ASIAN-MENA COUNSEL is delighted to present a summary of Clyde & Co’s second Middle East Deal Study, the full version of which can be found on their website at the bottom of this article.

In this, our Middle East Deal Study 2015, we have analysed data collated from numerous M&A and JV transactions on which we have worked in the region during 2013/14. With expert commentary provided throughout, our report offers a unique insight into what businesses might expect from doing deals in the Middle East, as well as an indication of what could be considered ‘market practice’.

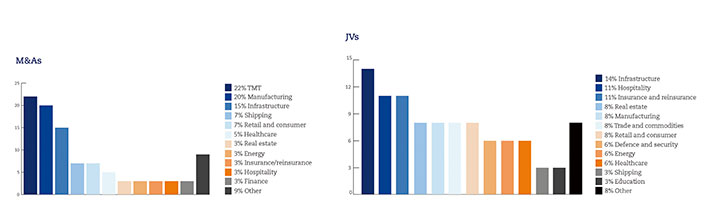

In compiling the 2015 Deal Study, we have analysed 75 of the key M&A and JV transactions in which our Middle East offices were involved during the period, 43 of which were M&A transactions with an aggregate consideration in excess of US$6.5 billion and 32 of which were JV transactions creating new business opportunities in a broad range of sectors, including TMT, infrastructure, insurance & re-insurance, hospitality, manufacturing, education, energy, healthcare, shipping and defence.

This edition of the deal study also provided us with an opportunity to benchmark and identify shifts in market trends, which its predecessor did not. For the first time, we have also included a sector analysis of the M&A and JV transactions, forming part of the 2015 Deal Study, which is designed to assist with the planning and implementation of your own transactions.

Throughout the report, we highlight what has stood out, both in terms of M&As and JVs in the Middle East. From an M&A perspective, we go into detail about why the Middle East offers a seller-friendly market, along with discussing security for claims, seller liability, choice of law/forum, tax and other aspects. |

Our JV highlights section in the executive summary divulges valuable information including of JV structures being overtaken by M&A structures as a route to market, offshore structures for flexibility, contributions in terms of what each party brings to the table, reserved matters, exclusivity, share transfers, deadlock resolution and choice of law/forum. |

In the sector analysis section, we demonstrate why there was sufficient confidence in various sectors to see high-value deals compete with relative regularity. Also, for the first time, we set out a sector analysis based on the volume of M&A and JV transactions, forming part of the 2015 Deal Study. Overleaf is a taster of what the full report offers.

|

Sector commentary: infrastructure & construction

Infrastructure/construction appears in the top three sectors for both M&A and JV transactions across the region. The Gulf Cooperation Council countries, in particular, appear to drive this growth, with increased levels of public investment across critical areas of the economy. We see this trend continuing along with growth in related sectors (such as healthcare and education) which are required to satisfy the demands of growing populations across the region.

However, whilst healthcare and education generate a lot of interest, the number of quality investment opportunities coming through in the region is still relatively low, which is reflected in our analysis.

|

M&A: forum and choice of law

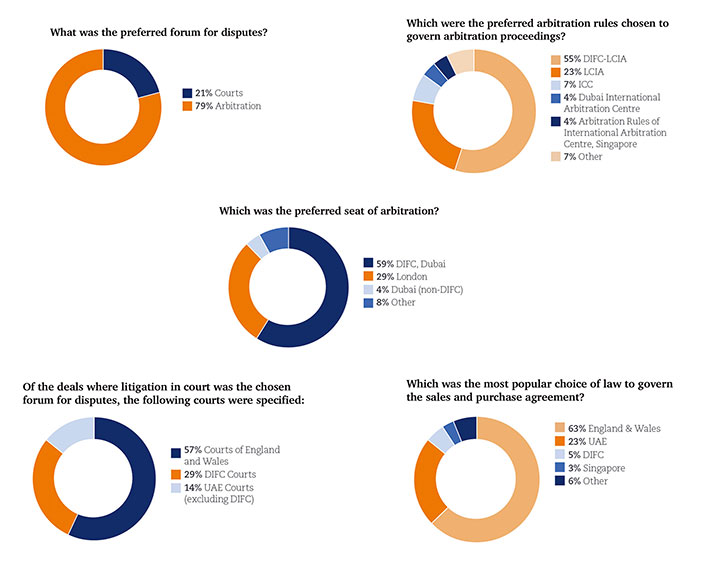

Choosing a forum for disputes and a law to govern the acquisition agreement can be one of the most critical parts. It will define how a claim for breach of contract is assessed and where it can be enforced.

