Although it is still early days, there is no doubt that the global economy has begun the process of transitioning from fossil fuel-based energy structures to lower carbon alternatives. The energy transition has already given rise to disruptions in markets, and these are likely to continue. One of the largest disrupters on the horizon is hydrogen; the prospects of a hydrogen-fueled energy transition is rapidly gaining traction.

Hydrogen has the potential to disrupt numerous sectors due to some of its unique characteristics. Unlike fuel sources currently being used to power the electricity grid, hydrogen gas does not exist in significant quantities in nature, meaning it needs energy inputs to be produced. As such, it is often thought of alongside batteries, pumped storage, and other technologies that can help resolve intermittency limitations inherent in variable renewable energy sources, such as wind and solar. In addition to its energy storage capabilities, it can also be used as a feedstock in industrial processes.

In this brief newsletter, we will provide an overview of the emerging hydrogen industry and the potential applications for the fuel, followed by a brief overview of Thailand’s potential for development and current legal framework.

The Emerging Hydrogen Industry

The colorful world of hydrogen

Pure hydrogen exists as a transparent gas in ambient conditions, though as mentioned above, it does not exist naturally in this state in great abundance. As such, pure hydrogen must be produced from one of a variety of different processes with varying levels of carbon intensity. To provide shorthand reference points, the industry has adopted an unofficial color-coding scheme to identify the various processes involved.

Grey hydrogen is produced by refining natural gas, which is comprised mainly of methane, into its component parts of carbon and hydrogen through a process known as steam reformation. Grey hydrogen produces carbon dioxide as a biproduct.

Blue hydrogen is produced in the same manner as grey hydrogen, with carbon capture, utilization and storage (“CCUS”) technology deployed to prevent carbon dioxide emissions. Provided the CCUS technologies can capture all the carbon dioxide that is emitted, blue hydrogen can be considered a low carbon source.

Green hydrogen is produced by electrolysis with water, where the electricity inputs come from renewable energy sources such as wind and solar. The process releases oxygen gas as a biproduct. Since it does not involve the processing or burning of any substances with carbon, the production or combustion of green hydrogen does not result in any carbon dioxide emissions.

Pink hydrogen is similar to green hydrogen, in that it is produced by way of electrolysis in water. However, the electricity used to produce the hydrogen comes from nuclear power rather than renewable sources. Since nuclear power does not emit any carbon dioxide in the generation process, the production and combustion of pink hydrogen is also a low carbon technology.

Turquoise hydrogen is produced with natural gas as a feedstock through a process known as methane pyrolysis, whereby the methane is heated to very high temperatures resulting in gaseous hydrogen and carbon in a solid state known as carbon black. Carbon black is currently used as an industrial feedstock in various applications such as paint pigments, tire manufacturing, etc. Like blue hydrogen, turquoise hydrogen is a low carbon source of hydrogen.

