By M ayuree Sapsutthiporn, Kudun & Partners

ayuree Sapsutthiporn, Kudun & Partners

Email: mayuree.s@kap.co.th

China will soon become the leading foreign investor in Thailand, but there are still significant challenges for the unwary.

[See the Chinese language version of this article here]

Moving to Thailand from China with my parents when I was only 13 years of age brought major personal challenges, but one of the most serious problems faced was when my parents suffered a major investment loss through a lack of understanding of Thai law. This early experience left such a deep impression that I was determined to study law and help others from China navigate Thailand’s legal minefield.

Fast forward a few decades and my dream has come true as I now head the dedicated China business unit at Kudun & Partners, the first law firm in Thailand to create a specialised unit focused on China.

China’s increasing foothold in Thailand

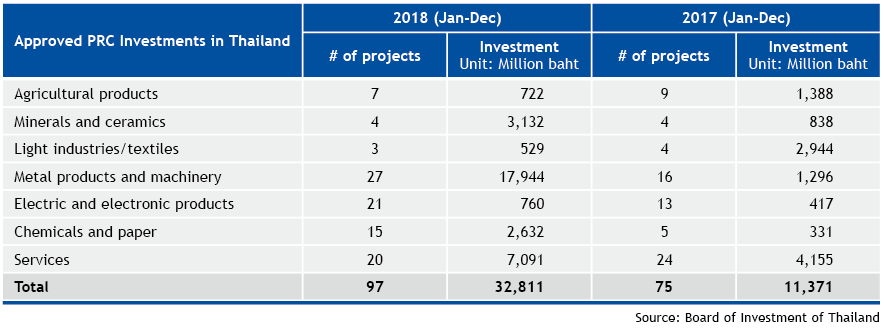

China will slowly surpass Japan to become the leading foreign investor in Thailand. Foreign investment applications submitted and approved through the Board of Investment (BOI) from the PRC have nearly tripled from 2017 to involve investments of over US$1 billion in 2018 and the scope of industries continues to broaden.

While metal products and machinery continue to be the primary industries in which Chinese firms invest in Thailand, the scope has expanded to include several other industries such as chemicals and paper, electronics as well as services (including retail services, hotels and condominiums) all of which are showing year-on-year growth.

Although Japan remains the largest investor in Thailand, 2018 revealed proportionately more aggressive growth from China than from Japan. Deputy Prime Minister Somkid Jatusripitak noted this fact in a seminar held by the BOI on March 4, 2019:

“With the advantage of geography and infrastructure, Thailand has become a centre for the CLMVT region and together with the initiation of the EEC (Eastern Economic Corridor) has resulted in an increase in foreign investment in Thailand. Especially in the EEC, foreign investments have increased by more than 100 percent in the past few years. Chinese investors will definitely represent our greatest opportunity given their Belt & Road policy to encourage outbound investment by Chinese.”1

The rebound in investment partially reflects the dramatic dip in overall China outbound investment as a result of the new PRC governmental regulations classifying investment as “encouraged, restricted or prohibited”. Restricted and prohibited investments are those considered to be non-strategic and potentially used as a means to avoid capital controls. However, the turnaround in 2018 China investment in Thailand reflects an increase in the type which is “encouraged” and which forms part of the overall Belt & Road initiative.

In 2015, the PRC’s Ministry of Commerce approved the establishment of the Chinese Rayong Industrial Zone in the EEC and there are now over 100 companies operating there. However, a growing proportion of Chinese investment is taking place beyond this area and involves more than the traditional manufacturing-based industries.

During the recent session of the 6th meeting of the Joint Committee on Trade, Investment and Economic Cooperation between Thailand and China, Deputy Prime Minister Somkid noted that Chinese investors are interested in new technology and innovation in the EEC locations, while State Councillor Wang Yong said that investors are interested in electric vehicles, smart logistics, digital infrastructure, education, energy, tourism and satellites.2

Thailand’s BOI has launched the Thailand 4.0 Project. While many projects and proposed partnerships are still in the planning stages, the emphasis is on development of technology-based manufacturing and an innovation-driven economy, especially in the five areas of biofuels and bio chemicals, digital economy, medical hub, automation and robotics as well as aviation and logistics. With household name Alibaba making significant long-term financial commitments to Thailand, the country is clearly open for Chinese business.

Key difficulties faced by Chinese firms looking to invest in Thailand

Despite substantial growth in Chinese investment, certain Chinese companies have failed to capitalise on opportunities with several falling prey to investment failures. The key challenges which Chinese clients typically face in Thailand, according to many of our esteemed clients at Kudun & Partners, include the following:

- Uncertainty as to whether Thailand is the best destination for them to make the investment. As Thailand vies with many other potential locations in Southeast Asia and globally, how can they be sure that the combination of issues such as tax exemptions, foreign exchange and capital controls, transfer pricing and logistics (among others) make Thailand the most suitable destination for investments. Our clients say they prefer to find a single point of legal contact who they can trust to coordinate the necessary resources (whether inside or outside of our law firm) to provide them comprehensive advice on these issues.

