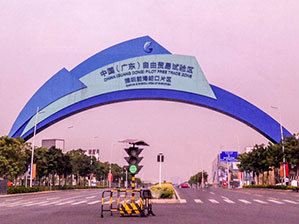

Gate of Qianhai & Shekou Area of Shenzhen, China (Guangdong) Pilot Free Trade Zone

China is experimenting with ad hoc arbitration in its free-trade zones, with the goal of creating a dispute resolution regime that is faster, cheaper and more flexible.

This new approach was unveiled at the end of December, when the Supreme People’s Court issued an opinion on judicial protection for the construction of pilot free-trade zones, aimed at encouraging institutional innovation and promoting international trade and investment.

It is clear from the opinions, and from a later article written by the three judges, that entities registered within the free-trade zones will be allowed to arbitrate disputes without the involvement of an onshore arbitral institution, which Denning Jin, a partner at Haiwen & Partners, describes as a “breakthrough to the current arbitration framework”.

Ad hoc arbitration agreements allow the parties involved to choose whichever arbitrators and rules they can agree on. This also opens the possibility of using offshore arbitration centres such as those in Hong Kong or Singapore, or the International Court of Arbitration, all of which have opened representative offices in Shanghai during the past few years.

“Ad hoc arbitrations are traditionally regarded as more flexible, faster and cheaper than institutional arbitrations,” according to Jin. “A particular advantage of ad hoc arbitration is that it can be tailored to the specific needs of the parties and the nature of the dispute on a case-by-case basis.”

Such arrangements are common in other jurisdictions, but China’s arbitration law does not recognise ad hoc agreements and requires that parties must appoint an arbitration commission.

However, a split between the former Shanghai and Shenzhen sub-commissions of the China International Economic and Trade Arbitration Commission in 2012 caused considerable confusion and helped to spur interest in an alternative system for resolving disputes.

Solace may be on the way. The adoption of ad hoc agreements in the free-trade zones is clearly intended as an experiment that will eventually be expanded nationwide if it is deemed a success.

Whether that is the case remains to be seen. Some uncertainty still needs to be clarified, says Jin, but the intention is clear and should be good news for foreign investors.