In a rare move, the Competition Commission of India (CCI) for the first time has exercised its sparingly used interim powers to redress competitive harm in the market for online intermediation services for booking hotels in India (OTA Market).

Background

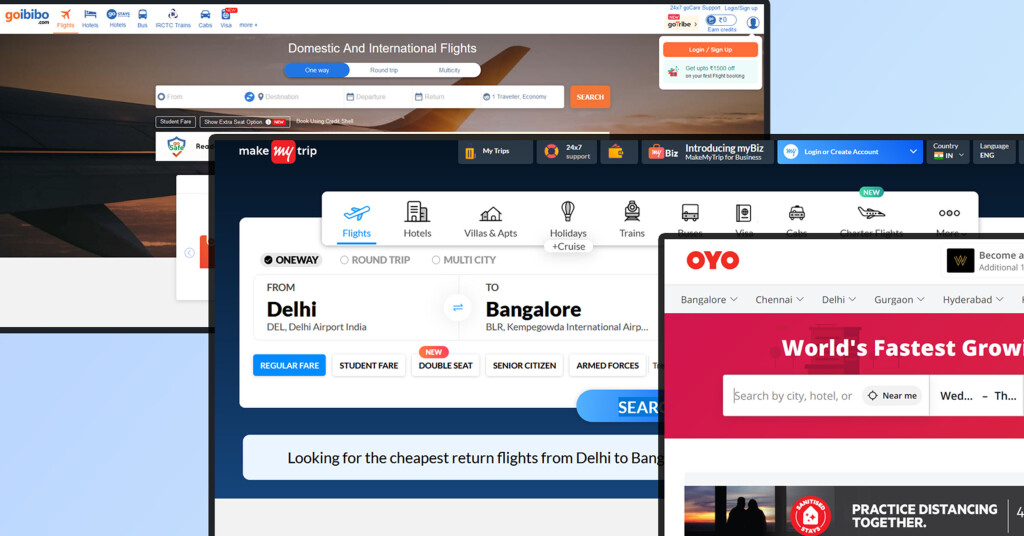

In 2019, the CCI initiated a probe against OTA players, MakeMyTrip Private Ltd. (MMT) and Ibibo Group Pvt. Ltd. (Go-Ibibo) (jointly, MMT-GO) under Section 3(4) (vertical anti-competitive restraints) and Section 4 (abuse of dominant position) of the Competition Act, 2002 (Act). Among other things, the allegations pertained to MMT-GO’s exclusive agreement with Oravel Stays Pvt. Ltd. (OYO) which allegedly resulted in foreclosure of the market for hotels / accommodations.

While the investigation is on-going, on 9 March 2021, the CCI granted interim relief to two franchisee budget hotels (FabHotels and Treebo), by directing MMT-GO to relist both hotels on its online portals with immediate effect.

CCI’s key observations

The CCI’s key observations while granting the interim relief are summarised below:

Threshold test for interim relief

| Ø | To grant an interim relief, the CCI must be satisfied that an act in violation of the Act was committed or continues to be committed. |

| Ø | The degree of satisfaction for grant of interim relief is higher than the threshold used by the CCI while passing the prima facie investigation order. However, such a degree requires a subjective assessment on a case-to-case basis. |

| Ø | The CCI noted the peculiarities of the present case, and held that there was sufficient compelling evidence against MMT-GO such that the threshold test for granting interim relief was satisfied. |

Digital platforms have become a necessary evil

| Ø | Digital markets, such as the OTA Market, are characterised by strong network effects and big data which play a crucial role in strengthening the market position of such platforms (for e.g., MMT-GO is a dominant OTA player); |

| Ø | Owing to a significant shift in consumer preference towards digital platforms, online visibility of hotels / accommodations on prominent platforms (such as, MMT-GO) is indispensable for their survival. |

Exclusive agreement between MMT-GO and OYO resulted in market foreclosure

| Ø | The exclusive agreement between MMT-GO and OYO was exclusionary in nature as it was conditioned upon delisting of OYO’s competitors from MMT-GO’s online portals. |

| Ø | By delisting budget hotels like, FabHotels and Treebo pursuant to the agreement, MMT-GO foreclosed an effective distribution channel for these hotels causing them to incur significant losses in revenue. |

Timely intervention is a must to redress competitive harm in dynamic markets

| Ø | Denial of market access in any manner which takes away the freedom of an enterprise to effectively compete in the market, amounts to a contravention of the Act. |

| Ø | More particularly, denial of market access in dynamic markets (where the winner-takes-it-all) can have the irreversible effect of tipping the market in favour of market incumbents who enjoy significant market strength (in this case, OYO). |

| Ø | Timely and early intervention to redress competitive harm in such markets is crucial because any delay in corrective recourse can pose the dangerous risk of permanent distortion of the competitive landscape since growth of inter-platform competition will be stunted. |

| Ø | For example, in this case, the CCI noted that the downstream market of franchisee hotels face the risk of marginalisation and can be forced to exit the market. |

Based on the above observations, the CCI noted that a strong prima facie case of a continuing contravention of the Act was made out against MMT-GO. Since the balance of convenience tilted towards the applicants (FabHotels and Treebo), the CCI granted them the interim relief by directing MMT-GO to relist both hotels on its online portals.

Key takeaways

| Ø | Last year, the CCI published its market study on the e-commerce sector which highlights the potential competition issues in digital markets in India, including the OTA market. As such, by granting the interim relief, the CCI has shown its pro-activeness and has set the tone for future investigations into digital markets. |

| Ø | What stands out in this case is the CCI’s categorical recognition of the importance of swift corrective actions to redress competitive harm in dynamic markets lest the competitive landscape of these markets should be permanently distorted. Recent modifications to the European Union’s competition legislation, also resonate with the stance that early intervention in such new-age markets is imperative to prevent marginalisation of rivals and irreparable ramifications to the competitive landscape. |

| Ø | Further, not only did the CCI highlight the role of network effects and data in strengthening the market position of digital platforms, it also analysed current market realities i.e., the COVID-19 stimulated boost to digital markets, shift in consumer preferences to “go digital”, and the resultant necessity of online visibility. |

While this interim order will set the trajectory for future investigations into digital markets, it remains to be seen how the CCI concludes its investigation against MMT-GO and OYO. All in all, the decision of the CCI is truly seminal in that it reflects the present enforcement priorities of the CCI which is to intervene before the ship has sailed.

Authors:

Anisha Chand (Partner), Anmol Awasthi (Associate) and Vasudhaa Ahuja (Associate).

Anisha Chand, |

For any queries please contact: editors@khaitanco.com