- Inability to find Thai lawyers who understand Chinese culture and their unique business needs. Jun Jie Sun, chief executive of Jetion Solar, which makes substantial investments in Thailand,3 comments: “It is rare to find lawyers who can cross the cultural divide between Thais and Chinese, and it is dangerous to rely simply on translation of Thai legal documents. Chinese lawyers based in Thailand are available to handle some of our needs but we don’t want to simply hire a translator. We seek to find a professional and experienced lawyer who can address legal issues from both angles and who truly has our best interests as a client in mind.”

- Inability of Chinese lawyers to represent Chinese clients in Thai courts in the case of litigation. According to Daniel Chernov, managing partner of Siam ADR4, “The Lawyers Act defines a lawyer as one who pleads cases in court and does not deal with lawyers working as ‘solicitors’ or legal consultants. In any case, the work permit forbids foreign lawyers from engaging in legal practice. Foreign counsel can appear for their clients in arbitration proceedings in Thailand, provided that such proceedings do not involve Thai law and the awards will not be enforced in Thailand.”

- Lack of understanding of required contract protection mechanisms. Chinese clients have not been fully and properly advised on investment structure and the agreements required to protect their investments in Thailand. This oversight has led to many failed investments in the past. Recently a well-known Chinese real estate company entered into a joint venture with a local partner in Thailand. Given good relations at first, they did not enter into a shareholders’ agreement therefore all rights and duties of the parties had not been clearly determined and properly identified. As a result, once the relationship soured, they were unable to resolve all disputes and disagreements arising out of the lack of understanding of required contract protection mechanisms.

- Thai lawyers lacking an understanding of Chinese government regulations on overseas investments, including tax, capital control, transfer pricing and filing requirements. Our clients have complained that although they have identified Thai lawyers who are fluent in Mandarin Chinese, they typically don’t have a thorough understanding of the PRC compliance issues.

While Thailand’s internal legal framework and enforcement are becoming increasingly foreign-investment friendly and legal recourse and litigation are possible, my main advice to Chinese firms seeking representation in Thailand is to do a thorough background search and research on potential law firm candidates through various secondary sources and impartial parties such as Thailand-China business associations and chambers of commerce.

For further explanation on how Kudun & Partners have addressed each of the typical challenges outlined above, please don’t hesitate to consult Mayuree (mayuree.s@kap.co.th).

___________________________________

ABOUT KUDUN & PARTNERS CHINA PRACTICE

Based on an increasingly growing clientele base from China, Kudun & Partners Limited (KAP) is the first in Thailand to have launched a premium dedicated business unit to serve the unique needs of Chinese companies with existing operations or interest in expansion into Thailand.

With experts in capital markets, M&A, tax, real estate and litigation, we draw on the specific expertise as the need arises to provide a full service one-stop solution to ensure our Chinese clients have the greatest chance for successful ventures in Thailand.

T: (662) 838 1750 Ext: 1803

___________________________________

Endnotes:

- Deputy Prime Minister, H.E. Somkid Jatusripitak’s presentation on Thailand Investment Year : Transforming Challenges into Opportunities in a seminar “Thailand Investment Year What’s New?” held by the Board of Investment of Thailand on March 4, 2019.

- “Growing interest from China in Thailand’s EEC”, September 3, 2018 by Suwatchai Songwanich, Chief Executive Officer, Bangkok Bank (China).

- Jetion Solar, a subsidiary of China National Building Material Group Co, Ltd. (CNBM) a Chinese Stated-Owned Enterprise is a leading manufacturer of high efficiency crystalline silicon solar cells and high-performance solar components development and production. They have expanded their business internationally in the U.K., Italy and Thailand. Mr Sun shares considerable praise for Mayuree Sapsutthiporn: “She truly understands what I, as a client, need and what is best for me as her client. She is a real problem solver and takes mission impossible assignments and pulls something extraordinary together.” He also adds that “She has strong tactical knowledge and knows her stuff, especially with regards to how to close deals and is commercially proficient. She is really solution-driven and what is most important is that she puts herself in our shoes when providing advice.”

- “Democracy Blooms? – Thailand’s legal market” – excerpt from cover story January 23, 2019 in the Asia Business Law Journal.

Kudun and Partners Limited

Kudun and Partners Limited Kudun Sukhumananda

Kudun Sukhumananda Troy Schooneman

Troy Schooneman