| Managing Director and Head, Group Legal and Secretariat at DBS Bank Sue Lynn Koo discusses her career trajectory, the importance of out-of-the-box thinking and how technology is both a blessing and a curse for her role. She also gives advice to external counsel she wishes she’d heard when she was one, and reveals the best advice she’s ever been given. |

ASIAN-MENA COUNSEL: Briefly, can you describe your career trajectory?

Sue Lynn Koo: As with many things in life, I had a bit of luck driving many fantastic opportunities for me.

I began my career as an attorney with Morrison & Foerster, which provided me with a rich, diverse experience and solid legal foundation. The skills and technical expertise acquired from MoFo enabled me to successfully transition into in-house and operational roles at a technology start-up and large organisations.

Following MoFo, I joined as General Counsel and COO of a technology start-up specialising in voice recognition during the height of the tech boom. The energy and dynamism fuelled by a never-ending supply of optimism and creativity that dominated the company culture were infectious. We completed two rounds of funding and successfully operationalised the business. I then joined Prudential Financial (US) as Chief Legal Officer for their Korean operations, which consisted of a securities firm, an asset management firm and life insurance business. Prudential had acquired the former two and there was much focus on integrating the businesses, merging cultures and cascading Prudential’s compliance culture. After around seven or so years, Prudential exited the investment businesses.

I then joined Korea Exchange Bank as its first General Counsel to revamp its legal and compliance structures and processes as well as to manage the sale of it by its majority shareholder. After the sale of the bank, I left to join my current post at DBS Bank.

AMC: How do you add value to your company?

Sue Lynn Koo: Having practised in many jurisdictions in various industries, I was able to broaden my experience and perspective. My willingness to partner with stakeholders to drive results and think out of the box without compromising compliance is at the core of my responsibilities. As General Counsel, we need to take ownership, support our team’s decisions and strive relentlessly to innovate and practise operational excellence. These tenets must permeate all that we do — providing strategic or legal advice, reflecting terms in documentation, harmonising policies and standards, leading significant projects or enabling good business outcomes.

AMC: Please describe how the in-house role has changed as the market has developed.

Sue Lynn Koo: The dynamic and shifting world business paradigm has compelled an onslaught of regulation and resulted in a substantial and complex risk environment — significantly enhancing the burden on financial institutions. This, in turn, mandates that in-house counsel re-think their traditional ‘advisory’ role as strategy and business responsibilities weave themselves into the role. Along with compliance colleagues, our primary responsibility is identifying and managing the growing universe of risk by proactively analysing the impact of increasingly complex global legislation and regulations, inculcating a robust compliance culture, threading risk-intelligent behaviour into the bank culture and embedding strong controls and processes.

