Circular Economy And How It Works

Circular economy (‘CE’) is one of the solutions to climate change, biodiversity loss, waste, and pollution.1 It is a resilient system that is good for business, the environment and mankind as it decouples economic activity from the consumption of finite resources.2

CE is based on three principles, eliminate waste and pollution, circulate products and materials and regenerate nature.3 Similar to recycling, the CE also has its cycles to achieve the three principles. There are two main cycles, the technical cycle, and the biological cycle.4 The technical cycle is when products are kept in circulation in the economy by way of reuse, repair, remanufacture and recycling.5 Biological cycle is when the nutrients from biodegradable materials are returned to Earth through composting or anaerobic digestion.6 In short, CE is recycling so no materials go to waste.

The Need For Circular Economy

The concept of CE speaks for itself. With the rapid growth in popularity and increased demand for raw materials, there is an urgent need to prevent further damage to the planet and ultimately aim to restore our planet. Additionally, with finite supplies means that countries are dependent on others in the importation of raw materials.7

Focusing on the live and pressing issue in Malaysia, ever since China banned plastic imports at the start of 2018, Malaysia has become the world’s top destination for global plastic waste for recycling.8 Additionally, there is also the bulk stems from domestic consumption of single-use plastics.9 In fact, Malaysia is one of the fastest-growing and developing countries even with the impact caused by the Covid-19 pandemic.10 Naturally, such rapid development of manufacturing industries will cause pollution and sustainability issues.11 The waste path is linear, meaning it flows in one direction from production to consumer to landfill, incineration, or litter.12 To transition towards a CE by increasing resource efficiency and reducing the use of virgin material, requires better product and packaging designs, collection, sorting systems, and recycling infrastructure.13

The Law On Circular Economy In Malaysia

Malaysia should focus on tackling these environmental issues with the implementation of CE. For decades, waste management has been the financial and administrative responsibility of the government, but the system has proven to be inefficient and unable to keep up with rising waste.14 There is currently a lack of legal framework for the implementation of CE. Only certain sections and regulations in the Environmental Quality Act 1974, Solid Waste and Public Cleansing Management Act 2007 and Environmental Quality (Scheduled Waste) Regulation 2005, respectively, promote resource circulation.

Recently, in the Twelfth Malaysia Plan announced by our Prime Minister on 27 September 2021, the followings are the latest national five-year plan outlined on the CE and waste management:15

- Develop relevant policies, legislation and economic instruments to facilitate the transition to the CE.

- Review the relevant policies and legislation to incorporate eco-design requirements, including the use of recycled materials.

- Introduce a new regulation on household e-waste to implement the EPR for e-waste, covering other types and streams of waste, particularly packaging materials and single-use plastics.

- Develop a comprehensive database for all types of waste.

- Construct integrated waste management facilities. This will enable treatment of about 95% of waste and only 5% will be disposed at sanitary landfills.

- Review existing legislation, including the Environmental Quality Act 1974 and the Customs Act 1967, to control waste imports and exports.

- Discourage single-use products, including plastics and packaging materials in eateries and at public events.

- Construct integrated scheduled waste treatment and disposal facilities to minimize illegal dumping and increase the recycling rate of scheduled waste to 35% by end of 2025.

Other Initiatives

Apart from the lack of legislation on CE, Bursa Malaysia (‘Bursa’), the Securities Commission Malaysia (‘SC’) and Bank Negara Malaysia (‘BNM’) had taken up the role of encouraging companies and banks to support CE by way of establishing policies that will be binding against companies or banks registered for their services.

1. Bursa

According to the Bursa Malaysia Sustainability Report 2020, Bursa aims to promote the concept of CE in Malaysia, particularly among the Public Limited Companies (‘PLCs’), while helping to provide sustenance for the poor and under-privileged groups. As such, under their 2021 – 2023 CSR Plan includes CSR Pillar 1: Responsible Consumption and Production where their leading initiative under this pillar is re.Food.16

re.Food is Bursa Malaysia’s flagship food waste management programme that aims to reduce food waste disposal to landfills.17 Through re.Food, Bursa aims to engage our capital market community to create a movement to drive sustainable behaviour change towards food waste prevention while helping the underprivileged.

2. BNM

BNM has published a Climate Change and Principle-based Taxonomy that is applicable to licensed banks, investment banks, international Islamic banks, Islamic banks, insurers, reinsurers, takaful operators, retakaful operators, and prescribed development financial institutions. It laid out two methods in which promotes and ensures CE, namely the assessment of economic activities and the classification of economic activities.