In the deals reviewed, there was a clear shift in preference to the use of arbitration being chosen as the forum for dispute resolution as opposed to courts (79 percent of M&A deals used arbitration over courts as the chosen forum for dispute resolution, up from 59 percent in the last deal study).

|

This is in line with global trends in international contracts. It probably arises from a number of factors including: lack of confidence of either party ‘playing away’ in the other courts (but note it is less of a factor when considering the courts of England and Wales and DIFC (which are seen as international)); a wish for confidentiality in arbitration rather than public court proceedings; and easier cross border enforcement of awards as opposed to enforcement of judgments.

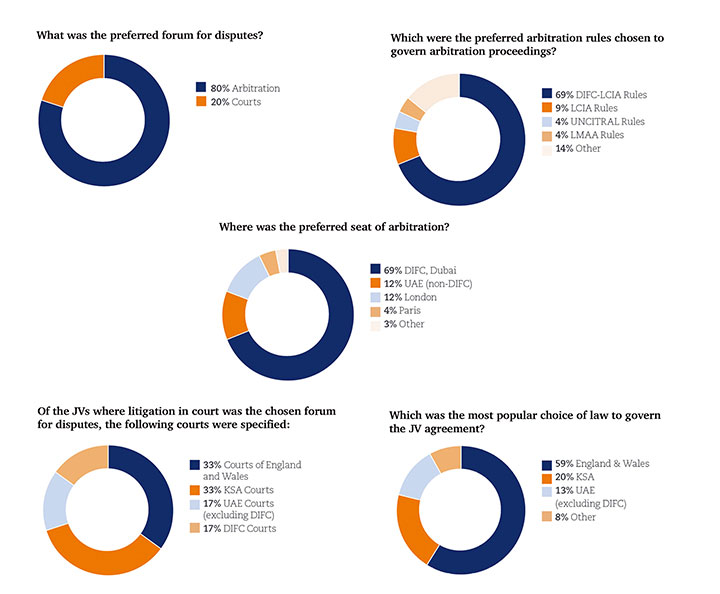

JVs: Forum and choice of law

A fundamental element of any JV agreement is the law which the parties choose to govern it, and where disputes are to be heard. This is what gives ‘teeth’ to the JV agreement, and the parties will want certainty both that the JV agreement will be interpreted as the parties intend it to be, and that awards will be enforceable in the intended jurisdictions as chosen by the parties.

The clear favourite governing law chosen in the JV agreements reviewed was English law, and the most popular dispute resolution process was arbitration in the DIFC.

59 percent of all JV agreements reviewed had English law as the governing law, and 80 percent chose arbitration (with nearly half of those specifying the DIFC-LCIA Arbitration Centre).

Since our last deal study, there has been an increase in the use of DIFC-LCIA rules in arbitrations (69 percent up from 47 percent). DIFC-LCIA arbitrations are clearly becoming more established and known to parties in the region in view of the benefits they offer including being well-known rules based on those of LCIA; and generally being seated in DIFC so that the DIFC Courts are the supervisory and enforcement courts, and are generally much more arbitration friendly than courts in the rest of the region.

Interestingly, there was a significant increase in JVs choosing courts as the preferred forum for dispute resolution (20 percent compared to seven percent in our previous deal study). Local partners may negotiate local courts for dispute resolution and as such, courts may be more advantageous to them. They may prefer to use local language in the court, rather than agree an English language arbitration, and also may prefer to be able to run a case in local courts without the risk of paying the other side’s costs if they lose. ________ For a more in-depth look at these topics, along with our other findings from our M&A and JV studies, please see our full deal summary at www.clydeco.com/firm/news/view/clyde-co-launches-2015-middle-east-deal-study. Should you have any queries, please email Philip O’Riordan. We look forward to hearing from you with your own insights and comments. |

Email:

philip.oriordan@clydeco.com

ross.barfoot@clydeco.com

Website: www.clydeco.com