Middle East (Others)

Shahram Safai

The election of Mr. Donald J. Trump as President of the United States has resulted in much consideration by corporates of existing strategies with respect to Iran. Mr. Trump‟s lack of experience in public office and some of his election campaign statements continue to cause anxiety. Will Mr. Trump tear up the Iran nuclear agreement and re-negotiate? Will he impose further sanctions on Iran? However, despite his election campaign rhetoric, his 100 day plan which appeared on YouTube on November 21, 2016 and his press conference of January 11, 2017 focused almost solely on domestic issues to the exclusion of foreign policy. Mr. Trump has also amassed more billionaires in his cabinet than ever before in US history. Hence, Mr. Trump‟s approach to foreign policy may shape up to be more business driven and “transactional in nature” rather than Pax Americana driven (for example, no longer anti-Russian). He has reinforced this message by appointing a Secretary of State, Rex Tillerson, who is the CEO of Exxon Mobil which is one of the original „Seven Sisters‟ oil companies with a deep history in Iran. At the end of the day, it‟s always difficult to predict such matters. However, with respect to Mr. Trump‟s foreign policy intentions, the fog does appear to be lifting somewhat…. (read full article in PDF below)

Tags:

Iran,

MiningNew UAE Funds RegimeThe UAE has embarked on an ambitious undertaking by introducing new business friendly mutual funds regulations to stimulate the UAE funds industry and provide the foundation for a more developed regional funds regime in the Gulf Cooperation Council ...

Doing Business in Iran: the banking bottleneckWith the easing of sanctions against Iran, vast business opportunities have opened up. The challenge is whether and how to participate in such a potentially phenomenal market without taking undue risks.

UAE amends the Labour LawThe amendments introduce equal treatment for male and female employees in respect of compensation and parental leave ...

Merger clearance matters in the UAEDespite the limited number of filings and the dearth of decisions, parties conducting M&A in or from the UAE should consider the impact of the competition regime.

Federal Penal Code amendmentsThe amendments are designed to make the UAE's Penal Code consistent with other recent federal legislation and current federal enforcement policies.

Netting arrangements made enforceable in the UAEFor decades, banks and other counterparties in the UAE have obtained financial services from foreign financial institutions. Industry bodies, such as the International Swaps and Derivatives Association (ISDA), the International Capital Market Association and the International Securities Lending Association, have ...

ADGM announces tech start-up licensing regimeThe licence provides access to a Professional Services Support Programme aimed at allowing entrepreneurs entry to a community of businesses, financial services and professional advisers.

Off-plan sales in Dubai: Risks and rewardsWhether buyers are looking to expand their real estate portfolio or buyers are simply looking to find their ideal home, great deals can be found in Dubai’s off-plan real estate sector ...

Opportunities in Dubai’s Healthcare SectorDubai is the fastest growing healthcare market within the GCC and is becoming an increasingly attractive sector for investors. Afridi & Angell explain the key drivers and options available to investors ...

New UAE Funds RegimeThe UAE has embarked on an ambitious undertaking by introducing new business friendly mutual funds regulations to stimulate the UAE funds industry and provide the foundation for a more developed regional funds regime in the Gulf Cooperation Council ...

The UAE Competition Law ClarifiedTwo Cabinet Decisions have been issued which provide guidance on the implementation of the Competition Law, particularly on market share thresholds and on small and medium establishments.

The New UAE Bankruptcy LawPerhaps the most important new feature of the new Law is the introduction of a regime that allows for protection and reorganization of distressed businesses ...

UAE Ministerial Decision No. (272) of 2016The Ministerial Decision No. (272) of 2016 addresses the scope of Article 104 of Federal Law No.2 of 2015, stating which articles relating to public and private joint stock companies apply to limited liability companies.

Doing Business in Iran: the banking bottleneckWith the easing of sanctions against Iran, vast business opportunities have opened up. The challenge is whether and how to participate in such a potentially phenomenal market without taking undue risks.

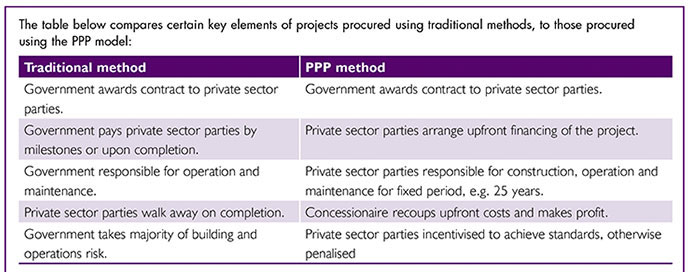

UAE Legal BulletinUpdates on the possibility of a Value Added Tax, the new PPP Law and other developments which companies doing business in the UAE should know

UAE Legal Bulletin July-August 2015Insights into the new Commercial Companies Law and relevant corporate updates which can help companies conduct business in the UAE, particularly in Dubai

Do I need a DIFC will?With the opening of the Wills and Probate Registry in the DIFC, it is now possible to register a will in Dubai and have a high degree of confidence that it will be enforced.

DFSA imposes record fine on Deutsche BankThe Dubai Financial Services Authority (DFSA) imposes its largest fine to date on Deutsche Back AG Dubai (DIFC Branch), sending a strong signal that DFSA is both independent and unafraid to take on well-resourced opponents.

Free Zones in the UAE – an overviewStrategically located between Europe, Africa and Asia, the United Arab Emirates has become a hub for trade and commerce throughout the world ...

UAE Competition Law - All bark and no bite?Federal Law No. 4 of 2012 on the regulation of competition (the “Competition Law”) introduced a regime for the regulation of anti- competitive behavior in the UAE which previously did not exist ...

Related Articles by Jurisdiction

M&AOur M&A Report includes SyCip Salazar Hernandez & Gatmaitan's article 'Further liberalisation and consolidation of the banking sector' and Phoenix Legal's contribution 'M&A Booster – New Companies Act has it all easy and ...

Middle EastASIAN-MENA COUNSEL's Middle East Cover Story looks at recent legal developments in the region, with a Special Report by Bin Shabib & Associates LLP, Dubai on arbitration issues in the UAE. Articles by Latham & Watkins. ...

Afridi & Angell

Afridi & Angell Masood Afridi

Masood Afridi Amjad Ali Khan

Amjad Ali Khan