To assess the economic activities, BNM has established the guiding principles to be followed. BNM believes that the financial institutions play an important role in the transition to CE by channelling capital and funds through their green financing and investment as well as advisory activities.18 The guiding principles should be embedded in the due diligence assessment of existing and prospective customers.19 There are five guiding principles, mainly climate change mitigation (GP1), climate change adaptation (GP2), no significant harm to the environment (GP3), remedial measures to transition (GP4) and prohibited activities (GP5).

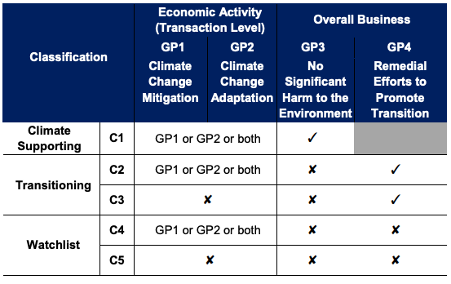

BNM believes that a consistent and systematic classification of economic activities can facilitate and promote the channelling of financial flows to activities that support climate change and environmental objectives.20 Economic activities are classified into three categories based on GP1 to GP4, namely climate supporting (C1), Transitioning (C2 and C3) and Watchlist (C4 and C5).21 C1 to C5 represent the different levels of contribution of economic activities towards climate and environmental objectives. The following table shows the GPs that are required to be satisfied for each categories:

Table extracted from Climate Change and Principle-based Taxonomy Report.

3. SC

According to the Public Consultation Paper22 published by the SC, it is the environmental objective to transition Malaysia to CE. An economic activity can be considered to support the transition to CE if it fulfils either of the criteria; adjust business operations so as to conserve raw material, energy, water, and other natural resources, and; implement CE principle via adapted products, production, technologies and processes.

The SC has produced the Sustainable and Responsible Investment Roadmap for the Malaysian Capital Market (SRI Roadmap).23 To develop a facilitative SRI in the Malaysian capital market, SC had listed the 5i-Strategy Widening the range of SRI instruments, increasing SRI investor base, building a strong SRI issuer base, instilling strong internal governance culture, and designing information architecture in the SRI ecosystem.

More recently, the SC had expanded its Green SRI Sukuk Grant Scheme to encourage more companies to finance green, social and sustainability projects through SRI sukuk and bonds issuance.24 In the SRI Sukuk and Bond Grant Scheme eligible issuers could claim the grant to offset up to 90% of the external review costs incurred, subject to a maximum of RM300,000 per issuance.25 The SRI Sukuk and Bond Grant Scheme is administered by Capital Markets Malaysia26, an affiliate of the SC. As announced in Budget 2021, income tax exemptions were provided for the recipients of the SRI Sukuk and Bond Grant Scheme for a period of five years until 2025.27

Conclusion

Ultimately, a CE can only be achieved by making circularity in businesses large and small the norm. As discussed above, Bank Negara Malaysia, Bursa Malaysia and Securities Commission already have in place strategies and policies that promote CE, and the market expect these to be rolled out in much clearer policy statements in the foreseeable future. For the nation of Malaysia to move forward to a sustainable future, the progression into CE is inevitable.

AUTHORS:

GABRIELLE LIM WAI YEE (Legal Executive)

GABRIELLE LIM WAI YEE (Legal Executive)

Gabrielle pursued her law degree and graduated from the University of Leeds, United Kingdom in 2020. She completed the Bar Training Course and was admitted to the Bar of England and Wales in 2021. She also completed her masters, LL.M in Legal Practice (Bar) from BPP University, Bristol, UK in 2022. She is currently attached to the Shipping, Litigation & Arbitration Practice Group.

HEU WEN YEN (Legal Executive)

Heu Wen Yen is a Legal Executive at Azmi & Associates. She graduated from University of Queensland with LLB (Hons) Degree in 2018. She is currently attached to the Capital & Debt Market department.

- 1 Ellen Macarthur Foundation, ‘Circular Economy Introduction’, (n.d., Ellen Macarthur Foundation), <https://ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview> accessed 19 April 2022.

- 2 Ibid.

- 3 Ibid.

- 4 Ellen Macarthur Foundation, ‘The Butterfly Diagram: Visualising the Circular Economy’, (n.d., Ellen Macarthur Foundation), <https://ellenmacarthurfoundation.org/circular-economy-diagram> accessed 19 April 2022.

