervision on using VPN’s in recent years ...

Latest Articles