Applications

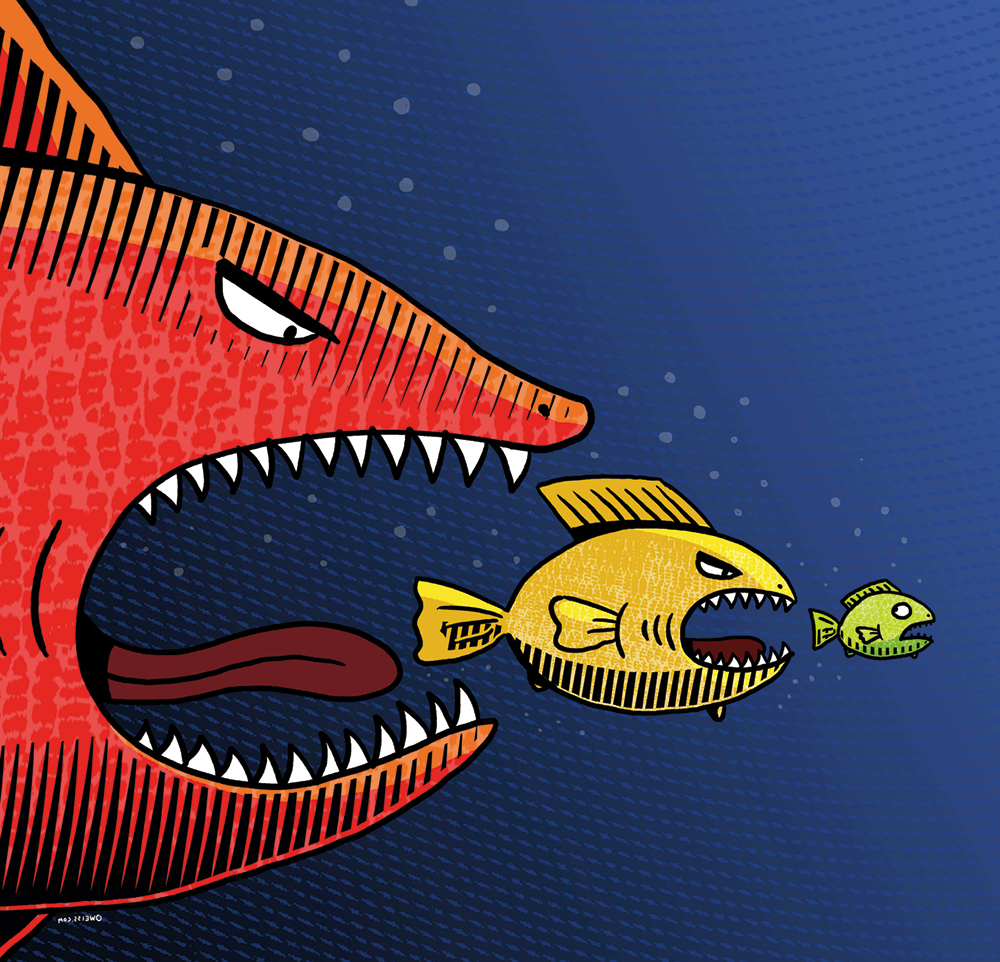

As described by a recent report published by the International Renewable Energy Agency, hydrogen “is best thought of as a general-purpose energy carrier that can foster innovation across many different industries and sectors”.[1] Hydrogen could feasibly be deployed in several sectors, though its use would not always be economical. For example, due to reductions of costs and improved capacity of lithium-ion batteries, the current fleet of internal combustion engine light vehicles are more likely to be replaced by electric vehicles rather than those powered by hydrogen fuel cell technology.

In the near-term, the more likely and straightforward applications for clean hydrogen are in those sectors where electrification is more difficult. This includes international shipping, long-haul aviation, refining of chemicals (particularly ammonia) and industrial processes where high temperatures are required, such as steel manufacturing. Although other applications are technically possible, such as heating and cooling of buildings, light transportation, and fuel substitution in gas-fired power plants, these would each require significant infrastructure investments in the near-term to effect the necessary transition. Given that these sectors can all be decarbonized in other ways (primarily, through the decarbonization of the electricity grid), it is unclear whether clean hydrogen will ever be suitable for these applications. Of course, if clean hydrogen is deployed widely in sectors that are more difficult to decarbonize, then in the future other sectors may benefit from economies of scale and then existing infrastructure.

Hydrogen in Thailand

Thailand does not currently have a substantial hydrogen industry, but it has the potential to develop low carbon hydrogen for domestic use and for export.

Given its tropical climate, Thailand benefits from irradiation conditions that render solar power productive throughout the year. According to the International Energy Agency, given current baseload capacity, Thailand’s grid could still accommodate significant additional deployment of variable renewable energy to generate electricity.[2] This may entail that in the near-term, developing solar capacity would have a greater impact by helping decarbonize the grid rather than producing green hydrogen.

In the coming years, Thailand may be better positioned to develop a low carbon hydrogen industry where methane is a primary input. Although Thailand’s proven and probable domestic natural gas reserves are nearly depleted, the Thai government aims to position the country as a regional LNG trading hub, thus requiring an increase in receiving capacity. In addition to using natural gas as a feedstock, new technologies are being developed that will permit methane captured from municipal and agricultural waste facilities to be used as feedstock for low carbon hydrogen. This flow of methane may be the basis for the development of a blue and/or turquoise hydrogen industry in Thailand.

Current legal framework

Under the Alternative Energy Development Plan (AEDP), one of Thailand’s five master plans relating to energy development, hydrogen is included as part of the “Alternative Fuels” category with a set target goal of 10 Kilotons of oil equivalent (KTOE) in total by 2036.

From the regulator’s side, the Energy Regulatory Commission (the “ERC“) has included hydrogen in the definition of “renewable energy” to be purchased by the Provincial or Metropolitan Electricity Authorities (for very small power producer, or VSPP projects) and EGAT (for small power producer, or SPP projects), pursuant to the ERC Notification re purchase of power from SPP operators of renewable energy by Feed-in Tariff (B.E. 2560) and the ERC Notification re purchase of power from VSPP operators of renewable energy (B.E. 2561).

As the hydrogen industry is in the early development phase, we may not see substantial hydrogen-specific regulations soon. General regulations would apply to hydrogen projects similarly to other power projects. For instance, in hydrogen projects where electricity is generated to be used in the electrolyzing process, an electricity generation licensing under the Energy Industry Act would be required. The operating site may also be subject to requirements under the Factory Act, depending on the activities being carried out. Meanwhile, at the moment, the hydrogen industry is not subject to the Fuel Control Act and Fuel Trading Act, as hydrogen does not fall within the definition of fuel thereunder.

To achieve its carbon neutrality goals, Thai lawmakers are considering implementing carbon pricing measures under the draft act on climate change. Since green, blue, or turquoise hydrogen projects do not result in carbon emissions, they would have a comparative advantage of not being subject to carbon pricing measures.

Final thoughts

The hydrogen industry has great potential in Thailand, particularly in the mid- to long-term; it is now starting to appear on the regulators’ radar. Understanding the legal contours of this nascent business, including the regulatory landscape, will be key to the success of any new hydrogen project.

[1] IRENA, “Geopolitics of the Energy Transformation: The Hydrogen Factor”, January 2022. Available at: https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen

[2] IEA, “Partner Country Series – Thailand Renewable Grid Integration Assessment”, October 2018. Available at: https://www.iea.org/reports/partner-country-series-thailand-renewable-grid-integration-assessment

17th and 36th Floors, Sathorn Square Office Tower

98 North Sathorn Road, Silom, Bangrak

Bangkok 10500, Thailand

TEL:+66-2-009-5000

https://chandlermhm.com/