- 5 Ibid.

- 6 Ibid.

- 7 European Parliament, ‘Circular Economy: Definition, Importance and Benefits’, (3 March 2021, European Parliament) <https://www.europarl.europa.eu/news/en/headlines/economy/20151201STO05603/circular-economy-definition-importance-and-benefits> accessed 19 April 2022.

- 8 Jazlyn Lee, ‘Waste not want not: Malaysia moves to become a leader in tackling plastic waste’, (3 February 2021, Eco-Business), <https://www.eco-business.com/opinion/waste-not-want-not-malaysia-moves-to-become-a-leader-in-tackling-plastic-waste/> accessed 17 April 2022.

- 9 Ibid.

- 10 Dr Ahmad Rais Mohamed Mokhtar, ‘Towards a comprehensive, holistic model of circular economy’ (27 May 2021, New Straits Times) ‘Towards a comprehensive, holistic model of circular economy’ (27 May 2021, <https://www.nst.com.my/opinion/columnists/2021/05/693348/towards-comprehensive-holistic-model-circular-economy> accessed 19 April 2022.

- 11 Ibid.

- 12 Ibid at [10].

- 13 Dr Ahmad Rais Mohamed Mokhtar (n 10).

- 14 Jazlyn Lee (n 8).

- 15 Aoki Kenji, ‘Malaysia announces 12th Malaysia Plan (2021-2025) Incorporating EPR regulations on e-waste, etc’ (3 November 2021, Enviliance ASIA), <https://enviliance.com/regions/southeast-asia/my/report_4619> accessed 17 April 2022.

- 16 Bursa Malaysia, ‘CSR Pillars’, (n.d. Bursa Malaysia) <https://www.bursamalaysia.com/about_bursa/sustainability/yayasan-bursa-malaysia/beneficiary-application> accessed 19 April 2022.

- 17 Bursa Malaysia, ‘Re.Food’, (n.d., Bursa Malaysia), <https://www.bursamalaysia.com/bm/about_bursa/sustainability/yayasan-bursa-malaysia/featured-csr-projects/re-dot-food> accessed 19 April 2022.

- 18 Bank Negara Malaysia, ‘Climate Change and Principle-based Taxonomy’, [12] 30 April 2021, <https://www.bnm.gov.my/documents/20124/938039/Climate+Change+and+Principle-based+Taxonomy.pdf> accessed 18 April 2022.

- 19 Ibid.

- 20 Ibid.

- 21 Ibid.

- 22 Securities Commission Malaysia, ‘Public Consultation Paper No. 1/2021 Principles-based Sustainable and Responsible Investment Taxonomy for the Malaysian Capital Market’ (17 December 2021, Securities Commission Malaysia) <https://www.sc.com.my/api/documentms/download.ashx?id=f610a75b-d5e1-4e99- 9bdb-393000a2c355> accessed 19 April 2022.

- 23 Securities Commission Malaysia, ‘SC Launches SRI Roadmap for the Capital Market’ (26 November 2019, Securities Commission Malaysia) <https://www.sc.com.my/resources/media/media-release/sc-launches-sri-roadmap-for-the-capital-market-to-drive-malaysias-sustainable-development> accessed 19 April 2022.

- 24 Securities Commission Malaysia, ‘SRI Sukuk and Bond Grant Scheme to encourage capital market fund raising for sustainable development’ (21 January 2021, Securities Commission Malaysia) <https://www.sc.com.my/resources/media/media-release/sri-sukuk-and-bond-grant-scheme-to-encourage-capital-market-fund-raising-for-sustainable-development> accessed 20 April 2022

- 25 Ibid at [24].

- 26 Capital Markets Malaysia, ‘SRI Sukuk Malaysia, Islamic Bonds and Green Sukuk’ <https://www.capitalmarketsmalaysia.com/public-sri-sukuk/> accessed 20 April 2022.

- 27 TheStar, ‘SC expands grant scheme to promote sustainable devt fund raising’ (21 January 2021, TheStar) < https://www.thestar.com.my/business/business-news/2021/01/21/sc-expands-grant-scheme-to-promote-sustainable-devt-fund-raising> accessed 20 April 2022.

Azmi & Associates

Azmi & Associates Dato’ Azmi Mohd Ali

Dato’ Azmi Mohd Ali Norhisham Abd Bahrin

Norhisham Abd Bahrin Syed Zomael Hussain

Syed Zomael Hussain