By Maharanny Hadrianto, Stephanie Kandou and Lina Amran, Makarim & Taira S.

By Maharanny Hadrianto, Stephanie Kandou and Lina Amran, Makarim & Taira S.

Bank Indonesia (BI) recently issued Regulation No. 21/2/PBI/2019 on the Reporting of Foreign Exchange Flow Activities (Kegiatan Lalu Lintas Devisa) (Reg. 21/2) on January 7, 2019, which came into effect on March 1, 2019.

Reg. 21/2 partially revokes BI Regulation No. 16/22/PBI/2014 on the Reporting of Foreign Exchange Flow Activities and the Reporting of the Application of the Prudential Principle in the Management of Non-Bank Entities’ Foreign Debts (Reg. 16/22), replacing all the provisions of Reg. 16/22 on the reporting of foreign exchange flow activities. Therefore, Reg. 16/22 now only covers reporting on the application of the prudential principle (kegiatan penerapan prinsip kehati-hatian, or KPPK).

Foreign exchange Flow Report

Scope

Reg. 21/2 has added risk participating transactions (transaksi partisipasi risiko, or TPR) to be reported as a part of the foreign exchange flow report (Flow Report). A TPR is defined as a risk assignment transaction of individual credit or other facilities under a master risk participation agreement. The scope of the Flow Report (Flow Report Scope) covers the following data and information:

- trade transactions of goods, services, and other transactions between a resident (ie a person, legal entity or other entity domiciled in Indonesia) and a non-resident;

- principal data of offshore debts (utang luar negeri, or ULN) and/or TPR;

- the plan of the ULN and/or TPR disbursements and/or payments;

- the realisation of the ULN and/or TPR disbursements and/or payments;

- the position of and amendments to offshore financial assets (aset finansial luar negeri), offshore financial liabilities (kewajiban finansial luar negeri) and/or TPR; and/or

- a new ULN plan and/or its amendment.

Except for TPR and the information required in items c) and d) of the Flow Report Scope above on the plan and realisation of ULN and/or TPR disbursements which are now covered by Reg. 21/2, the remaining scope of the Flow Report above is similar to the scope under Reg. 16/22.

The Flow Report must be submitted by the reporting party online through BI’s reporting website.

Reporting Party

The following parties are categorised as a reporting party required to submit the Flow Report:

- financial institutions, ie banks and non-bank financial institutions;

- non-financial institution business entities, ie legal entities and non-legal entities;

- other entities; and

- individuals.

Timings for Flow Report submission

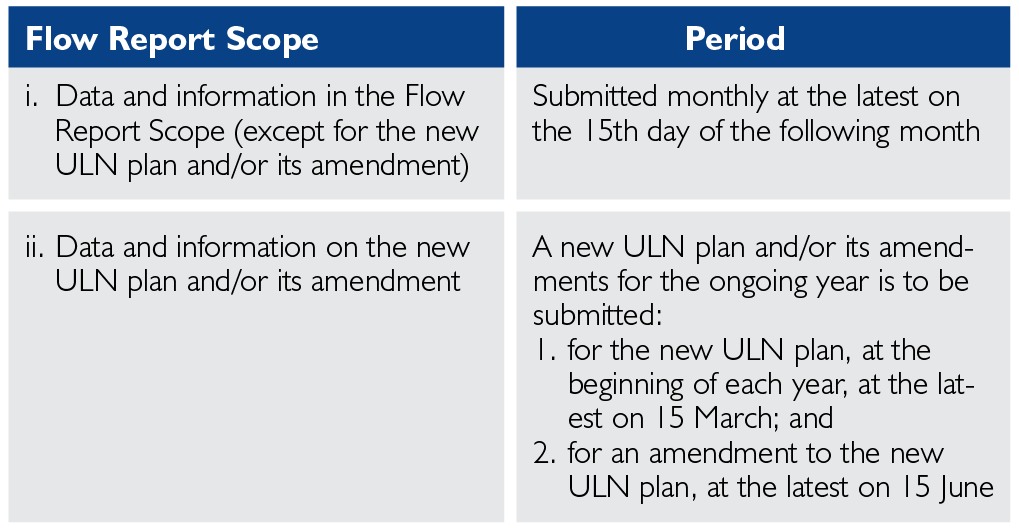

The following timings apply to submitting the Flow Report:

Previously, Reg. 16/22 required any amendment to the planned new ULN to be submitted by July 1 rather than June 15.

Corrections to the Flow Report must be submitted at the latest on the 20th day of the relevant submission month. If the deadline for the submission of the Flow Report or the correction falls on a weekend or holiday, the report can be submitted the following working day.

Sanctions

Unlike Reg. 16/22, BI under Reg. 21/2 no longer imposes monetary sanctions (fines). A reporting party that:

- submits a Flow Report with incorrect data and/or information (except for the new ULN plan and/or its amendments) and does not submit a correction;

- submits the Flow Report late; and/or

- does not submit the Flow Report,

will be served written warnings. The written warnings may be served by mail, e-mail or another medium. Written warnings only apply to new reporting parties after certain periods have lapsed.

A reporting party undergoing bankruptcy or is no longer operating may submit an appplication to BI to not have a written warning served by submitting the supporting evidence (such as copy of the bankruptcy application to the court or a letter evidencing a licence revocation from the relevant ministry).

Closing

Reg. 21/2 is effective as of March 1, 2019. The implementing regulations of Reg. 16/22 are still valid as long as they are not contrary to Reg. 21/2, but may be replaced by further regulations by Bank Indonesia related to the Flow Report, particularly on (i) the scope of the report, (ii) report coverage, procedures for submitting the report and report corrections and (iii) the procedures for sanctions.

![]()

E: info@makarim.com

E: maharanny.hadrianto@makarim.com

E: stephanie.kandou@makarim.com

E: lina.amran@makarim.com

T: (62) 21 5080 8300

F: (62) 21 252 2750

Makarim & Taira S. (Old)

Makarim & Taira S. (Old) Rahayu Ningsih Hoed

Rahayu Ningsih Hoed