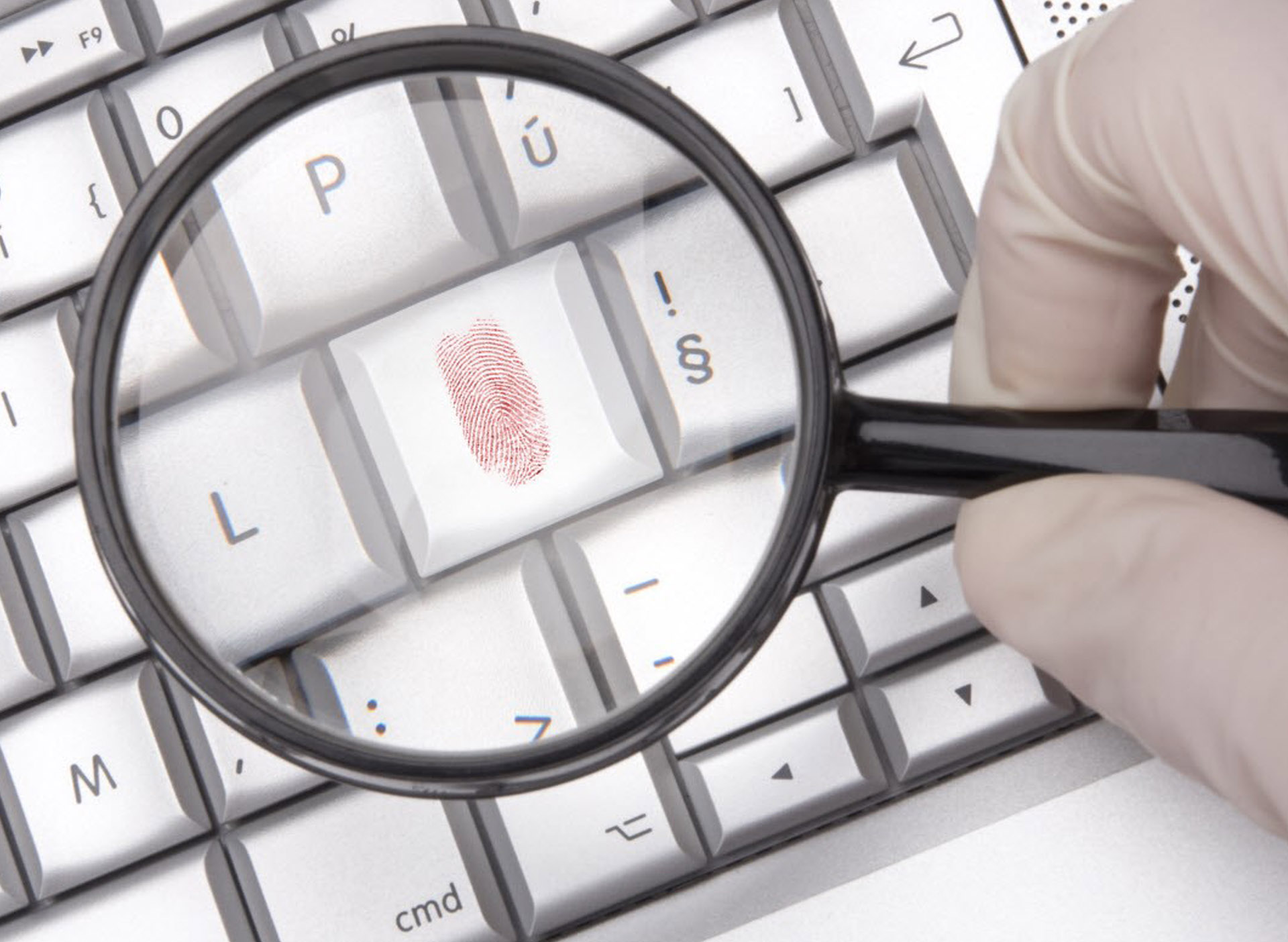

Our roles are further complicated by heightened focus in areas such as financial crime, anti-bribery and corruption, and more broadly on conduct of business as well as new, emerging issues, such as cyber security and data management, generated by the growth in and application of technology. Managing these trends, along with the growing complexity of global and local rules, requires sourcing specialised experts, evolving our legal advice models and investing significant resources in training and technology. We must, therefore, augment the depth and breadth of our technical expertise and partner closely with our stakeholders to create ‘user-friendly’ journeys and facilitate business outcomes, adeptly manage the universe of risk and execute operational excellence. We must, in short, align the legal function’s strategy with that of the organisation. A tall order indeed …

AMC: Based on this, as well as other influential aspects such as technology, what changes do you expect to see in the world of law over the next 5-10 years? Sue Lynn Koo: The penetration of the digital age and technology in all aspects of our lives has extended to our role and will invariably transform and, hopefully, revolutionise the legal industry. If nothing else, the sheer exponential growth in processing speeds, use of data analytics and diverse emerging technologies will give rise to unprecedented automation and innovation in how we devise legal advice and solutions. We need to position ourselves to be early adopters and allow for experimentation. Just as using e-mail to communicate with clients was considered a serious breach of the duty of confidentiality and ethics a mere twenty years ago, technology will prove to be disruptive and challenging, and force us to drill down on our value proposition. Embracing the digital opportunity is critical to us pioneering positive change and efficacy in our profession. AMC: When seeking external help, what makes some law firms or lawyers stand out? AMC: Is there anything you have learned since moving in-house that you wish you knew when you were an external counsel? AMC: Please describe a typical work day. AMC: What’s the best advice you have been given and what’s the best advice you could give? Being able to crystallise the essence of what it means to be me, thereby articulating my personal purpose and endeavouring to live it and impact the world in which I live, has been a transformative experience. Aligning my personal purpose with that of the bank has made work itself and setting objectives simpler and immensely more meaningful.

Sue Lynn Koo is an In-House Community Thought Leader. Since this article was published, Ms Koo has moved to Coupang as General Counsel. |